Q3 Rundown: VeriSign (NASDAQ:VRSN) Vs Other E-commerce Software Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how the e-commerce software stocks have fared in Q3, starting with VeriSign (NASDAQ:VRSN).

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 6 e-commerce software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 0.9% while next quarter's revenue guidance was 0.8% above consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but e-commerce software stocks held their ground better than others, with the share prices up 23.3% on average since the previous earnings results.

Weakest Q3: VeriSign (NASDAQ:VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

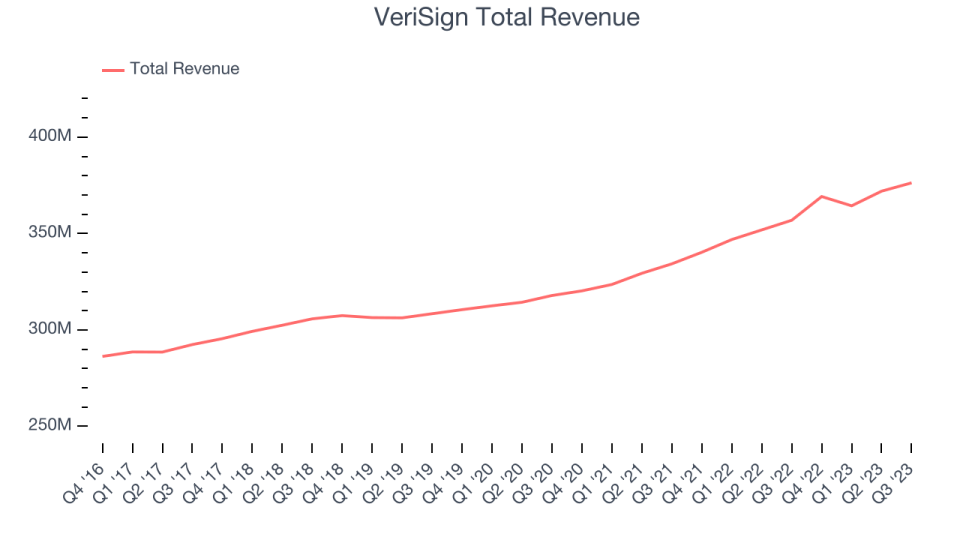

VeriSign reported revenues of $376.3 million, up 5.4% year on year, falling short of analyst expectations by 0.8%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

“We remain focused on our long-term strategy of value creation and return to shareholders through responsible expense management and efficient capital allocation, which has produced another solid quarter,” said Jim Bidzos, Executive Chairman and Chief Executive Officer.

VeriSign delivered the weakest performance against analyst estimates of the whole group. The stock is down 0.8% since the results and currently trades at $203.04.

Is now the time to buy VeriSign? Access our full analysis of the earnings results here, it's free.

Best Q3: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.71 billion, up 25.5% year on year, outperforming analyst expectations by 2.6%. It was a very strong quarter for the company, with a significant improvement in its gross margin and a decent beat of analysts' revenue estimates.

Shopify pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 64.2% since the results and currently trades at $80.15.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it's free.

BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $78.05 million, up 7.8% year on year, falling short of analyst expectations by 0.1%. It was a mixed quarter for the company, with a miss of analysts' revenue estimates., while the revenue outlook for the next quarter came in roughly in line with Wall Street's expectations.

BigCommerce had the weakest full-year guidance update in the group. The stock is down 16.9% since the results and currently trades at $8.34.

Read our full analysis of BigCommerce's results here.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $393.8 million, up 13.9% year on year, surpassing analyst expectations by 1.1%. It was an impressive "beat and raise" quarter with revenue guidance exceeding expectations.

The stock is up 41.4% since the results and currently trades at $127.1.

Read our full, actionable report on Wix here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $257.1 million, up 18.1% year on year, surpassing analyst expectations by 2%. It was a decent quarter for the company, with strong sales guidance for the next quarter but a decline in its gross margin.

Squarespace pulled off the highest full-year guidance raise among its peers. The stock is up 9.9% since the results and currently trades at $33.05.

Read our full, actionable report on Squarespace here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned