Quantamental Technologies LLC's Q2 2023 13F Filing Analysis

Quantamental Technologies LLC, a renowned investment firm, recently filed its 13F report for the second quarter of 2023, which ended on June 30, 2023. The firm is known for its unique investment philosophy that combines quantitative analysis with fundamental investing, hence the name 'Quantamental'. This approach allows the firm to leverage the strengths of both strategies, providing a comprehensive view of the market and individual stocks.

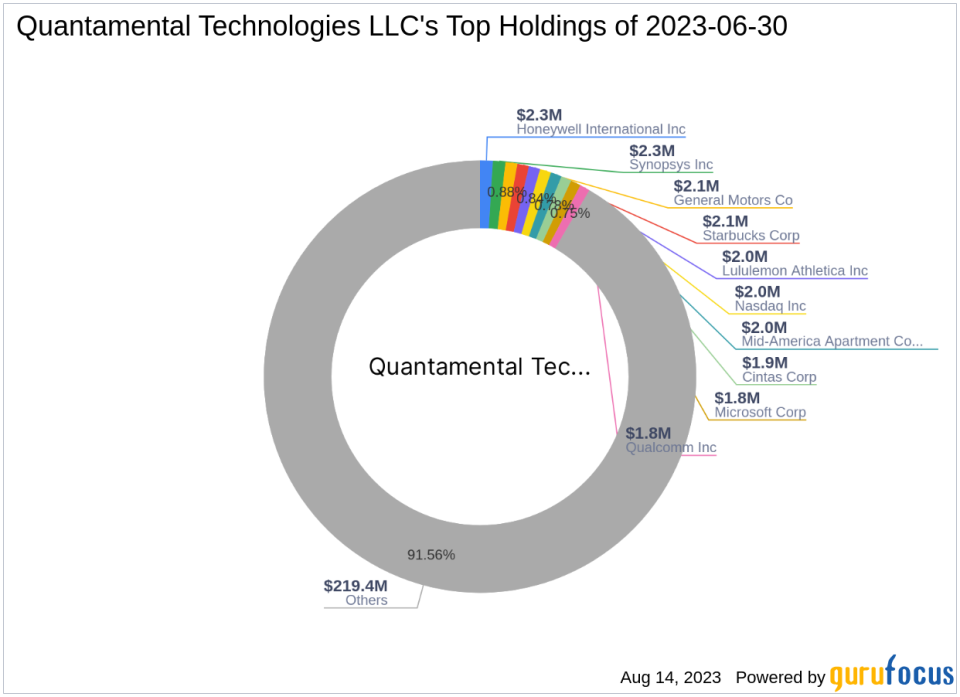

The firm's portfolio for Q2 2023 contained 456 stocks with a total value of $240 million. The top holdings were Honeywell International Inc. (HON) with 0.95%, Synopsys Inc. (SNPS) with 0.94%, and General Motors Company (GM) with 0.88%.

Top Three Trades of the Quarter

The firm's top three trades of the quarter were Rockwell Automation Inc (NYSE:ROK), IQVIA Holdings Inc (NYSE:IQV), and Kellogg Co (NYSE:K).

Rockwell Automation Inc (NYSE:ROK)

Quantamental Technologies LLC sold out of their 6,384-share investment in Rockwell Automation Inc. The shares were previously weighted at 1.01% in the portfolio and traded for an average price of $288.82 during the quarter. As of August 14, 2023, ROK's price was $298.835 with a market cap of $34.32 billion. The stock has returned 17.75% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. In terms of valuation, ROK has a price-earnings ratio of 24.37, a price-book ratio of 10.27, a PEG ratio of 4.13, a EV-to-Ebitda ratio of 18.14, and a price-sales ratio of 4.02.

IQVIA Holdings Inc (NYSE:IQV)

The firm also sold out of their 9,060-share investment in IQVIA Holdings Inc. The shares were previously weighted at 0.97% in the portfolio and traded for an average price of $200.75 during the quarter. As of August 14, 2023, IQV's price was $220.015 with a market cap of $40.29 billion. The stock has returned -10.59% over the past year. GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. In terms of valuation, IQV has a price-earnings ratio of 37.87, a price-book ratio of 7.01, a PEG ratio of 2.46, a EV-to-Ebitda ratio of 17.41, and a price-sales ratio of 2.82.

Kellogg Co (NYSE:K)

Lastly, Quantamental Technologies LLC sold out of their 25,432-share investment in Kellogg Co. The shares were previously weighted at 0.92% in the portfolio and traded for an average price of $67.9 during the quarter. As of August 14, 2023, K's price was $63.76 with a market cap of $21.83 billion. The stock has returned -12.74% over the past year. GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, K has a price-earnings ratio of 25.50, a price-book ratio of 5.51, a EV-to-Ebitda ratio of 15.84, and a price-sales ratio of 1.40.

In conclusion, Quantamental Technologies LLC's Q2 2023 13F filing reveals a strategic shift in their portfolio, with the firm exiting positions in Rockwell Automation, IQVIA Holdings, and Kellogg Co. These decisions reflect the firm's quantamental approach, which combines quantitative analysis with fundamental investing to make informed investment decisions.

This article first appeared on GuruFocus.