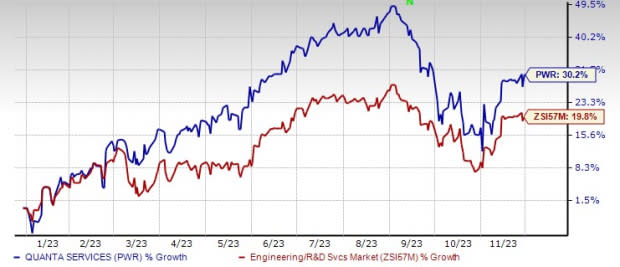

Quanta (PWR) Stock Rises 30.2% YTD: More Room to Run?

Quanta Services, Inc. PWR has been benefiting from the rising demand for sustainable energy solutions. The year 2024 exhibits widespread growth opportunities, with continuous growth opportunities for infrastructure solutions and increased project activity associated with renewable generation.

Quanta stock has gained 30.2% year to date (YTD), outperforming the Zacks Engineering - R and D Services industry’s 19.8% growth. This Zacks Rank #3 (Hold) stock is also expected to gain from prudent growth strategies and accretive acquisitions.

Yet, project delays, higher costs and cyclical nature of the business are major concerns.

Nonetheless, the Zacks Consensus Estimate for earnings per share (EPS) of $7.07 for 2023 and $8.35 for 2024 indicates 11.5% and 18.1% year-over-year growth, respectively.

Image Source: Zacks Investment Research

Let’s take a look at the factors supporting the growth.

High Infrastructural Demand: Quanta is benefiting from its active participation in advancing and implementing technology solutions across the entire decarbonization spectrum. This encompasses activities related to carbon management, mitigation, compliance consulting, and the establishment of infrastructure supporting carbon-free energy solutions. Quanta Services has strategically positioned itself to leverage significant industry trends and take a prominent role in the ongoing energy transition, fostering technological innovation. Notable initiatives, such as expanding electric vehicle charging infrastructure and the underground placement of electrical infrastructure, are gaining momentum and contributing to the success of Quanta Services.

Solid Backlog Level: The company ended the third quarter of 2023 with a 12-month backlog of $17.02 billion and a total record backlog of $30.1 billion. This compares favorably with the December 2022-end’s 12-month backlog of $13.79 billion and the total backlog of $24.09 billion. The reported metrics were also up from the year-ago respective figures of $12.43 billion and $20.87 billion. This demonstrates the strength of its core operations. Quanta’s optimism stems from healthy backlog levels, which are expected to grow further.

Quanta envisions delivering a 10% organic adjusted EPS compound annual growth rate (CAGR) and more than 15% adjusted EPS CAGR through 2026.

Acquisitions: Quanta considers acquisitions to be a pivotal element of its strategy to augment its market presence and expand its order backlog. During the third quarter of 2023 earnings call, the company announced its successful acquisition of Pennsylvania Transformer Technology, or PTT, a manufacturer of power transformers and components for investor-owned electric utility, renewable energy, municipal power and industrial markets. The company believes that this strategic buyout will provide it and its clients with a crucial supply-chain solution that aligns with its strategy. In January 2023, Quanta completed the acquisition of three companies.

Factors Hindering Growth

Margin Pressure: In the third quarter, the operating margin of the Renewable Energy Infrastructure Solutions unit contracted 40 basis points (bps) to 8.7%. This contraction was attributed to fluctuations in project timing overall and heightened cost absorption pressure, primarily stemming from increased fixed costs aimed at supporting the anticipated rise in project activity in the forthcoming period. Similarly, during the second quarter, the operating margin for this segment experienced an 85-bps contraction to 8% compared to the previous year. This decline was a result of escalated costs associated with the augmented resources required to facilitate the expected upsurge in project activity in the latter half of 2023 and extending into 2024.

Business Cyclicality: The business exhibits a cyclical nature as the demand for Quanta's services is subject to fluctuations. Consequently, the company is particularly susceptible to declines in both government and private industrial expenditures. Throughout its history, fluctuations in commodity prices have adversely affected not only the oil and gas sector but also regions where economic stability is significantly tied to commodity prices.

Key Picks

Some better-ranked stocks in the Zacks Construction sector are:

Gates Industrial Corporation plc GTES manufactures engineered power transmission and fluid power solutions. GTES currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GTES’ expected earnings growth rate for 2023 is 10.5%. The consensus mark for GTES’ 2023 earnings has moved north to $1.26 per share from $1.21 in the past 30 days.

Sterling Infrastructure, Inc. STRL currently has a Zacks Rank #2 (Buy). STRL delivered a trailing four-quarter earnings surprise of 12.2%, on average.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 4.9% and 32.3%, respectively, from the previous year’s reported levels.

Willdan Group, Inc. WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry.

WLDN presently carries a Zacks Rank #2. Its expected earnings growth rate for 2023 is 50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report