Q3 Earnings Roundup: Boston Beer (NYSE:SAM) And The Rest Of The Beverages and Alcohol Segment

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the beverages and alcohol stocks, starting with Boston Beer (NYSE:SAM).

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It's also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

The 14 beverages and alcohol stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 1.1% while next quarter's revenue guidance was 3.9% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but beverages and alcohol stocks held their ground better than others, with share prices down 1.9% on average since the previous earnings results.

Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

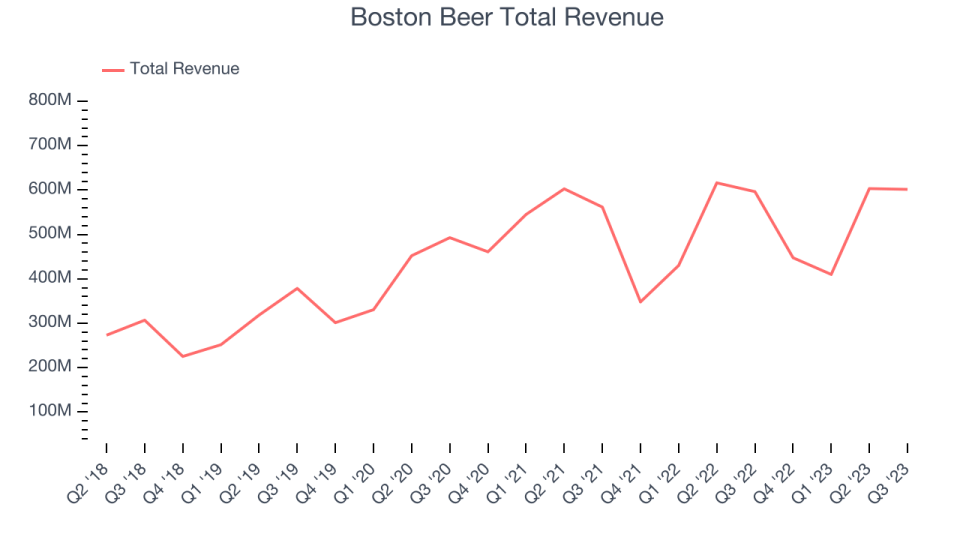

Boston Beer reported revenues of $601.6 million, flat year on year, topping analyst expectations by 1.2%. It was a strong quarter for the company, with optimistic earnings guidance for the full year.

"We are pleased with our performance in the third quarter as momentum on Twisted Tea remained strong and we continued to show progress on our margin enhancement plans while increasing brand investment. Based on our results year-to-date and our expectations for the fourth quarter, we are narrowing our revenue and EPS guidance ranges," said President and CEO Dave Burwick.

The stock is down 1.1% since the results and currently trades at $360.84.

Is now the time to buy Boston Beer? Access our full analysis of the earnings results here, it's free.

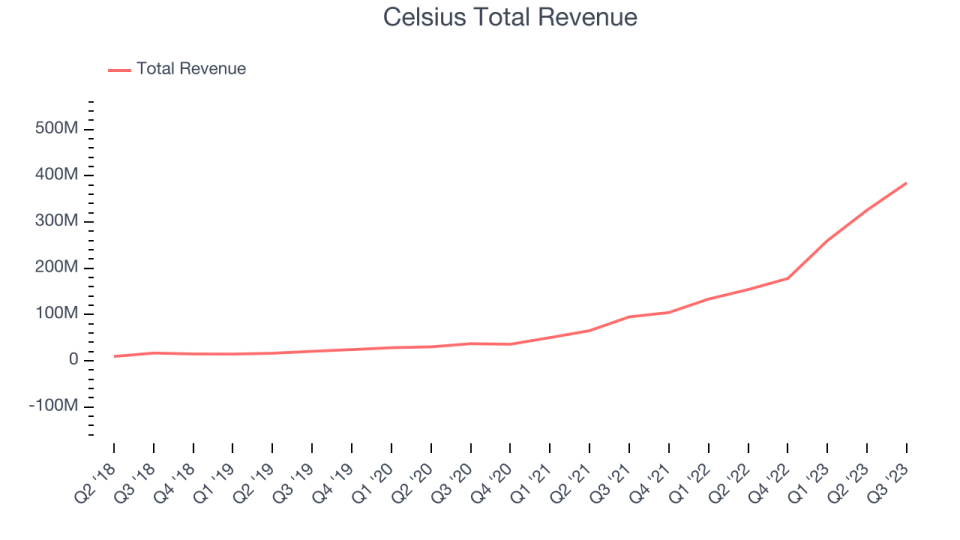

Best Q3: Celsius (NASDAQ:CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $384.8 million, up 104% year on year, outperforming analyst expectations by 9.4%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

Celsius scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 9.4% since the results and currently trades at $53.47.

Is now the time to buy Celsius? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Duckhorn (NYSE:NAPA)

With many of their grapes sourced from the famous Napa Valley region of California, The Duckhorn Portfolio (NYSE:NAPA) is a producer of premium wines and known for its Merlot and other Bordeaux varietals.

Duckhorn reported revenues of $102.5 million, down 5.2% year on year, falling short of analyst expectations by 1%. It was a weaker quarter for the company, with a miss of analysts' earnings estimates.

Duckhorn had the slowest revenue growth and weakest full-year guidance update in the group. The stock is down 12.2% since the results and currently trades at $8.96.

Read our full analysis of Duckhorn's results here.

PepsiCo (NASDAQ:PEP)

With a history that goes back more than a century, PepsiCo (NASDAQ:PEP) is a household name in food and beverages today and best known for its flagship soda.

PepsiCo reported revenues of $23.45 billion, up 6.7% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an impressive beat of analysts' earnings guidance for the full year. On the other hand, the year on year volume decline was greater than expectations.

The stock is up 3.8% since the results and currently trades at $167.49.

Read our full, actionable report on PepsiCo here, it's free.

Zevia PBC (NYSE:ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

Zevia PBC reported revenues of $43.09 million, down 2.6% year on year, surpassing analyst expectations by 9%. It was a slower quarter for the company, with a miss of analysts' earnings estimates.

Zevia PBC delivered the highest full-year guidance raise among its peers. The stock is down 21.2% since the results and currently trades at $1.6.

Read our full, actionable report on Zevia PBC here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned