Quaker Chemical (KWR) Stock Rallies 32% in 3 Months: Here's Why

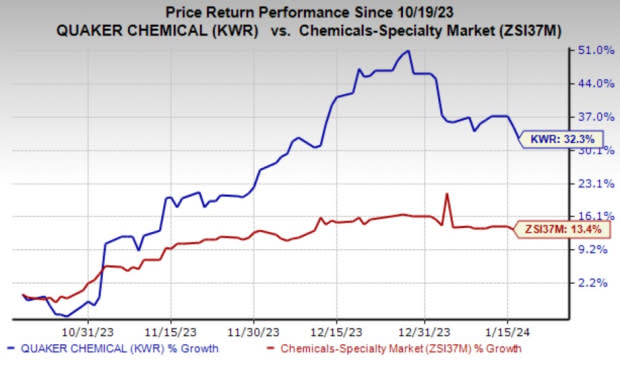

Quaker Chemical Corporation’s KWR shares have rallied 32.3% in the past three months. Owing to the upside, the stock outperformed its industry’s rise of 13.4% over the same time frame. The company has topped the S&P 500’s nearly 9% rise over the same period.

Image Source: Zacks Investment Research

Let’s look at the factors driving this Zacks Rank #3 (Hold) stock.

What’s Driving Quaker?

Quaker reported robust performance in the third quarter, surpassing expectations with adjusted earnings per share at $2.05, beating the Zacks Consensus Estimate of $1.89. Despite a slight dip in net sales by 0.3% to $490.6 million, it exceeded the Zacks Consensus Estimate of $483.6 million. The company demonstrated resilience through higher selling prices, a favorable currency impact and an improved product mix.

In the EMEA unit, sales rose by 4% year-over-year to $139.6 million, surpassing the consensus estimate of $129 million. This upside was driven by higher selling prices and a positive currency impact, although partially offset by lower sales volumes. The Asia/Pacific unit achieved sales of $105.1 million, a 2% increase from the previous year, surpassing the consensus estimate of $96 million, which can be attributed to increased sales volumes. However, the Americas segment experienced a 3% decline in sales, totaling $245.9 million.

The company consistently delivered positive earnings surprises in each of the last four consecutive quarters, with an average beat of 16.7%. The Zacks Consensus Estimate for 2023 earnings is pegged at $7.53 per share, indicating 28.3% growth from the previous year's reported figure. Earnings are also expected to register 17.9% growth in 2024.

KWR remains committed to executing its enterprise strategy as it collaborates with customers to provide value-added services and solutions. It is progressing to position the company to build upon its market-leading position by further differentiating its customer intimacy model and accelerating new business wins.

Quaker Houghton Price and Consensus

Quaker Houghton price-consensus-chart | Quaker Houghton Quote

Zacks Rank & Key Picks

Some better-ranked stocks in the Basic Materials space are Cameco Corporation CCJ, Carpenter Technology Corporation CRS and The Andersons ANDE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cameco has a projected earnings growth rate of 156% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 6.7% in the past 60 days. The stock is up around 89.2% in a year.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 47.6% in the past year.

ANDE beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 32.8%. The company’s shares have increased 44.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Quaker Houghton (KWR) : Free Stock Analysis Report