QuantumScape (NYSE:QS): Don’t Seek the EV Holy Grail with This Stock

QuantumScape (NYSE:QS) is on a quest to find the Holy Grail in the electric vehicle (EV) industry — a long-lasting battery to beat all currently available EV batteries. At the same time, meme-stock traders are always looking for the Holy Grail of a short squeeze. They found one yesterday, but it didn’t last long, and I’m currently bearish on QS stock.

QuantumScape develops solid-state lithium-metal batteries for EVs and other applications. The company isn’t profitable and usually falls short of Wall Street’s quarterly EPS estimates. Furthermore, insider transactions generally don’t bode well for the company, with a QuantumScape director reportedly having sold 69,309 of his company’s shares not long ago.

Plus, as we’ll discuss later, analysts aren’t very bullish about QuantumScape, and the company certainly isn’t problem-free. Nevertheless, hope springs eternal among the meme-stock crowd, and some folks might try to double or triple their money with QuantumScape stock. I’d advise caution, however, as meme dreams can quickly turn into a nightmare if you end up on the wrong side of the trade.

QuantumScape’s Share Issuance Causes Consternation

Sometimes, you’ll see a publicly-listed company issue a large number of shares in order to shore up its capital position. QuantumScape did this recently, and many investors weren’t happy about it.

Let’s back up for a moment, though. Why would QuantumScape resort to share issuance to raise money? As I mentioned earlier, the company isn’t profitable and has had unfavorable quarterly EPS results. To that, I’ll add that Quantumscape is a “pre-revenue” company.

That’s a polite way of saying that QuantumScape hasn’t generated any revenue from its battery-cell products. The company acknowledged this in a Form 10-Q filing, stating, “As of September 30, 2023, the Company had not derived revenue from its principal business activities.”

That Form 10-Q was for 2023’s third quarter, during which QuantumScape reported a net loss of $110.6 million. Moreover, QS stock has performed poorly over time, sinking from over $100 during the speculative frenzy of late 2020 to less than $10 recently. Evidently, now that interest rates are higher than they were in 2020 and 2021, the market just doesn’t have an appetite for pre-revenue, profitless companies anymore.

Adding to the consternation last year was QuantumScape’s “underwritten public offering” (i.e., printing and selling) of 37,500,000 common-stock shares. This caused QuantumScape stock to drop as investors expressed concerns about share dilution (diluting the stock’s value per share).

QuantumScape Stock Soared Over 50%: Was It Justified?

The share dilution concerns are understandable. After all, what’s to stop QuantumScape from printing and selling more shares in the future? Still, the tide turned briefly in the buyers’ favor when QS stock rallied by over 50% yesterday at one point.

That rally is already starting to fade, with QuantumScape stock falling 6.45% midday today. I expect this bearish share price action to continue because, while yesterday’s news for QuantumScape was positive, the stock’s move was too extreme.

Here’s what happened. German automaker Volkswagen (OTC:VWAGY) announced that QuantumScape’s solid-state battery cell passed an endurance test. Baird analyst Ben Kallo views the published results “as an affirmation of QS’s technology.”

Kallo’s remark is duly noted, but the Baird analyst still kept his Neutral rating on QuantumScape stock. Plus, Kallo’s $5 price target for the shares implies significant downside from the current price.

There’s no denying that Volkswagen’s press release conveys good news for QuantumScape. It summarizes, “Solid-state battery from QuantumScape achieved more than 1,000 charging cycles with still more than 95 percent capacity.”

The press release continues, “Depending on the model, an electric car could drive more than 500,000 kilometers without any noticeable loss of range.” That’s great, but QuantumScape CEO Jagdeep Singh acknowledged that his company has “more work to do to bring this technology to market.”

Singh and QuantumScape seek to “industrialize this technology and bring it to market as quickly as possible.” That’s not a specific timeline, though. Some of QuantumScape’s shareholders have patiently waited several years for the company to fully commercialize its battery-cell technology, only to end up losing big-time on their QS stock investments.

Is QuantumScape Stock a Buy, According to Analysts?

On TipRanks, QS comes in as a Moderate Sell based on four Holds and two Sell ratings assigned by analysts in the past three months. The average QuantumScape price target is $5.84, implying 32.9% downside potential.

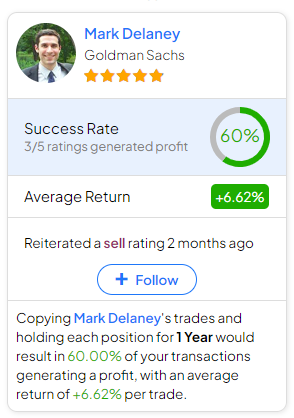

If you’re wondering which analyst you should follow if you want to buy and sell QS stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mark Delaney of Goldman Sachs (NYSE:GS), with an average return of 6.62% per rating and a 60% success rate. Click on the image below to learn more.

Conclusion: Should You Consider QuantumScape Stock?

I strongly suspect that yesterday’s massive rally in QuantumScape stock was primarily due to a short squeeze and the overenthusiasm of meme-stock traders. In the real world, QuantumScape probably still has a long way to go before the company achieves full product commercialization.

By then, QuantumScape’s financial situation could easily go from bad to worse. Consequently, I’m not considering buying QS stock and feel that it’s too volatile to trade right now.