QIAGEN's (QGEN) Molecular Diagnostics Gains Share, FX Woe Stays

QIAGEN’s QGEN business is expected to get a boost from its growing molecular diagnostic market and expanded test menu. Yet, QIAGEN faces a tough competitive landscape and foreign exchange headwinds. The stock carries a Zacks Rank #3 (Hold).

QIAGEN offers one of the broadest portfolios of molecular technologies for healthcare. The range of assays for diseases and biomarkers speeds up and simplifies laboratory workflow and standardizes many lab procedures.

Meanwhile, the molecular diagnostics space is fast gaining share in the global market while catering to the rapidly growing treatment areas of oncology, infectious diseases and immune monitoring. Molecular testing is the most dynamic segment of the global in vitro diagnostics market.

QIAGEN has built a position as a preferred partner to co-develop companion diagnostics paired with targeted drugs. It is consistently creating a rich pipeline of molecular tests that are transforming the treatment of cancer and other diseases. QGEN has more than 25 master collaboration agreements with pharmaceutical industry customers, some with multiple co-development projects.

QIAGEN’s Molecular Diagnostics customers accounted for $1.1 billion in sales in 2022.

In terms of the latest development, QIAGEN’s market-leading QuantiFERON latent TB test delivered an outstanding third quarter of 2023, generating 25% CER growth and delivering a significant milestone, with quarterly sales rising above $100 million for the first time. The company continues to see a very healthy conversion trend from the tuberculin skin test.

The QIAcuity digital PCR system delivered over 40% sales growth at CER, driven by new placements and increasing biopharma consumable sales. The QIAstat diagnostic syndromic testing platform also did well this quarter with a combination of growth in consumables, driven by double-digit CER gains in noncoding testing and placements above the same level achieved in the third quarter of last year.

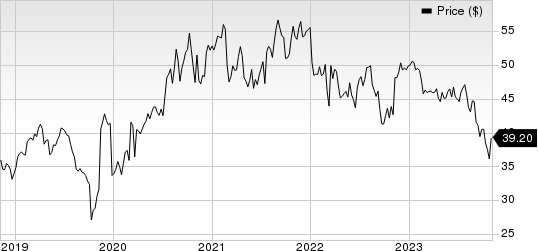

QIAGEN N.V. Price

QIAGEN N.V. price | QIAGEN N.V. Quote

QIAGEN’s long-term business strategy involves strategic alliances as well as marketing and distribution arrangements with academic, corporate and other partners relating to the development, commercialization, marketing and distribution of certain of their existing and potential products.

In October 2023, QIAGEN and Myriad Genetics collaborated to develop companion diagnostic tests in the field of cancer. The partnership aims to deliver innovative services and products to pharmaceutical companies, enabling the development and commercialization of proprietary cancer tests for the U.S. clinical market and providing distributable companion diagnostic test kits for the global market.

On the flip side, QIAGEN currently markets products in more than 100 countries. Its international operations are subject to a variety of risks arising from the economy, political outlook, language and cultural barriers in the countries it operates.

In many of these emerging markets, QIAGEN faces several risks. These include economies that may be dependent on only a few products and are therefore subject to significant fluctuations, weak legal systems that may affect the company’s ability to enforce contractual rights, exchange controls, unstable governments, and privatization or other government actions affecting the flow of goods and currency.

In the quarter under review, the Asia Pacific/Japan region reported revenue decline in low single-digit CER rates for non-COVID sales. Non-COVID sales in China declined at a low single-digit CER rate as well. Revenues from Europe, the Middle East and Africa (30.5% of sales) reportedly fell 6%. The overall sales declined 11% at CER due to significant COVID-19 sales in the third quarter of 2022.

Recording more than 50% of its revenues from the international market, QIAGEN is highly exposed to the risk of foreign currency movement. The situation may worsen with the strengthening of the domestic currency against high-focus nations. Any unanticipated currency headwinds in high-focus markets may drag the top and the bottom line further in the future.

Foreign currency transactions resulted in a net loss of $9.0 million and $4.1 million in the years ended Dec 31, 2021 and 2020, respectively.

Over the past year, shares of QIAGEN have plunged 21.4% compared with 21% fall of the industry.

Key Picks

Some better-ranked stocks in the broader medical space are DexCom DXCM, Insulet PODD and Haemonetics HAE, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DexCom has a long-term expected earnings growth rate of 33.6%. Earnings estimates for 2023 have increased from $1.23 to $1.41 in the past 30 days.

DXCM’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 36.43%. In the last reported quarter, it posted an earnings surprise of 47.1%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.62 to $1.65 in the past 30 days. PODD has a long-term expected earnings growth rate of 41.5%.

Insulet’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 126.94%. In the last reported quarter, it delivered an earnings surprise of 58.33%.

Estimates for Haemonetics’ fiscal 2024 earnings have remained constant at $3.82 in the past 60 days. HAE has a long-term expected earnings growth rate of 10%.

Haemonetics’ earnings beat estimates in each of the trailing four quarters, with the average beat being 19.39%. In the last reported quarter, it delivered an earnings surprise of 38.16%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report