Quanta (PWR) Q2 Earnings Lag, Margin Up, 2023 Guidance Raised

Quanta Services Inc. PWR reported mixed results for second-quarter 2023, wherein adjusted earnings missed the Zacks Consensus Estimate but revenues surpassed the same. Both metrics were up on a year-over-year basis.

The company continues to experience high demand for its infrastructure solutions that support energy transition initiatives and increase reliability, safety and efficiency. Project activity associated with renewable generation has been going strong and is expected to continue throughout the year.

Backed by solid first-half performance and a strengthening outlook, particularly for the Renewable Infrastructure Solutions segment, the company raised its full-year guidance for major metrics.

However, shares of this leading national provider of specialty contracting services dipped 1.1% in the pre-market trading session on Aug 3.

Detailed Discussion

Quanta’s adjusted earnings of $1.65 per share lagged the consensus estimate of $1.67 by 1.2% but increased 6.5% from the year-ago quarter’s $1.55. The upside was backed by strong demand for its services driven by the customers’ multi-year programs designed to modernize and harden utility infrastructure, increase renewable generation and transmission infrastructure and move toward a reduced-carbon economy.

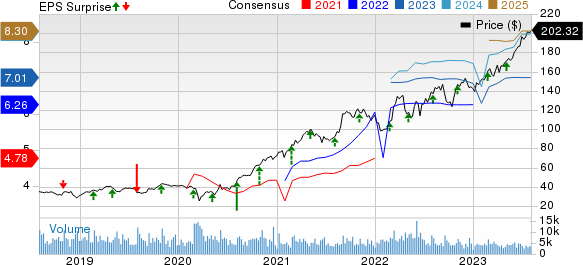

Quanta Services, Inc. Price, Consensus and EPS Surprise

Quanta Services, Inc. price-consensus-eps-surprise-chart | Quanta Services, Inc. Quote

Total revenues of $5.05 billion surpassed the consensus mark of $4.7 billion by 7.5% and increased 19.3% year over year.

The operating margin for the quarter expanded 60 basis points (bps) to 5.5% from a year ago. Adjusted EBITDA of $472.1 million improved 11.8% from $422.1 million in the year-ago quarter. We projected operating margins to be 6.6% and adjusted EBITDA to be up 12.5%.

The company reported a 12-month backlog of $15.64 billion and a total backlog of $27.2 billion at June 2023-end. This compares favorably with the December 2022-end’s 12-month backlog of $13.79 billion and the total backlog of $24.09 billion. The reported metrics were also up from the year-ago respective figures of $11.58 billion and $19.85 billion. Our model suggested a total backlog of $24.01 billion.

Segment Details

It reports results under three segments: Electric Power Infrastructure Solutions, Renewable Energy Infrastructure Solutions and Underground Utility and Infrastructure Solutions.

Revenues from Electric Power Infrastructure Solutions totaled $2.42 billion, increasing 10% year over year. The upside was primarily backed by growth in spending by the utility customers on grid modernization and hardening as well as revenue growth from acquired businesses.

The operating margin, however, contracted 50 bps to 10.1%. Lower equity in earnings from its integral unconsolidated affiliates and lower utilization of Canadian resources offset the improved margin growth associated with communications projects.

Nonetheless, the segment’s 12-month backlog was $7.53 billion, up from $6.38 billion a year ago. The total backlog of $13.58 billion grew from $11.72 billion reported in the prior-year quarter.

Revenues from Renewable Energy Infrastructure Solutions totaled $1.39 million, up 50% year over year. This was driven by increased renewable infrastructure project activity and its customers' ability to move forward with construction activities in the current favorable regulatory environment and through acquisitions.

Operating margins contracted 85 bps to 8% from a year ago due to increased costs related to higher levels of resources required to support the expected increase in project activity in the second half of 2023 and into 2024.

The segment’s 12-month backlog was $5.17 billion, up from $2.35 billion a year ago. The total backlog of $7.01 billion increased from $3 billion reported in the year-ago period.

Within the Underground Utility and Infrastructure Solutions segment, revenues rose 12% from the prior-year quarter’s levels to $1.24 billion, backed by higher demand from gas utility and industrial customers as well as large pipeline projects in Canada.

The operating margin of 8.6% was up 50 bps from 8.1% reported in the prior-year quarter. Segment’s 12-month backlog totaled $2.94 billion, up from $2.84 billion a year ago. The total backlog increased to $6.6 billion from $5.12 billion in the prior-year quarter.

Liquidity

As of Jun 30, 2023, Quanta had cash and cash equivalents of $362 million, down from $428.5 million at 2022-end. The company’s long-term debt (net of current maturities) amounted to $4.22 billion, up from $3.69 billion as of Dec 31, 2022.

Net cash provided by operating activities was $127.4 million in the second quarter, up from $118.7 million a year ago. The free cash flow for the quarter was $46.3 million versus $13.5 million reported in the year-ago period.

2023 Guidance Lifted

Quanta now expects revenues between $19.6 billion and $20.0 billion versus prior expectations of $18.6 billion and $19.1 billion.

The company now expects adjusted (non-GAAP) earnings within $6.90-$7.30, up from the previous projection of $6.75-$7.25. Adjusted EBITDA is now projected within $1.88-$1.97 billion compared with $1.84-$1.95 billion expected earlier.

Quanta’s non-GAAP free cash flow projection is now expected to be $800-$1.00 billion compared with $750-$1 billion expected previously. Quanta now expects net cash attributable to operating activities in the $1.20-$1.40 billion range versus $1.15-$1.40 billion anticipated earlier.

Zacks Rank & Recent Construction Releases

Quanta currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KBR, Inc. KBR reported mixed second-quarter 2023 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. Earnings beat the consensus estimate for the seventh straight quarter. Revenues, on the other hand, surpassed the mark in three of the trailing seven quarters and missed on other four occasions.

Although KBR’s quarterly earnings were impacted by losses related to convertible notes and a legacy legal matter, the company delivered a strong quarter of financial and environmental, social and governance or ESG performance, underpinned by its mission focus and operational discipline.

Louisiana-Pacific Corporation LPX or LP, reported unimpressive results for second-quarter 2023. Earnings and net sales missed the Zacks Consensus Estimate and declined year over year.

That said, LP's strategy positions it well for long-term growth as the housing outlook continues to improve.

Weyerhaeuser Company WY reported mixed second-quarter 2023 results, wherein its earnings handily beat the Zacks Consensus Estimate but net sales missed the same marginally. On a year-over-year basis, the top and bottom lines declined.

Meanwhile, in July, Weyerhaeuser made a significant acquisition, purchasing 22,000 acres of timberlands in Mississippi for around $60 million. These timberlands are known for their high productivity and have been strategically chosen due to their proximity to Weyerhaeuser's current operations. The acquisition is expected to bring about immediate synergies and create additional opportunities for real estate and natural climate solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report