Quanta (PWR) Hikes Dividend by 12.5% to Boost Investors' Value

Quanta Services, Inc.’s PWR shares jumped 1.28% in the last trading session after it announced a 12.5% quarterly dividend hike to enhance its stockholders’ value.

The company boosted its quarterly dividend to 9 cents per share (36 cents annually) from 8 cents (32 cents annually). The hike was approved by the company’s board of directors and will be paid on Jan 12, 2024, to its stockholders of record as of Jan 2. The dividend yield, based on the latest payout and closing market price of $191.85 (as o Dec 6, 2023), is approximately 0.17%.

This hike is reflective of its confidence in the stability of the base business, long-term prospects and solid financial position. A dividend increase not only enhances shareholder returns but also raises a stock’s market value. In fact, companies often tend to attract new investors and retain the old ones through this strategy.

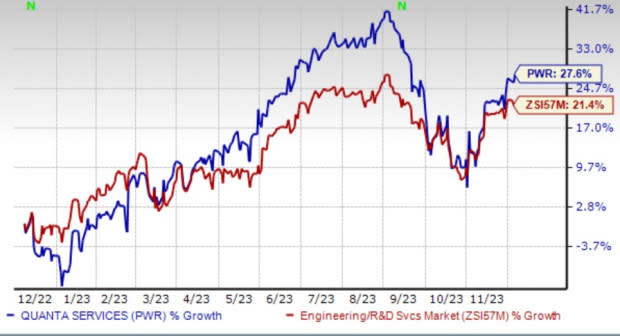

Image Source: Zacks Investment Research

The stock rose 27.6% in the past year compared with the Zacks Engineering - R and D Services industry’s 21.4% growth.

What Led to the Dividend Increase?

Quanta has been benefiting from the rising demand for sustainable energy solutions. The year 2024 exhibits continuous widespread growth opportunities for infrastructure solutions and increased project activity associated with renewable generation.

The company reported impressive earnings and revenues for third-quarter 2023, which increased 26.6% and 26%, respectively, year over year. The upside was backed by solid demand for its services driven by customers’ multi-year programs designed to modernize and harden utility infrastructure, increase renewable generation and transmission infrastructure and move toward a reduced-carbon economy.

This specialty contracting services provider achieved strong double-digit growth in adjusted EBITDA (up 26.8%) and adjusted earnings per share, which is reflective of the benefits of its operations portfolio strategy and strategic capital deployment.

It reported a 12-month backlog of $17.02 billion and a total backlog of $30.1 billion at September 2023-end, up from the year-ago figures of $12.43 billion and $20.87 billion, respectively. This compares favorably with the December 2022-end’s 12-month backlog of $13.79 billion and the total backlog of $24.09 billion.

The company has been capitalizing on megatrends to lead the energy transition and enable technological development. Initiatives toward a reduced-carbon economy continue to drive the demand for PWR’s services and depict incremental growth opportunities.

PWR has been banking on a solid project execution strategy and three pronged growth plans, which emphasize the timely delivery of projects to exceed customer expectations, leveraging the core business to expand in complementary adjacent service lines and consistently explore new service lines.

Backed by the above-mentioned tailwinds, Quanta raised its full-year guidance. It now expects revenues in the range of $20.1-$20.4 billion compared with the prior guidance of $19.6-$20 billion. The company now expects adjusted EPS (non-GAAP) in the range of $7.00-$7.20 compared with the previous projection of $6.90-$7.30. Adjusted EBITDA is now projected to be between $1.91 billion and $1.95 billion compared with the prior guidance of $1.88-$1.97 billion.

Zacks Rank & Key Picks

The company currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Construction sector have been discussed below.

Gates Industrial Corporation plc GTES manufactures engineered power transmission and fluid power solutions. GTES currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GTES’ expected earnings growth rate for 2023 is 10.5%. The consensus mark for GTES’ 2023 earnings has moved north to $1.26 per share from $1.21 in the past 30 days.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank #1. MPTI delivered a trailing four-quarter average earnings surprise of 35.6%.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year's level.

Willdan Group, Inc. WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry.

WLDN presently sports a Zacks Rank #1. Its expected earnings growth rate for 2023 is 50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report