QCR Holdings Inc (QCRH) Announces Record Earnings for Q4 and Full Year 2023

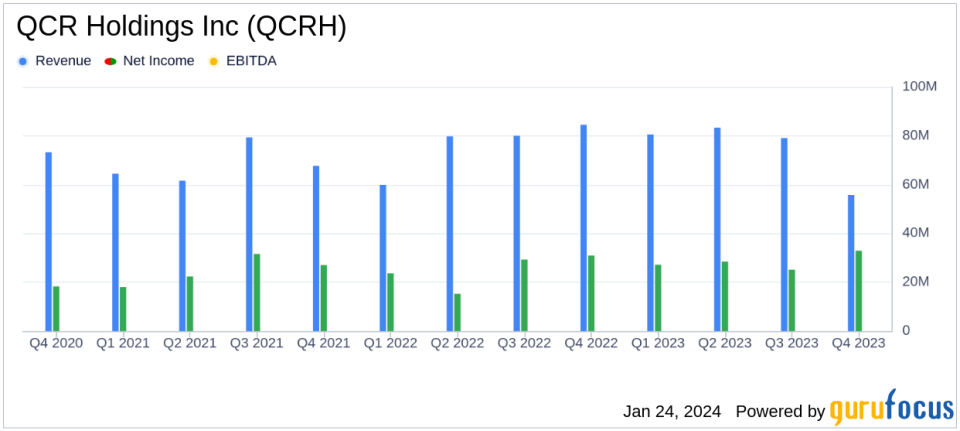

Net Income: QCRH reported a record net income of $32.9 million for Q4 2023, and $113.6 million for the full year.

Diluted EPS: Diluted earnings per share reached $1.95 for Q4, up from $1.49 in Q3, and $6.73 for the full year.

Loan Growth: Loans and leases held for investment grew by $213.4 million in Q4, marking a 13% annualized increase.

Capital Markets Revenue: A record $37.0 million in capital markets revenue was achieved in Q4, contributing to a total of $92 million for the year.

Asset Quality: Nonperforming assets improved slightly to $34.2 million, with the ratio of NPAs to total assets at 0.40%.

Net Interest Margin: NIM expanded to 2.90%, with a tax-equivalent yield of 3.32% for Q4.

Capital Ratios: The total risk-based capital ratio stood at 14.15%, with a common equity tier 1 ratio of 9.57%.

On January 23, 2024, QCR Holdings Inc (NASDAQ:QCRH) released its 8-K filing, announcing record earnings for both the fourth quarter and the full year of 2023. The multi-bank holding company, which operates through segments such as Commercial Banking and Wealth Management, has reported significant growth in net income and earnings per share (EPS), driven by robust loan growth and exceptional capital markets revenue.

Financial Performance and Growth Drivers

QCRH's net interest income for Q4 2023 totaled $55.7 million, with a slight increase from the previous quarter. The net interest margin (NIM) saw an expansion to 2.90%, reflecting a positive trend in loan and investment yields and a stabilization in the deposit mix. Noninterest income for the quarter was notably high at $47.7 million, with capital markets revenue contributing a record $37.0 million, attributed to the strong demand for affordable housing and favorable long-term interest rates.

Loan growth was a key highlight, with loans and leases held for investment growing by $213.4 million in Q4, and a total growth of $669.5 million for the full year, excluding the impact of loan securitizations. This growth underscores QCRH's effective relationship-based community banking model and the economic resilience across its markets.

Asset Quality and Capital Strength

Asset quality remained excellent, with nonperforming assets (NPAs) showing a slight improvement to $34.2 million. The ratio of NPAs to total assets improved to 0.40%, indicating strong credit quality within the company's loan portfolio. The company also maintained strong capital levels, with a total risk-based capital ratio of 14.15% and a common equity tier 1 ratio of 9.57%. The tangible common equity to tangible assets ratio (non-GAAP) was 8.75%, reflecting a solid capital position.

Outlook and Management Commentary

CEO Larry J. Helling expressed satisfaction with the record results, highlighting significant fee income, loan growth, and strong asset quality. He also noted the completion of the company's first two securitizations of low-income housing tax credit loans and a 6% growth in core deposits. Looking forward, Helling remains focused on building the franchise through relationship banking and delivering attractive returns to shareholders.

We enter 2024 with a solid deposit and loan pipeline, a strong balance sheet, excellent credit quality and well-managed expenses," said Mr. Helling.

President and CFO Todd A. Gipple also commented on the improved net interest margin and the exceptional performance in capital markets revenue, which is expected to remain healthy with increased guidance for the next twelve months.

Our adjusted NIM on a tax equivalent yield basis improved by one basis point on a linked-quarter basis to 3.29% and was above the midpoint of our guidance range," said Mr. Gipple.

Conclusion

QCR Holdings Inc (NASDAQ:QCRH) has demonstrated a strong financial performance in Q4 and throughout 2023, with record net income and EPS, substantial loan growth, and remarkable capital markets revenue. The company's asset quality and capital ratios remain robust, positioning it well for continued success in 2024. Investors and stakeholders can anticipate sustained growth and profitability as QCRH continues to execute its strategic initiatives and capitalize on market opportunities.

For more detailed information, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from QCR Holdings Inc for further details.

This article first appeared on GuruFocus.