Quanterix (QTRX): A Closer Look at Its Modestly Undervalued Status

Quanterix Corp (NASDAQ:QTRX) recently experienced a daily gain of 1.87% and a three-month gain of 21.86%. Despite its Loss Per Share of $1.77, the stock is considered modestly undervalued. This article delves into the valuation analysis of Quanterix, providing an in-depth look at the company's financial health and growth prospects. We invite you to explore this analysis further to understand whether Quanterix is a wise investment choice.

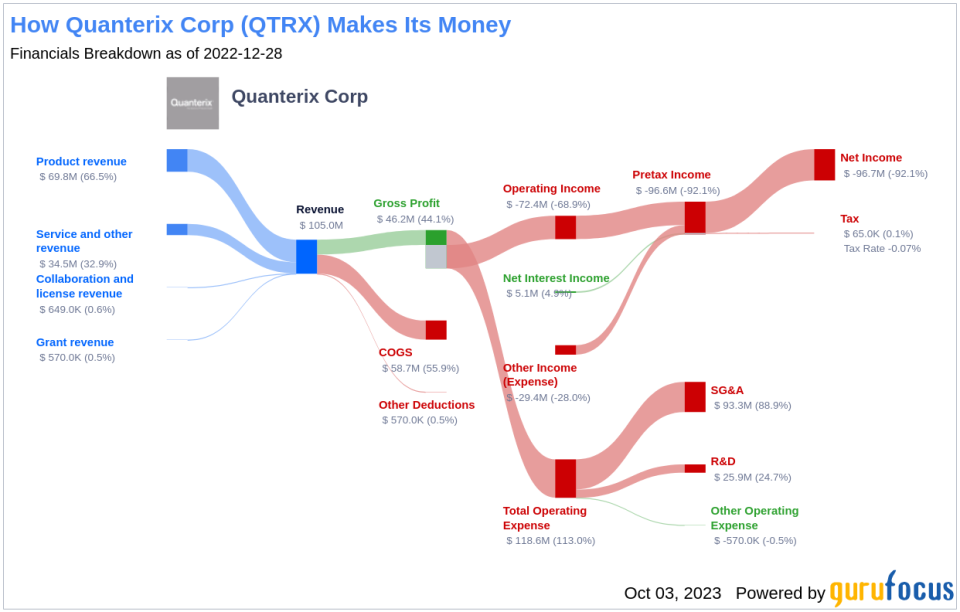

Company Overview

Quanterix Corp is a life sciences company that develops ultra-sensitive digital immunoassay platforms to advance precision health for life sciences research and diagnostics. The company's innovative Simoa bead-based and planar array platforms enable customers to reliably detect protein biomarkers in low concentrations in blood, serum, and other fluids, which are undetectable using conventional, analog immunoassay technologies. With a current stock price of $27.21 and a GF Value of $30.95, Quanterix Corp (NASDAQ:QTRX) has a market cap of $1 billion, suggesting that the stock is modestly undervalued.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance. The GF Value Line provides an overview of the fair value at which the stock should be traded.

Quanterix (NASDAQ:QTRX) stock is believed to be modestly undervalued based on the GuruFocus Value calculation. The company's GF Value suggests that the stock is likely to deliver a higher long-term return than its business growth due to its undervalued status.

Link: These companies may deliver higher future returns at reduced risk.

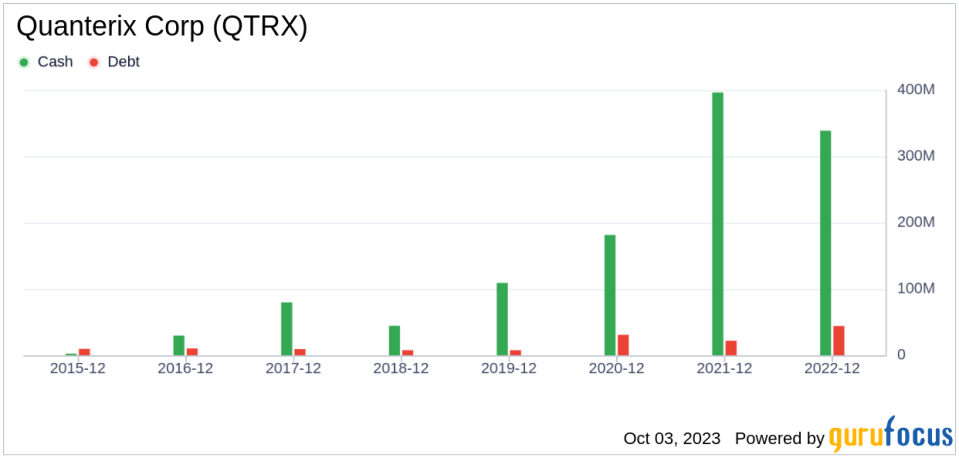

Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Factors such as the cash-to-debt ratio and interest coverage of a company offer a great way to understand its financial strength. Quanterix has a cash-to-debt ratio of 7.6, ranking better than 66.11% of 832 companies in the Medical Devices & Instruments industry. The overall financial strength of Quanterix is 7 out of 10, indicating fair financial health.

Profitability and Growth

Consistent profitability over the long term offers less risk for investors. Quanterix has been profitable 0 over the past 10 years. Over the past twelve months, the company had a revenue of $111.10 million and a Loss Per Share of $1.77. Its operating margin is -43.41%, ranking worse than 68.72% of 828 companies in the Medical Devices & Instruments industry. Overall, the profitability of Quanterix is ranked 2 out of 10, indicating poor profitability.

Growth is a crucial factor in the valuation of a company. Quanterix's 3-year average revenue growth rate is better than 51.51% of 728 companies in the Medical Devices & Instruments industry. However, its 3-year average EBITDA growth rate is -5.6%, ranking worse than 71.88% of 729 companies in the same industry.

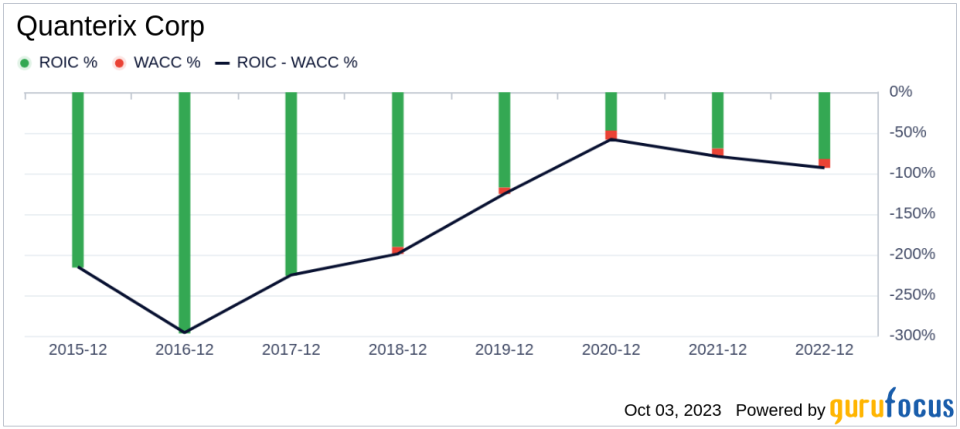

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another method of determining its profitability. For the past 12 months, Quanterix's ROIC is -50.76, and its WACC is 9.53.

Conclusion

In conclusion, the stock of Quanterix (NASDAQ:QTRX) is believed to be modestly undervalued. The company's financial condition is fair, but its profitability is poor. Its growth ranks worse than 71.88% of 729 companies in the Medical Devices & Instruments industry. To learn more about Quanterix stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.