Do Qube Holdings' (ASX:QUB) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Qube Holdings (ASX:QUB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Qube Holdings

How Quickly Is Qube Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Qube Holdings has grown EPS by 26% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

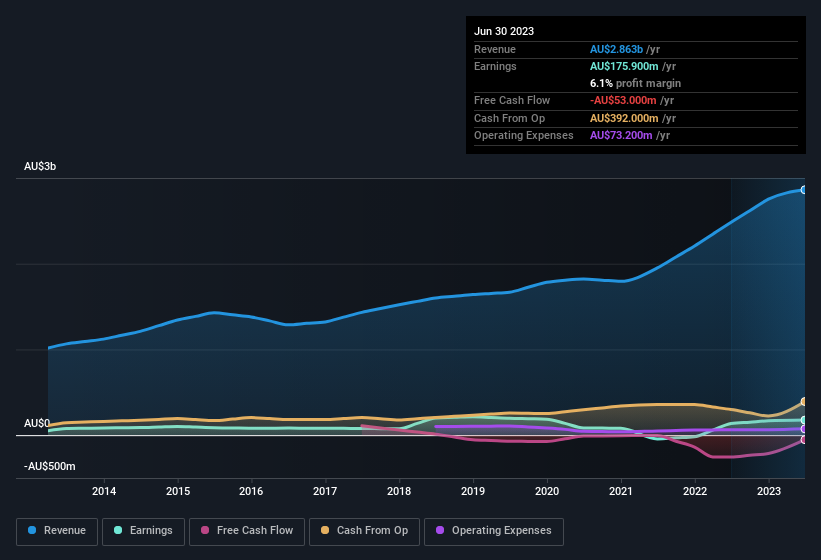

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Qube Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to AU$2.9b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Qube Holdings' forecast profits?

Are Qube Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Qube Holdings shareholders is that no insiders reported selling shares in the last year. Add in the fact that John Mann, the Independent Non-Executive Director of the company, paid AU$34k for shares at around AU$2.82 each. It seems that at least one insider is prepared to show the market there is potential within Qube Holdings.

On top of the insider buying, it's good to see that Qube Holdings insiders have a valuable investment in the business. With a whopping AU$103m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

Does Qube Holdings Deserve A Spot On Your Watchlist?

For growth investors, Qube Holdings' raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Of course, just because Qube Holdings is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Qube Holdings, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.