Qualcomm (QCOM) Down on China Woes: Should Investors Worry?

Qualcomm Incorporated QCOM shares tumbled last week on news that Beijing is mulling to impose a ban on the use of iPhones in government offices and state-backed entities as part of its concerted effort toward self-reliance. The restrictions on Apple Inc. AAPL are likely to take a toll on Qualcomm, which is one of the leading suppliers to the iPhone manufacturing firm. The ripple effect is expected to have broader repercussions on the semiconductor industry as well, impacting various technology firms within the supply chain.

The new directive by the communist nation is apparently aimed at encouraging the sale and wider usage of domestic smartphone brands and curbing its reliance on foreign technology. It also intends to control the flow of sensitive information outside China. However, experts widely believe the latest ploy to be a retaliatory strike in the Sino-U.S. trade spat, with Apple being the biggest pawn yet in this tech war.

The U.S. Commerce Department has long imposed various trade restrictions against China that banned the sale of high-tech equipment, chips, components and related technology to develop high-end smartphones and AI-enabled chips. Despite adding China-based Huawei to the ‘Entity List’, the newly developed Huawei Mate 60 smartphone is believed to have violated the U.S. trade sanctions. This has forced the U.S. watchdog to enforce stricter trade restrictions while conducting the authenticity of the trade violations, which probably led to a tit-for-tat action against Apple.

Over the years, China has been one of the primary markets for Apple. As the news of the purported ban spread like a wildfire, shares slumped and the company lost nearly $200 billion in market capitalization. This further affected its suppliers like Qualcomm, among others. Qualcomm modems have been a key feature in iPhone models, connecting the device to cellular networks for fast web browsing and instant app access. Built on indigenous technology that requires specialized engineering expertise and broad industry know-how, these modems have been the hallmark of impeccable performance standards.

Moreover, China accounts for a lion’s share of Qualcomm’s revenues. The company also supplied older-generation 4G chips to Huawei. Consequently, Qualcomm shares had a knee-jerk effect amid the sudden developments.

However, Qualcomm is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge with a diversified revenue stream. It is witnessing healthy traction in EDGE networking that helps to transform connectivity in cars, business enterprises, homes, smart factories, next-generation PCs, wearables and tablets. The automotive telematics and connectivity platforms, digital cockpit and C-V2X solutions are also fueling emerging automotive industry trends such as the growth of connected vehicles, the transformation of the in-car experience and vehicle electrification. Qualcomm believes it is on track to become the largest smartphone RF front-end supplier by revenues in the near future.

With the acquisition of Veoneer, Qualcomm has incorporated Arriver's Computer Vision, Drive Policy and Driver Assistance assets into its ADAS portfolio to deliver an open and competitive platform for automakers to better compete with rivals within the self-driving vehicle market. This, in turn, is likely to augment its automotive business as it strives to boost revenues beyond chipmaking for the smartphone market.

The company intends to harness artificial intelligence to meet increased demands for essential products and services that are the building blocks of digital transformation in a cloud economy. Qualcomm envisions solid growth opportunities within the mobile space, driven by its Snapdragon portfolio.

Amid this backdrop, we expect the China setback to have a limited effect on its share prices.

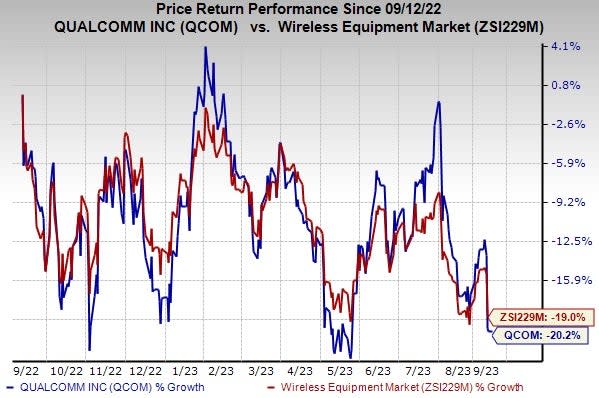

Shares of the company have lost 20.2% in the past year compared with the industry’s decline of 19%.

Image Source: Zacks Investment Research

Qualcomm currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC is a Zacks Rank #2 stock. It has a long-term earnings growth expectation of 4.3% and delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report