Will Qualcomm (QCOM) Gain From Manchester United Sponsorship?

Qualcomm Incorporated QCOM recently inked an agreement with Manchester United plc MANU for an undisclosed amount for being the official shirt sponsor from next season. The three-year agreement with one of the premier English Premier League ("EPL") soccer clubs with a dedicated fanbase is likely to prove beneficial for Qualcomm and augment its global exposure.

Per the deal, effective from the start of the 2024-25 season, the Snapdragon brand of Qualcomm will be put in front of the iconic jerseys of the EPL club. Snapdragon will feature on all the home, away and third kits of the men’s and women’s teams of Manchester United, replacing Germany-based software firm TeamViewer. Although no official deal value is currently available, people familiar with the proceedings have billed it to be one of the largest jersey deals in soccer.

TeamViewer has been the official sponsor of MANU team jerseys since 2021 when it signed a five-year agreement worth £47 million per year. However, in December 2022, the companies signed a mutually agreeable pact under which Manchester United would buy back the rights to the sponsorship, with TeamViewer facing intense shareholder pressure to terminate the deal that reportedly drained its coffers.

This opened the sponsorship gates for Qualcomm, who had been associated with the EPL club since 2022 as its global partner. Snapdragon was also the sponsor of the Red Devils’ 2023 U.S. summer tour. The expanded agreement will allow the chipmaker to showcase its processor that powers smartphones, PCs, connected cars, gaming devices and smart wearables.

Manchester United historically sells around 2 million shirts each year on average, with the club maintaining a rich legacy and huge fan-following base across the globe. This, in turn, is likely to provide additional mileage for upcoming Snapdragon models with top-of-the-mind recall and boost its brand presence. The deal gains further significance as Qualcomm chips will be featured in the upcoming iPhone models with a renewed deal inked with Apple Inc.

Qualcomm is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge with a diversified revenue stream. It is witnessing healthy traction in EDGE networking that helps to transform connectivity in cars, business enterprises, homes, smart factories, next-generation PCs, wearables and tablets. The automotive telematics and connectivity platforms, digital cockpit and C-V2X solutions are also fueling emerging automotive industry trends such as the growth of connected vehicles, the transformation of the in-car experience and vehicle electrification. Qualcomm believes it is on track to become the largest smartphone RF front-end supplier by revenues in the near future.

The company intends to harness artificial intelligence to meet increased demands for essential products and services that are the building blocks of digital transformation in a cloud economy. Qualcomm envisions solid growth opportunities within the mobile space, driven by the strength of its Snapdragon portfolio. Amid this backdrop, the sponsorship deal with the Red Devils is expected to be conducive to long-term growth.

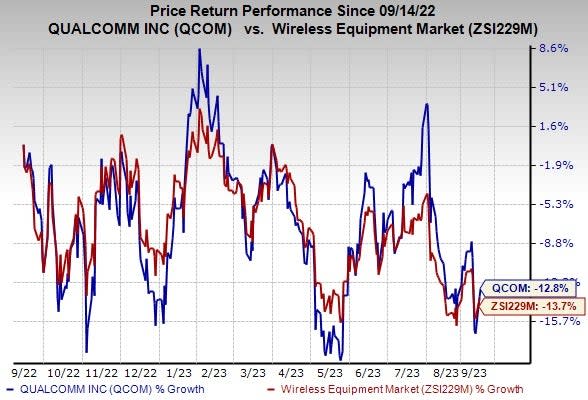

Shares of the company have lost 12.8% in the past year compared with the industry’s decline of 13.7%.

Image Source: Zacks Investment Research

Qualcomm currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC is a Zacks Rank #2 stock. It has a long-term earnings growth expectation of 4.3% and delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Manchester United Ltd. (MANU) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report