Q3 Earnings Roundup: ON24 (NYSE:ONTF) And The Rest Of The Sales And Marketing Software Segment

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at ON24 (NYSE:ONTF), and the best and worst performers in the sales and marketing software group.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 24 sales and marketing software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 2.4% while next quarter's revenue guidance was in line with consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but sales and marketing software stocks held their ground better than others, with the share prices up 15.7% on average since the previous earnings results.

ON24 (NYSE:ONTF)

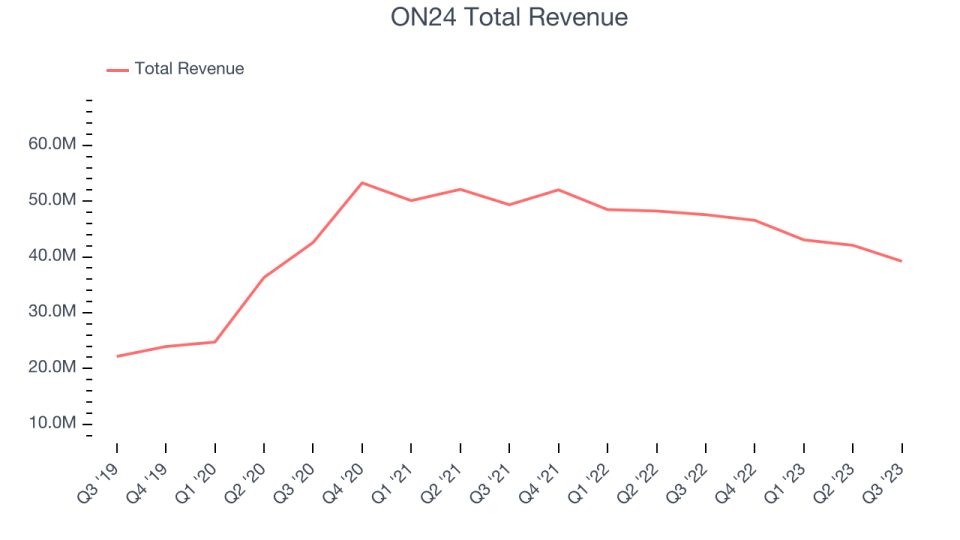

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $39.22 million, down 17.6% year on year, topping analyst expectations by 3.3%. It was a very strong quarter for the company, with optimistic revenue guidance for the next quarter and full-year revenue guidance beating analysts' expectations.

“We are pleased with our performance for the third quarter. We delivered results ahead of guidance across all metrics, and despite the tough macroeconomic environment, we see positive momentum in our business. We are focused on executing against our strategic growth pillars, and are excited to be launching ACE, our new AI-powered Analytics and Content Engine. ACE will be available across our platform and will fuel the next generation of our customers’ experiences,” said Sharat Sharan, co-founder and CEO of ON24.

ON24 delivered the slowest revenue growth of the whole group. The stock is up 7.6% since the results and currently trades at $6.93.

Is now the time to buy ON24? Access our full analysis of the earnings results here, it's free.

Best Q3: AppLovin (NASDAQ:APP)

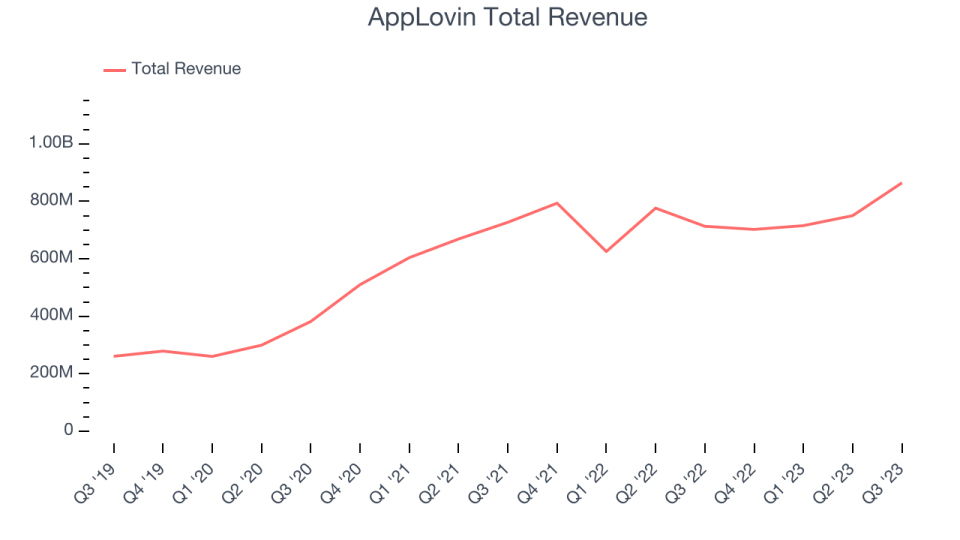

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $864.3 million, up 21.2% year on year, outperforming analyst expectations by 8.5%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

AppLovin delivered the biggest analyst estimates beat among its peers. The stock is up 1.7% since the results and currently trades at $40.85.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $101.2 million, up 1.9% year on year, falling short of analyst expectations by 1%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

Yext had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is down 21.5% since the results and currently trades at $5.5.

Read our full analysis of Yext's results here.

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Salesforce reported revenues of $8.72 billion, up 11.3% year on year, in line with analyst expectations. It was a strong quarter for the company, with revenue beating analysts' expectations by a narrow amount but both current and total RPO (remaining performance obligations, a leading indicator of revenue) beat more convincingly. In addition, non-GAAP operating profit and non-GAAP EPS outperformed expectations.

The stock is up 17.7% since the results and currently trades at $271.15.

Read our full, actionable report on Salesforce here, it's free.

Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.71 billion, up 25.5% year on year, surpassing analyst expectations by 2.6%. It was a very strong quarter for the company, with a significant improvement in its gross margin and a decent beat of analysts' revenue estimates.

The stock is up 66.4% since the results and currently trades at $81.2.

Read our full, actionable report on Shopify here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned