Quanex Building Products Corp (NX) Reports Q1 2024 Earnings: Margin Expansion Despite Sales Dip

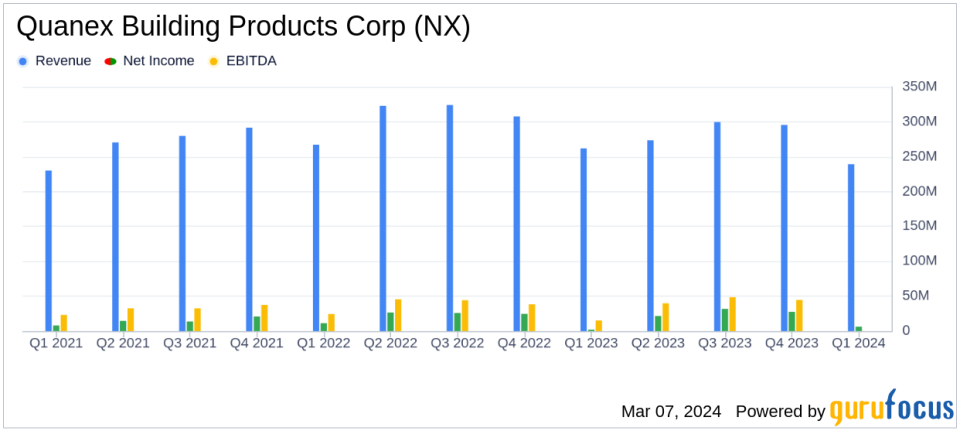

Net Sales: Decreased by 8.7% to $239.2 million from $261.9 million in Q1 2023.

Gross Margin: Improved to 21.5% from 19.8% year-over-year.

Net Income: Increased to $6.2 million from $1.9 million in Q1 2023.

Diluted EPS: Rose to $0.19 from $0.06 in the same period last year.

Adjusted EBITDA: Slightly decreased to $19.3 million from $20.5 million in Q1 2023.

Free Cash Flow: Negative at ($5.7) million, compared to ($4.4) million in Q1 2023.

Debt Repayment: Reduced bank debt by $5 million during the quarter.

Quanex Building Products Corp (NYSE:NX), a leading manufacturer of components for the building products industry, has announced its financial results for the first quarter of 2024. Despite a decrease in net sales, the company has successfully expanded its gross margin and increased net income, showcasing resilience in a challenging market environment.

The company's net sales for the quarter ended January 31, 2024, were $239.2 million, an 8.7% decrease from the $261.9 million reported in the same period of 2023. This decline was primarily due to softer market demand and lower pricing in North America, particularly in the North American Fenestration and Cabinet Components segments. Despite the sales dip, Quanex achieved a gross margin of 21.5%, up from 19.8% in the prior year, reflecting a more profitable mix of products and a decline in raw material costs.

Financial Highlights and Challenges

Quanex's net income for the first quarter rose significantly to $6.2 million, up from $1.9 million in the first quarter of 2023. This increase was largely due to the aforementioned decline in raw material costs, a decrease in stock-based compensation expense, and lower interest expense. Diluted earnings per share (EPS) also increased to $0.19 from $0.06 in the previous year.

Adjusted EBITDA, however, saw a slight decrease to $19.3 million from $20.5 million in the first quarter of 2023, with the adjusted EBITDA margin percentage improving to 8.1% from 7.8%. The company's free cash flow was negative at ($5.7) million, compared to ($4.4) million in the prior year's first quarter, which is not uncommon for the company due to the seasonality of the business.

Quanex's balance sheet remains strong, with total debt standing at $65.2 million, of which $13.5 million is related to real-estate leases considered "finance" leases under U.S. GAAP. The company's leverage ratio of Net Debt to LTM Adjusted EBITDA was unchanged at 0.1x, indicating a solid financial position.

Outlook and Industry Position

George Wilson, President and Chief Executive Officer of Quanex, expressed cautious optimism for the second half of 2024, anticipating an improvement in product demand. The company estimates net sales of approximately $1.1 billion for fiscal 2024, with an expected Adjusted EBITDA of $145 million to $150 million. Wilson reaffirmed the positive long-term outlook for the residential housing market, which remains a key driver for Quanex's business.

"We were able to realize margin expansion on a consolidated basis for the first quarter of 2024 despite market volume softness related to normal seasonality combined with ongoing macroeconomic challenges, and some pricing pressure," said George Wilson, President and CEO of Quanex.

Quanex's performance in the first quarter of 2024 demonstrates its ability to manage costs and maintain profitability in a challenging market. The company's focus on cash generation and working capital management has allowed it to reduce debt and maintain a strong balance sheet, positioning it well for both organic and inorganic growth opportunities.

Value investors may find Quanex's margin expansion and debt reduction strategies appealing, as they indicate a company that is not only navigating current market challenges but also laying the groundwork for future growth. The company's commitment to innovation and expansion into adjacent markets suggests potential for long-term value creation.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications of Quanex's financial performance on their investment decisions.

Explore the complete 8-K earnings release (here) from Quanex Building Products Corp for further details.

This article first appeared on GuruFocus.