QIAGEN (QGEN) Expands Sample Technologies Line With New Launch

QIAGEN N.V. QGEN recently launched TissueLyser III and the RNeasy PowerMax Soil Pro Kit to support researchers in managing diverse materials such as bone, tissue and soil samples.

The recent launch will expand its sample technologies portfolio.

More on the News

The TissueLyser III is a high-throughput instrument for enhanced and versatile disruption of a range of biological samples containing nucleic acids (DNA and RNA). Even with challenging-to-lyse materials like bones or tissues, the TissueLyser III is an excellent option for labs looking for effective sample disruption and high-quality DNA and RNA purification.

Building on the trusted technology of its prior-generation instrument, which has been cited in over 14,000 scientific publications, the TissueLyser III offers enhanced capabilities for efficient sample disruption — a critical aspect of nucleic acid purification procedures.

The TissueLyser III is compatible with many QIAGEN kits — including the new RNeasy PowerMax Soil Pro Kit. The kit is specifically designed for challenging soil samples, particularly those rich in PCR inhibitors such as compost, sediment and manure.

Significance of the Launch

The release of the TissueLyser III and the RNeasy PowerMax Soil Pro Kit are two more milestones in QIAGEN's commitment to expand its line of best-in-class sample technologies. These two items are intended to better address the special needs of researchers working with challenging samples, allowing them to work more efficiently and accurately.

TissueLyser III illustrates QIAGEN's unwavering commitment to continuously improve its automated sample preparation and analysis solutions. It adds to QIAGEN's high-throughput instrument portfolio, which includes the QIAcube HT, QIAxcel Connect and QIAsymphony.

Image Source: Zacks Investment Research

The kit produces high-yield, high-purity RNA suited for downstream applications such as real-time quantitative RT-PCR, digital PCR and next-generation sequencing by utilizing QIAGEN's innovative patent-pending Inhibitor Removal Technology (IRT) and efficient bead beating and lysis chemistry. The new kit's streamlined workflow saves processing time by 60% compared with its predecessor, the RNeasy PowerSoil Total RNA Kit, allowing for speedier discoveries and advances in the knowledge of microbial ecosystems.

Industry Prospects

According to a report, the global DNA/RNA extraction kit market is expected to register a CAGR of 7.26% from 2021 to 2026. Increased demand for the automation of DNA/RNA extraction technology, new user-friendly and easy extraction kits and use of DNA/RNA in profiling new diseases causing microorganisms are expected to boost the market.

Recent Developments

In September 2023, QIAGEN added two new nucleic acid extraction kits, extending its eco-friendly QIAwave product line. The two new kits are the QIAwave RNeasy Plus Mini Kit and the QIAwave DNA/RNA Mini Kit, eco-friendlier versions of the RNeasy Plus Mini Kit and the All DNA/RNA Mini Kit.

In July 2023, QIAGEN launched the QIAseq Normalizer Kits, giving researchers a fast, convenient and cost-effective method to pool different DNA libraries for best-quality results from next-generation sequencing (NGS) runs. Researchers can use QIAseq Normalizer with QIAGEN's existing QIAseq library prep solutions to streamline NGS workflows or with various DNA- and RNA-library prep methods from other vendors for Illumina sequencing platforms.

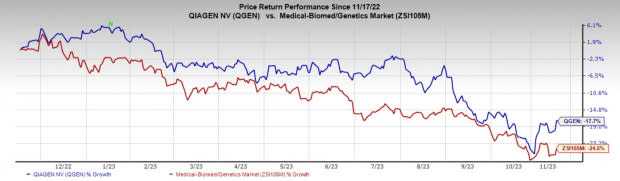

Price Performance

In the past year, QIAGEN’s shares have increased 7.3% against the industry’s fall of 5.7%.

Zacks Rank and Key Picks

QIAGEN carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Abbott Laboratories ABT, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

Abbott, carrying a Zacks Rank of 2 (Buy), reported adjusted earnings per share (EPS) of $1.14 in third-quarter 2023, beating the Zacks Consensus Estimate by 3.6%. Revenues of $10.14 billion outpaced the consensus mark by 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 6.8%.

DexCom reported third-quarter 2023 adjusted EPS of 50 cents, beating the Zacks Consensus Estimate by 47.1%. Revenues of $975 million surpassed the Zacks Consensus Estimate by 4%. It currently carries a Zacks Rank #2.

DexCom has a long-term estimated growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%.

Integer Holdings reported adjusted EPS of $1.27 in third-quarter 2023, beating the Zacks Consensus Estimate by 20.9%. Revenues of $404.7 million surpassed the Zacks Consensus Estimate by 8.7%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report