Quanterix Corp (QTRX): An In-Depth Look at Its Undervalued Status

Quanterix Corp (NASDAQ:QTRX) recently experienced a daily gain of 5.63% and a three-month gain of 16.54%. However, with a Loss Per Share of 1.77, an important question arises: Is the stock modestly undervalued? This article aims to provide an in-depth analysis of Quanterix's valuation status, shedding light on its intrinsic worth. Let's delve into the company's financials, growth prospects, and market position to answer this question.

Introduction to Quanterix Corp (NASDAQ:QTRX)

Quanterix Corp is a key player in the life sciences industry, primarily focusing on the development of an ultra-sensitive digital immunoassay platform. This platform advances precision health for life sciences research and diagnostics. The company's unique Simoa bead-based and planar array platforms allow for reliable detection of protein biomarkers in low concentrations in various fluids, which are otherwise undetectable using conventional technologies. With a current stock price of $27, and a GF Value of $30.93, Quanterix appears to be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value based on historical trading multiples, an internal adjustment factor, and future business performance estimates. The GF Value Line provides a visual representation of the stock's fair value. If the stock price is significantly above the GF Value Line, the stock may be overvalued, and its future return could be poor. Conversely, if the stock price is significantly below the GF Value Line, the stock may be undervalued, and its future return could be higher.

Given its current price of $27 per share and a market cap of $1 billion, Quanterix appears to be modestly undervalued. This implies that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

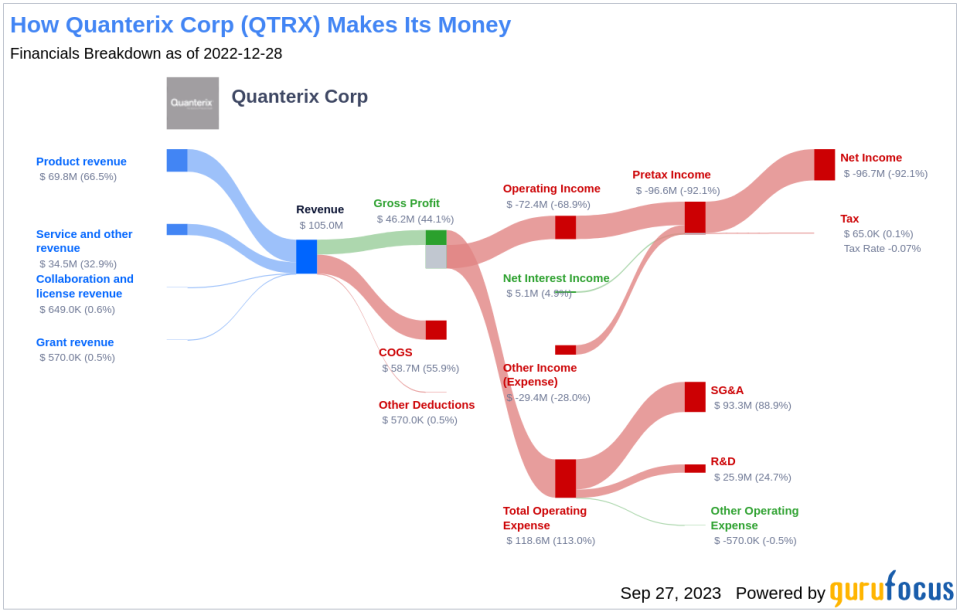

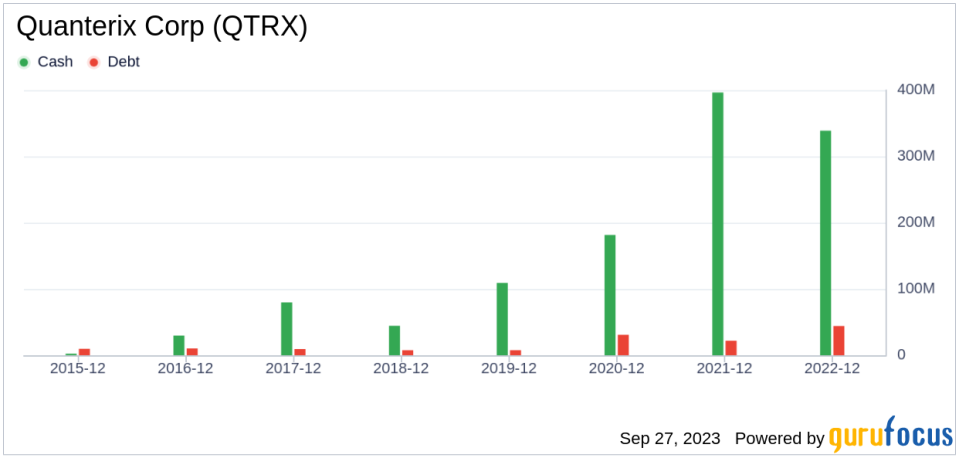

Quanterix's Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent loss. Therefore, it's crucial to assess the financial strength of a company before investing. Quanterix's cash-to-debt ratio of 7.6 is better than 66.31% of 840 companies in the Medical Devices & Instruments industry, indicating fair financial strength.

Profitability and Growth

Companies that have consistently shown profitability over the long term tend to offer less risk for investors. Quanterix has been profitable 0 over the past 10 years. Its operating margin is -43.41%, which ranks worse than 68.26% of 835 companies in the Medical Devices & Instruments industry, indicating poor profitability.

Growth is a critical factor in a company's valuation. Quanterix's 3-year average annual revenue growth is 7.9%, which ranks better than 51.71% of 731 companies in the Medical Devices & Instruments industry. However, its 3-year average EBITDA growth rate is -5.6%, which ranks worse than 71.78% of 737 companies in the industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can provide insights into its profitability. Quanterix's ROIC is -50.76, and its cost of capital is 9.46, suggesting that the company is not currently creating value for shareholders.

Conclusion

Overall, Quanterix (NASDAQ:QTRX) stock appears to be modestly undervalued. The company's financial condition is fair, but its profitability is poor, and its growth ranks worse than 71.78% of 737 companies in the Medical Devices & Instruments industry. To learn more about Quanterix stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.