Quaker Houghton Reports Solid Fourth Quarter and Record Full Year 2023 Results

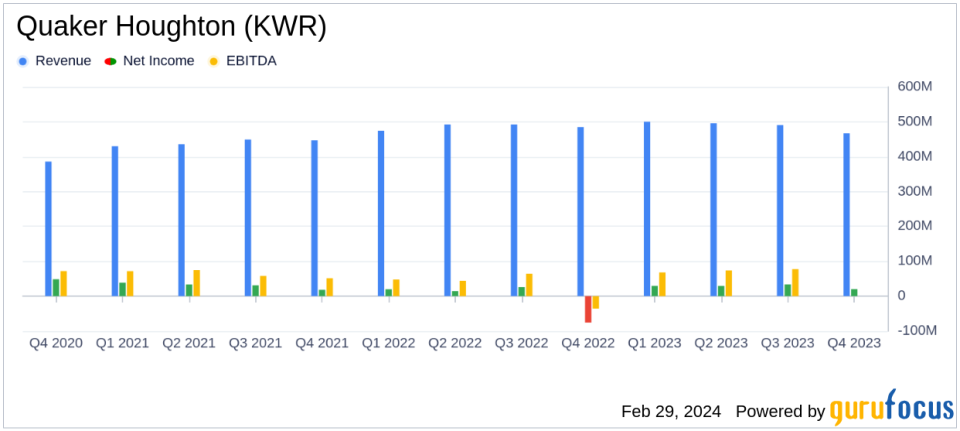

Net Sales: Q423 net sales decreased by 4% year-over-year to $467.1 million.

Net Income: Q423 net income was $20.2 million, a significant recovery from a net loss in Q422.

Earnings Per Share: Earnings per diluted share for Q423 stood at $1.12, with non-GAAP earnings per diluted share at $1.78.

Adjusted EBITDA: Q423 adjusted EBITDA increased by 13% year-over-year to $77.0 million.

Full Year Performance: Full year net sales reached $1.95 billion with a net income of $112.7 million.

Operating Cash Flow: Record operating cash flow of $279.0 million for the full year 2023.

Share Repurchase Program: A new share repurchase program of up to $150 million announced.

On February 29, 2024, Quaker Houghton (NYSE:KWR), a global leader in industrial process fluids, released its fourth quarter and full year 2023 results through an 8-K filing. The company manufactures and sells a variety of industrial process fluids, with a broad product portfolio that caters to multiple industries across the Americas, EMEA, and Asia/Pacific regions, with the majority of its revenue generated from the Americas.

Financial Performance and Challenges

Quaker Houghton's fourth quarter net sales of $467.1 million represented a 4% decrease compared to the same period in the previous year, primarily due to a decrease in selling price and product mix, and a slight decrease in sales volumes, partially offset by favorable foreign currency translation. Despite softer market conditions, including the impact of the United Auto Workers strike, the company managed to report a net income of $20.2 million, a stark contrast to the net loss of $76.0 million in Q422. This turnaround is indicative of the company's resilience and ability to navigate market volatility.

The full year net sales amounted to $1.95 billion, with a net income of $112.7 million, showcasing the company's ability to maintain profitability over the longer term. The record full year adjusted EBITDA of $320.4 million and operating cash flow of $279.0 million underscore the company's strong financial health and operational efficiency, which are critical in the chemicals industry where managing costs and capital investments are key to sustaining growth.

Financial Achievements and Industry Significance

Quaker Houghton's financial achievements, particularly the 13% year-over-year increase in adjusted EBITDA for Q4 and the record operating cash flow for the full year, are significant as they reflect the company's successful margin improvement initiatives and working capital management. These achievements are particularly important in the chemicals industry, where companies face constant pressure from raw material costs and the need to invest in technology and innovation.

Key Financial Metrics and Importance

The company's performance is further illuminated by key financial metrics:

Adjusted EBITDA margin for Q423 was 16.5%, an improvement from 14.0% in Q422.

Net operating cash flow increased by $237.2 million in 2023 compared to 2022, reflecting enhanced operating performance and working capital management.

Net debt to trailing twelve months adjusted EBITDA was approximately 1.8x, indicating a manageable level of debt given the company's earnings.

These metrics are important as they provide insights into the company's profitability, liquidity, and leverage, which are critical for investors assessing the company's financial stability and growth prospects.

Commentary from Leadership

Andy Tometich, Chief Executive Officer and President, commented, Quaker Houghton delivered solid fourth quarter results capping off a strong 2023. We generated record net sales and earnings in 2023, reflecting the considerable improvement in the profitability of our business while managing through a challenging market environment. These results, and our focus on working capital improvements, also led to record operating cash flow, which further strengthened our financial position. I am confident in our strategy and our ability to continue to outperform our markets, and we have the right team to further unlock our potential."

Analysis of Company's Performance

Quaker Houghton's performance in the fourth quarter and full year of 2023 demonstrates the company's operational strength and strategic execution. Despite a challenging market environment, the company managed to improve gross margins and deliver solid financial results. The introduction of a new share repurchase program reflects confidence in the company's future and a commitment to delivering shareholder value.

The company's ability to generate record operating cash flow and manage its debt effectively provides it with the financial flexibility to invest in growth opportunities and navigate economic cycles. Quaker Houghton's focus on margin improvement initiatives and working capital management is expected to continue driving profitability and cash generation in the future.

For more detailed information on Quaker Houghton's financial performance and strategic outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Quaker Houghton for further details.

This article first appeared on GuruFocus.