QuantumScape Corp Chief Legal Officer Sells 21,840 Shares

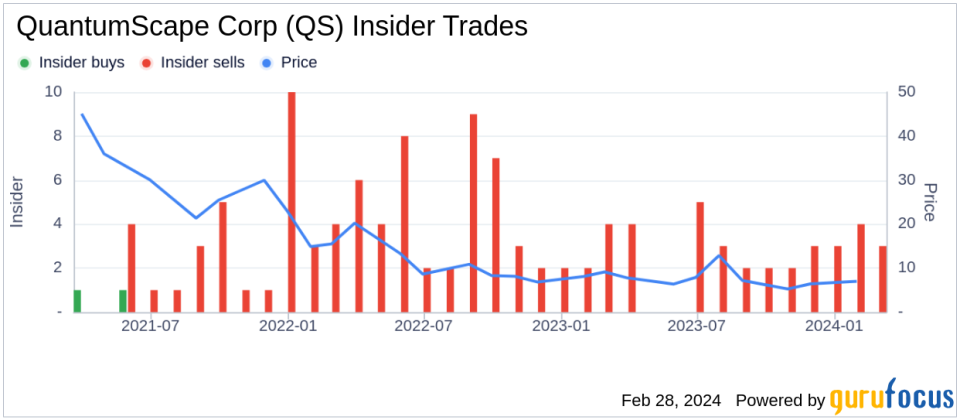

QuantumScape Corp (NYSE:QS), a company specializing in the development of solid-state lithium-metal batteries for electric vehicles, has reported an insider sale according to a recent SEC filing. The insider, Chief Legal Officer McCarthy Michael O III, sold 21,840 shares of the company on February 26, 2024.McCarthy Michael O IIIs transaction was executed at an average price, resulting in a total value of the sale being undisclosed. Following this transaction, the insider's stake in QuantumScape Corp has decreased, reflecting a change in their investment portfolio.Over the past year, McCarthy Michael O III has been an active seller of QuantumScape Corp stock, having sold a total of 476,018 shares, while not purchasing any shares during the same period.The insider transaction history at QuantumScape Corp shows a pattern of sales from insiders over the past year. There have been no insider purchases reported, but there have been 31 insider sales, indicating a possible consensus among insiders about the stock's prospects.

On the day of the insider's most recent sale, shares of QuantumScape Corp were trading at $6.17. The company's market capitalization stood at $3.016 billion, positioning it as a significant player in the electric vehicle battery market.Investors and analysts often monitor insider transactions as they can provide insights into how the company's executives and directors view the stock's value and future performance. However, insider selling does not always indicate a lack of confidence in the company; it can also reflect personal financial management or diversification strategies.For more detailed information, interested parties can view the official SEC filing through the following link: SEC Filing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.