QIAGEN (QGEN) Expands Digital PCR Offering With New Pact

QIAGEN N.V. QGEN recently announced the expansion of its digital PCR (dPCR) offering for the biopharma sector's cell and gene therapy development in partnership with Niba Labs. The recent development will likely bolster QIAGEN’s Life Sciences PCR business.

The company also introduced the new CGT Viral Vector Lysis Kit, which enables a standardized workflow from cell lysates to absolute and precise quantification of viral titers for multiple serotypes.

More on Latest Offering

The collaboration between QIAGEN and Niba Labs, an analytical lab with extensive experience in developing and testing digital PCR assays, will enable QIAcuity customers to take advantage of the combined knowledge to create new simplex or multiplex assays for the quantification of nucleic acids and improve current qPCR assays for digital PCR. In accordance with Good Manufacturing Practise (GMP), Niba Labs will assess the assays' performance and validate them.

QIAcuity, a digital PCR tool from QIAGEN, can quantify even the smallest signals from DNA and RNA by employing nanoplates to spread a sample over a large number of tiny partitions and then simultaneously reading the reaction in each one.

The newly-launched CGT Viral Vector Lysis Kit for the QIAcuity digital PCR instrument expands QIAGEN's rapidly-expanding digital PCR portfolio for the biopharma industry. The new kit is perfect for drug development and quality control in manufacturing because it has high repeatability, can quantify over a wide dynamic range with high accuracy when combined with the QIAcuity CGT dPCR Assays and can determine viral genome titers in single- and multiplex reactions.

Benefits of New Offerings

With their combined offerings, QIAGEN and Niba Labs can assist companies developing cell and gene therapies in overcoming significant resource limitations and adhering to stringent project deadlines. The partnership will offer the biopharma sector the most cutting-edge analytical options to satisfy the sector's changing needs and enhance their cell and gene therapy products.

Image Source: Zacks Investment Research

With the introduction of the CGT Viral Vector Lysis Kit, QIAGEN aims to offer a simplified AAV lysis methodology that helps standardise bioprocessing workflows and improve standard operating procedures, quality control and safety. This kit enables vector genome titration with outstanding accuracy, repeatability and durability when used in conjunction with its QIAcuity CGT tests.

Industry Prospects

Per a report by Allied Market Research, the global digital PCR market was valued at $508.82 million in 2020 and is projected to reach $1,305.30 million by 2030 at a CAGR of 8.6%. The market growth is primarily driven by the increase in prevalence of different types of cancers such as lung cancer, blood cancer and brain tumor.

Recent Developments

In June 2023, QIAGEN’s ForenSeq MainstAY workflow for the U.S. National DNA Index System (“NDIS”) received FBI approval. Licenced forensic DNA laboratories will be able to process DNA casework samples and compare the resulting profiles to American databases. NDIS CODIS database, containing 20 million offender profiles, are used by authorities across the United States to solve criminal investigations countrywide.

The same month, QIAGEN announced that its software for interpreting and reporting variants, QIAGEN Clinical Insight (QCI Interpret), is being used in Denmark as part of a government initiative to provide sequencing-based treatments for cancer patients. The QCI Interpret solution was selected by Danish National Genome Center for variant interpretation in oncology genome sequencing.

Price Performance

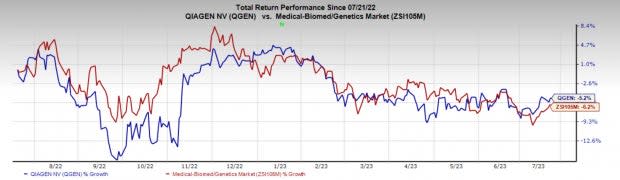

In the past year, QGEN’s shares have declined 5.2% compared with the industry’s fall of 6.2%.

Zacks Rank and Other Key Picks

QIAGEN currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Alcon ALC, Perrigo Company PRGO and Hologic HOLX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Alcon has an estimated long-term growth rate of 14.9%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 8.85%.

ALC’s shares have rallied 22.7% year to date compared with the industry’s 10.9% growth.

Perrigo’s earnings are expected to improve 24.6% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, delivering an average negative surprise of 0.79%.

The company’s shares have gained 2.1% year to date compared with the industry’s 5.5% growth.

Hologic has an estimated earnings growth rate of 4.1% for fiscal 2024. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 27.32%.

HOLX’s shares have risen 4.9% year to date compared with the industry’s 10.9% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report