Quadratic Launches Deflation ETF

On Tuesday, Quadratic Capital Management announced the launch of the Quadratic Deflation ETF (BNDD).

The fund seeks to profit from a variety of challenging environments including lower growth, deflation, lower or negative long-term interest rates, and/or a reduction in the spread between shorter and longer-term interest rates by investing in U.S. Treasuries and options.

The ETF has an expense ratio of 0.99% and trades on NYSE Arca.

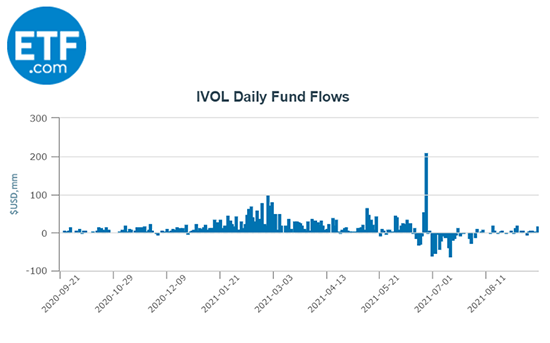

BNDD is the second ETF from Quadratic. In May 2019, the firm debuted the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL). This ETF has resonated with investors worried about inflation, gathering over $3.3 billion in assets under management in just over two years.

Chart courtesy of FactSet

(For a larger view, click on the image above)

The majority of those assets flowed into the fund in early 2021. At that time, signs of rising inflation were starting to . By April, the Consumer Price Index showed prices had risen by 4.2% since the year prior, marking the fastest gain since 2008.

Since inflation has dominated the headlines for much of the year, Quadratic’s choice to launch an ETF that benefits from a deflationary environment is an interesting one. Per the prospectus, the fund’s strategy is designed to hedge against deflation risk and generate positive returns from the fund’s options during periods when the U.S. interest rate curve flattens or inverts.

Nancy Davis, founder and CIO of Quadratic Capital, explained the rationale for the launch: “Many investors look at this environment, demographics around the world, extreme overindebtedness, and are looking for a solution. What if the U.S. isn’t going to be growing, or is having less growth? There are negative yields still all around developed countries, whether you look at Europe or Japan. For investors who want to protect their portfolio against demographics and deflationary trends, this is a product for them.”

The portfolio mainly comprises long-dated U.S. Treasury bonds, enhanced by a portfolio of options. Bonds have an inverse correlation with interest rates, meaning that when interest rates fall, bond prices go up in value. Long-dated bonds tend to be more sensitive to changes in rates due to having a higher duration.

The options portion of the portfolio is expected to increase in value with the compression of the spread between shorter- and longer-term interest rates. In other words, the portfolio should benefit when longer-term interest rates aren’t much higher, or potentially even lower than shorter-term rates.

Contact Jessica Ferringer at jessica.ferringer@etf.com and follow her on Twitter

Recommended Stories