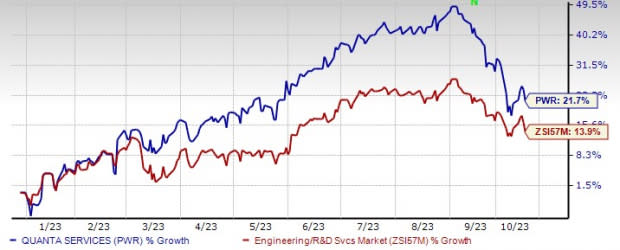

Quanta (PWR) Stock Rises 21.7% YTD: What's Driving It?

Quanta Services, Inc. PWR has been benefiting from enduring demand in its target markets and the robust performance of its fundamental operations. The company has been effectively leveraging megatrends to take the lead in driving the transition toward sustainable energy solutions and facilitating technological advancements. The year 2023 exhibits widespread growth opportunities, with continuous growth opportunities for infrastructure solutions.

Quanta stock has gained 21.7% year to date (YTD), outperforming the Zacks Engineering - R and D Services industry’s 13.9% growth. This Zacks Rank #2 (Buy) stock is also expected to gain from prudent growth strategies and accretive acquisitions.

Although project delays, supply chain risks and oil & gas volatility are major concerns, the Zacks Consensus Estimate has witnessed an uptrend over the past 60 days as analysts raised their estimates. Over the said time frame, the Zacks Consensus Estimate for earnings per share (EPS) of $7.08 for 2023 has increased from $7.06. The estimated figure indicates 11.7% year-over-year growth.

Image Source: Zacks Investment Research

Let’s take a look at the factors supporting the growth.

Solid Backlog: The company ended the second quarter with a total record backlog of $27.2 billion and a 12-month backlog of $15.64 billion. This compares favorably with the December 2022-end’s 12-month backlog of $13.79 billion and the total backlog of $24.09 billion. The reported metrics were also up from the year-ago respective figures of $11.58 billion and $19.85 billion. This underscores the resilience of its fundamental operations, showcasing the company's core strength. Quanta holds a positive outlook for its future, driven by its growing backlog, which is expected to remain healthy and continue to expand. Quanta envisions delivering a more than 15% adjusted EPS compound annual growth rate through 2026.

Decarbonization Efforts: Quanta is anticipated to enjoy the benefits of its engagement in diverse technological solutions aimed at advancing decarbonization initiatives. These encompass various domains, including carbon management and mitigation, compliance consulting, as well as the full spectrum of infrastructure necessary to support carbon-neutral energy solutions. Quanta has been strategically positioned to capitalize on major trends driving the energy transition and fostering technological advancements. Notably, initiatives like the expansion of electric vehicle charging infrastructure and the undergrounding of electrical infrastructure are gaining significant traction, further contributing to the company's growth prospects.

Acquisitions: Quanta considers acquisitions as a pivotal element of its strategy to augment its market presence and expand its order backlog. In January 2023, Quanta completed the acquisition of three companies. One of these specializes in providing services related to high-voltage transmission lines, overhead and underground distribution, emergency restoration, and industrial and commercial wiring and lighting. This acquisition primarily strengthens Quanta's presence in the Electric Power sector. Another acquired company offers solutions in the field of concrete construction services, bolstering Quanta's capabilities in both the Electric Power and Renewable Energy segments. The third acquisition involves a business focused on procuring components, assembling kits for sale, managing logistics, and installing solar tracking equipment for utility and development clients, primarily enhancing Quanta's operations within the Renewable Energy segment.

3 Other Top-Ranked Construction Stocks Hogging in the Limelight

Toll Brothers, Inc. TOL currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 31.4%, on average. Shares of TOL have surged by 43.7% YTD. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TOL’s 2023 sales indicates a 5.1% decline but EPS indicates 19.8% growth from the year-ago period’s levels.

TopBuild Corp. BLD has a Zacks Rank #2 at present. It has a trailing four-quarter earnings surprise of 14.1%, on average. Shares of BLD have surged by 52.1% YTD.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates gains of 3.3% and 8.4%, respectively, from the year-ago period’s levels.

EMCOR Group, Inc. EME currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 17.2%, on average. Shares of EME have risen 36.4% YTD.

The Zacks Consensus Estimate for EME’s 2023 sales and EPS suggests growth of 11.3% and 35.4%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report