Q4 Earnings Outperformers: Intuit (NASDAQ:INTU) And The Rest Of The Finance and HR Software Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Intuit (NASDAQ:INTU), and the best and worst performers in the finance and HR software group.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 2.5% while next quarter's revenue guidance was 1% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, and while some of the finance and HR software stocks have fared somewhat better than others, they have not been spared, with share prices declining 5.4% on average since the previous earnings results.

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $3.39 billion, up 11.3% year on year, falling short of analyst expectations by 0.1%. It was a slower quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' billings estimates.

“We had another strong quarter as consumers and small businesses continue to rely on Intuit’s platform to power their prosperity,” said Sasan Goodarzi, Intuit's chief executive officer.

The stock is down 2.2% since the results and currently trades at $642.99.

Is now the time to buy Intuit? Access our full analysis of the earnings results here, it's free.

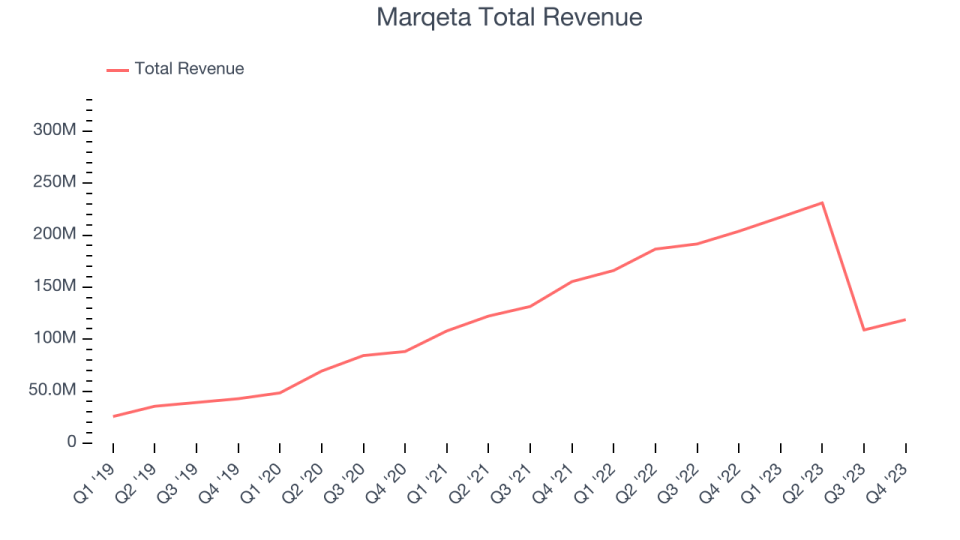

Best Q4: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $118.8 million, down 41.7% year on year, outperforming analyst expectations by 7.7%. It was a very strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

Marqeta had the slowest revenue growth among its peers. The stock is down 19.7% since the results and currently trades at $5.9.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Paylocity (NASDAQ:PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $326.4 million, up 19.5% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and full year.

The stock is down 0.7% since the results and currently trades at $171.06.

Read our full analysis of Paylocity's results here.

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $110.7 million, up 7.4% year on year, roughly inline with analyst expectations. It was a weaker quarter for the company, with full-year revenue guidance missing analysts' expectations.

Zuora had the weakest full-year guidance update among its peers. The stock is up 5.4% since the results and currently trades at $9.05.

Read our full, actionable report on Zuora here, it's free.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $159.5 million, up 20.1% year on year, surpassing analyst expectations by 2.4%. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter.

The stock is down 2.2% since the results and currently trades at $19.16.

Read our full, actionable report on Paycor here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.