QIAGEN's (QGEN) Strategic Alliances Aid Amid Macro Woes

QIAGEN’s QGEN business has been getting a boost from its growing molecular diagnostic market, international expansion, expanded test menu and growth-driving strategic collaborations. Yet, macroeconomic headwinds impede growth. The stock currently carries a Zacks Rank #3 (Hold).

QIAGEN is progressing well with its testing menu expansion strategy, which is driving the company’s growth. In October 2023, QIAGEN launched the QuantiFERON-EBV RUO (Research Use Only) assay. This new addition to the QuantiFERON portfolio of assays is designed to support research into EBV infection and EBV-related malignancies. It utilizes highly specific EBV antigens to stimulate a cell-mediated immune response, offering a dynamic view of the host’s active immune engagement with the virus.

In September 2023, QIAGEN added two new nucleic acid extraction kits, extending its eco-friendly QIAwave product line. The two new kits are the QIAwave RNeasy Plus Mini Kit and the QIAwave DNA/RNA Mini Kit, eco-friendlier versions of the RNeasy Plus Mini Kit and the All DNA/RNA Mini Kit.

QIAGEN’s long-term business strategy involves entering into strategic alliances as well as marketing and distribution arrangements with academic, corporate and other partners relating to the development, commercialization, marketing and distribution of certain of their existing and potential products.

In October 2023, QIAGEN and Myriad Genetics collaborated to develop companion diagnostic tests in the field of cancer. The partnership aims to deliver innovative services and products to pharmaceutical companies, enabling the development and commercialization of proprietary cancer tests for the U.S. clinical market and providing distributable companion diagnostic test kits for the global market.

QIAGEN’s NGS portfolio has been witnessing double-digit revenue growth over the past few quarters. Management aims to expand the NGS platform by rapidly scaling up the new Enterprise Genomics Services. It is also working on the launch of a range of new proprietary Digital NGS technology-based gene panels within the GeneReader system. QIAGEN’s latest partnerships with NHS England and Element Biosciences are expected to add further growth momentum within the genomics business.

QIAGEN is one of the top three providers of human identification solutions, which have included sample preparation and PCR kits. The company is now leveraging this position as it expands into next-generation sequencing-based applications with the recent acquisition of Verogen in early 2023. The acquisition is offering new ways to solve cases and bring resolution to those affected.

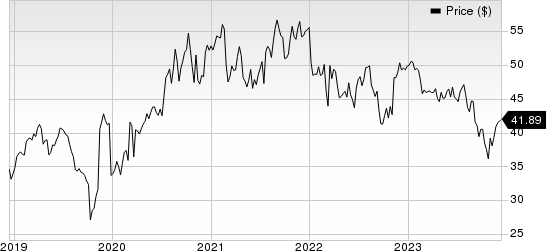

QIAGEN N.V. Price

QIAGEN N.V. price | QIAGEN N.V. Quote

On the flip side, QIAGEN currently markets products in more than 100 countries. Its international operations are subject to a variety of risks arising from the economy, political outlook, language and cultural barriers in the countries it operates. In many of the emerging markets, QIAGEN faces several risks, which include economies that may be dependent on only a few products and are, therefore subject to significant fluctuations. Weak legal systems may affect its ability to enforce contractual rights and exchange controls. Unstable governments and privatization or other government actions may affect the flow of goods and currency.

In the quarter under review, overall sales declined 11% at CER due to difficult year-over-year comparisons. In the year-ago quarter, the company had witnessed strong COVID-19 sales.

QIAGEN records more than 50% of its revenues from the international market. As a result, it is highly exposed to the risk of foreign currency movement. The situation may worsen with the strengthening of the domestic currency against high-focus nations. Any unanticipated currency headwinds in high-focus markets may drag down the top and bottom lines further in the future.

Foreign currency transactions resulted in a net loss of $9.0 million and $4.1 million in 2021 and 2020, respectively.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 for 2023 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report