Q4 Earnings Highs And Lows: Soho House (NYSE:SHCO) Vs The Rest Of The Hotels, Resorts and Cruise Lines Stocks

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Soho House (NYSE:SHCO) and the rest of the hotels, resorts and cruise lines stocks fared in Q4.

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 13 hotels, resorts and cruise lines stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 1.6% while next quarter's revenue guidance was 4.8% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but hotels, resorts and cruise lines stocks held their ground better than others, with the share prices up 4% on average since the previous earnings results.

Slowest Q4: Soho House (NYSE:SHCO)

Boasting fancy locations in hubs such as NYC and Miami, Soho House (NYSE:SHCO) is a global hospitality brand offering exclusive private member clubs, hotels, and restaurants.

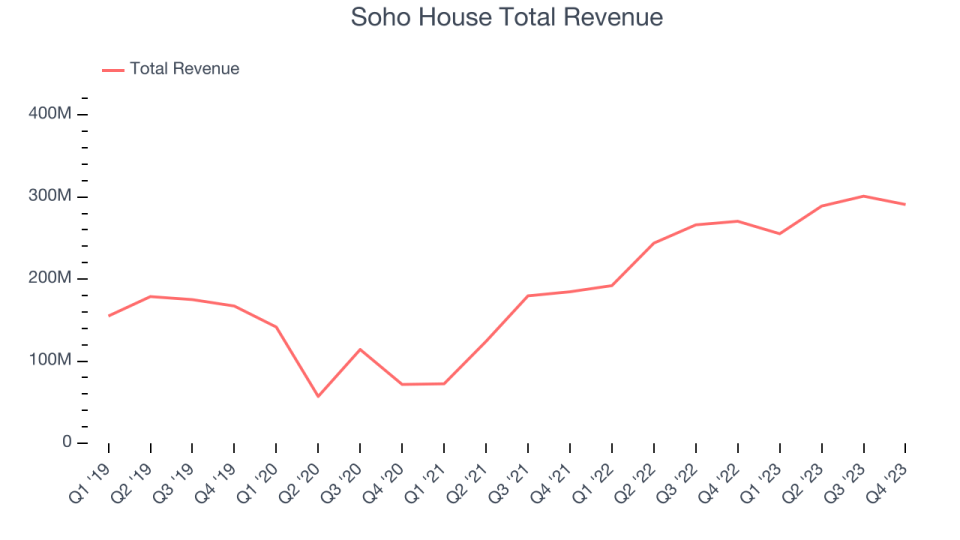

Soho House reported revenues of $290.8 million, up 7.5% year on year, falling short of analyst expectations by 3.7%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' members estimates.

Soho House delivered the weakest performance against analyst estimates of the whole group. The stock is up 6.1% since the results and currently trades at $6.09.

Read our full report on Soho House here, it's free.

Best Q4: Playa Hotels & Resorts (NASDAQ:PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ:PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $242.5 million, up 15% year on year, outperforming analyst expectations by 8.8%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates. In addition, full year 2024 guidance for adjusted EBITDA was in line, showing that the company is staying on track.

Playa Hotels & Resorts pulled off the biggest analyst estimates beat among its peers. The stock is up 9.1% since the results and currently trades at $9.63.

Is now the time to buy Playa Hotels & Resorts? Access our full analysis of the earnings results here, it's free.

Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $687.1 million, up 8.9% year on year, falling short of analyst expectations by 0.6%. It was a weak quarter for the company, with revenue and adjusted EBITDA outlook for next quarter and the full year all below Wall Street's estimates.

Sabre had the weakest full-year guidance update in the group. The stock is down 47.5% since the results and currently trades at $2.31.

Read our full analysis of Sabre's results here.

Norwegian Cruise Line (NYSE:NCLH)

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

Norwegian Cruise Line reported revenues of $1.99 billion, up 30.8% year on year, surpassing analyst expectations by 1.2%. It was a mixed quarter for the company, with optimistic earnings forecast for next quarter, which blew past analysts' expectations. In addition, its revenue narrowly outperformed Wall Street's estimates. On the other hand, its passenger cruise days unfortunately missed and its EPS fell short of Wall Street's estimates.

The stock is up 29% since the results and currently trades at $20.55.

Read our full, actionable report on Norwegian Cruise Line here, it's free.

Bluegreen Vacations (NYSE:BVH)

Managing resorts in top leisure and urban destinations, Bluegreen Vacations (NYSE:BVH) is a leading vacation ownership company that markets and sells vacation ownership interests.

Bluegreen Vacations reported revenues of $277.5 million, up 6.4% year on year, surpassing analyst expectations by 8.8%. It was an exceptional quarter for the company, with an impressive beat of analysts' revenue estimates.

The stock is up 2.5% since the results and currently trades at $75.

Read our full, actionable report on Bluegreen Vacations here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.