Q3 Rundown: WalkMe (NASDAQ:WKME) Vs Other Sales And Marketing Software Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how the sales and marketing software stocks have fared in Q3, starting with WalkMe (NASDAQ:WKME).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 24 sales and marketing software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 2.4% while next quarter's revenue guidance was in line with consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but sales and marketing software stocks held their ground better than others, with the share prices up 15.9% on average since the previous earnings results.

WalkMe (NASDAQ:WKME)

Founded in Israel in 2011, WalkMe (NASDAQ:WKME) is software that teaches users how to get the most out of new applications.

WalkMe reported revenues of $67.02 million, up 5.8% year on year, falling short of analyst expectations by 0.6%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and full-year revenue guidance missing analysts' expectations.

“Q3 was a milestone quarter as WalkMe achieved our goal of reaching profitability ahead of schedule. We believe our investments in our strategic growth drivers are paying off in the public sector and our partner ecosystem as we continue to deliver big value to our global customer base. With AI transformation on the rise, Digital Adoption is now more essential than ever. WalkMe is well positioned to help organizations drive productivity and manage change,” said Dan Adika, CEO of WalkMe.

The stock is up 8.3% since the results and currently trades at $10.52.

Read our full report on WalkMe here, it's free.

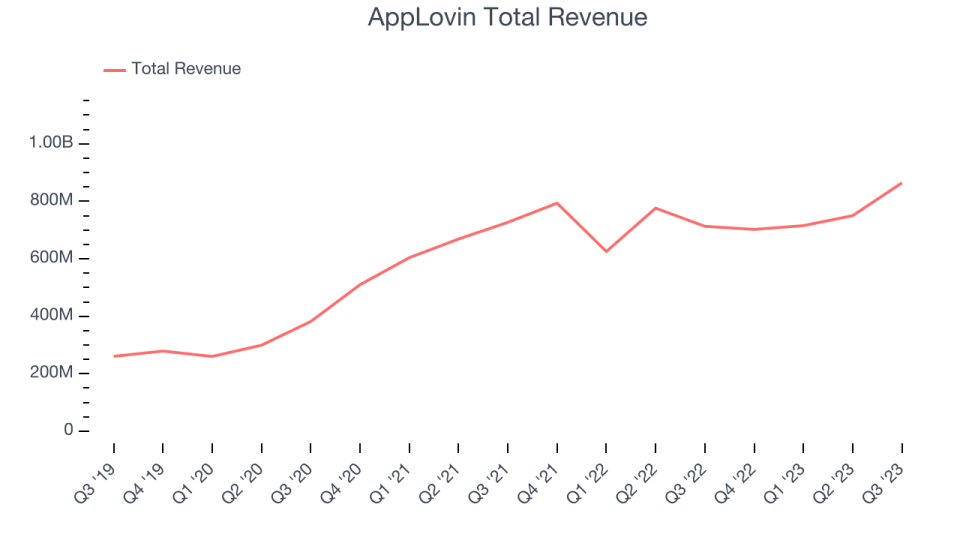

Best Q3: AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $864.3 million, up 21.2% year on year, outperforming analyst expectations by 8.5%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

AppLovin delivered the biggest analyst estimates beat among its peers. The stock is up 1.7% since the results and currently trades at $40.85.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $101.2 million, up 1.9% year on year, falling short of analyst expectations by 1%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

Yext had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is down 21.5% since the results and currently trades at $5.5.

Read our full analysis of Yext's results here.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.07 billion, up 3.5% year on year, in line with analyst expectations. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter. Growth is slow these days, but at least GoDaddy delivered strong free cash flow.

The stock is up 39.2% since the results and currently trades at $104.7.

Read our full, actionable report on GoDaddy here, it's free.

Sprout Social (NASDAQ:SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Sprout Social reported revenues of $85.53 million, up 31% year on year, surpassing analyst expectations by 1.6%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but decelerating customer growth.

The company added 720 enterprise customers paying more than $10,000 annually to reach a total of 8,111. The stock is up 40.3% since the results and currently trades at $59.7.

Read our full, actionable report on Sprout Social here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned