Qualys Inc (QLYS) Reports Strong Earnings Growth and Expands Share Repurchase Program

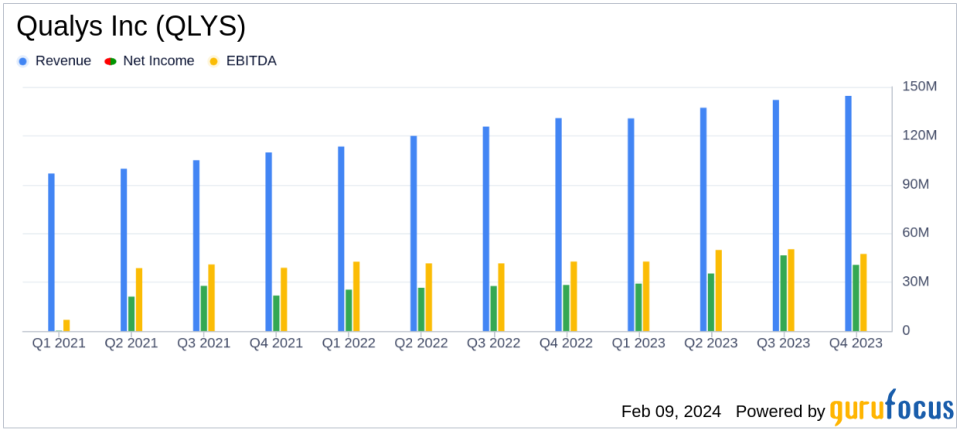

Revenue Growth: Q4 2023 revenues increased by 10% year-over-year to $144.6 million.

GAAP EPS Growth: Full year GAAP EPS rose to $4.03, a 47% increase from 2022.

Non-GAAP EPS Growth: Non-GAAP EPS for 2023 was $5.27, reflecting a significant rise from the previous year.

Gross Margin Improvement: GAAP and Non-GAAP gross margins improved to 81% and 83% for Q4 2023, respectively.

Adjusted EBITDA: Adjusted EBITDA for Q4 2023 increased by 20% to $65.8 million.

Operating Cash Flow: Operating cash flow for Q4 2023 decreased by 23% to $33.8 million.

Share Repurchase: Announced a $200 million increase to the share repurchase program.

On February 7, 2024, Qualys Inc (NASDAQ:QLYS), a leading provider of cloud security and compliance solutions, released its 8-K filing, detailing robust financial results for the fourth quarter and full year of 2023. The company, known for its innovative IT, security, and compliance solutions, has reported a year-over-year revenue growth of 13% for 2023, with a 10% increase in the fourth quarter alone.

Qualys Inc (NASDAQ:QLYS) has demonstrated a strong financial performance, with significant increases in both GAAP and non-GAAP earnings per share (EPS). The company's strategic vision of consolidating security tools on an integrated platform has resonated with customers, leading to growing scale and module adoption. This approach has not only transformed security stacks for transparent risk assessment but also delivered measurable business results and lower total cost of ownership (TCO).

Financial Performance Highlights

The company's financial achievements reflect its solid position in the software industry. The increase in GAAP gross profit by 14% and non-GAAP gross profit by the same margin in Q4 2023, compared to the same quarter in 2022, underscores Qualys' ability to maintain high profitability while scaling its operations. The improvement in gross margins, both GAAP and non-GAAP, from 79% and 81% in Q4 2022 to 81% and 83% in Q4 2023 respectively, highlights the company's efficiency in managing costs relative to revenue growth.

Operating income saw a substantial rise, with GAAP operating income increasing by 35% and non-GAAP operating income by 28% for the fourth quarter of 2023. This growth in operating income as a percentage of revenues from 23% to 29% for GAAP and from 36% to 42% for non-GAAP, indicates a strong operational leverage and disciplined expense management.

Despite the impressive profitability metrics, operating cash flow experienced a 23% decrease in Q4 2023 compared to the same quarter in the previous year. This decline may raise concerns about the company's cash generation efficiency, which will be an important metric for investors to monitor going forward.

Business and Financial Outlook

Qualys Inc (NASDAQ:QLYS) has not only delivered strong financial results but also made significant strides in product innovation and market recognition. The company's VMDR was acknowledged as the best vulnerability management solution, and its Threat Research Unit continued to receive accolades for its contributions to cybersecurity research.

Looking ahead, Qualys provided guidance for the first quarter and full year of 2024, projecting continued revenue growth and profitability. For Q1 2024, revenues are expected to be in the range of $144.5 million to $146.5 million, with GAAP EPS between $0.84 and $0.92 and non-GAAP EPS between $1.27 and $1.35. For the full year, the company anticipates revenues between $600.0 million and $610.0 million, with GAAP EPS ranging from $3.11 to $3.43 and non-GAAP EPS from $4.95 to $5.27.

Qualys' commitment to innovation and customer value, combined with its prudent financial management, positions the company well for sustained growth. Investors and potential GuruFocus.com members interested in the cloud security and compliance sector will find Qualys Inc (NASDAQ:QLYS) to be a compelling company to follow.

For a more detailed analysis of Qualys Inc (NASDAQ:QLYS)'s financial results and future outlook, investors are encouraged to review the full 8-K filing and consider the implications for their investment strategies.

Explore the complete 8-K earnings release (here) from Qualys Inc for further details.

This article first appeared on GuruFocus.