Quest Diagnostics (DGX) Gains From New Alliances Amid FX Woes

Quest Diagnostics DGX is gaining from strategic acquisitions and alliances. Yet, the company is currently dealing with the challenges of post-COVID transition. The stock carries a Zacks Rank #3 (Hold).

Quest Diagnostics is benefiting from strong volume growth across its base business (which refers to testing volumes, excluding COVID-19 testing). The collaborations with health plans, hospitals and physicians have aided the company in the elevated demand for services, which reflects a continued return to care. With the severity of the COVID-19 pandemic significantly reducing over the past few quarters, the company’s base business profitability has improved compared with the pandemic-laden phase till the first half of 2022.

Across Physician Lab Services, a large number of strategic partnerships with health plans involve value-based arrangements, which are leading to faster growth and share gains than traditional relationships. These arrangements make Quest Diagnostics well-positioned to be a more strategic partner with health plans, cooperating on leakage, shared savings and redirection programs. In addition, the recent acquisition of New York-Presbyterian's outreach assets also added to volume growth from physicians.

Within Hospital labs, progress in terms of partnerships with Northern Light Health, Lee Health and Tower Health is particularly encouraging in the Professional Lab Services (“PLS”) business, which witnessed a strong second quarter. Having gained from both new and existing PLS relationships, Quest Diagnostics is seeing growing momentum with a significant pipeline of potential deals with large health systems.

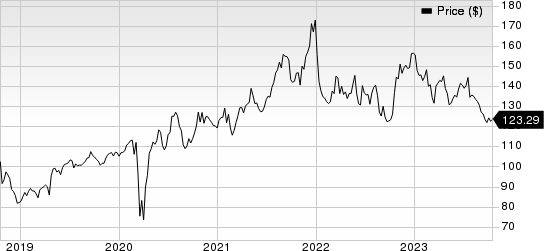

Quest Diagnostics Incorporated Price

Quest Diagnostics Incorporated price | Quest Diagnostics Incorporated Quote

In Consumer Health, the company witnessed strong base business growth on its digital platform — questhealth.com. Increase in marketing spend is likely to be worthwhile for the consumer-initiated testing business to target customers more strategically. In the second quarter, Quest Diagnostics talked about expanding test options for health-minded consumers with the launch of Genetic Insights on questhealth.com. The initial uptake of the company’s first-ever consumer-initiated genetic health test adds to the prospect.

On the flip side, Quest Diagnostics posted second-quarter 2023 results, wherein the top line reflected a nearly 88% drop in COVID-19 testing revenues. Citing this reason, Diagnostic Information Services reported lower contributions in the quarter despite strong growth in the base business.

Adjusted operating income also bore the brunt, reflecting a 104-basis points contraction. Shares of DGX have dropped 10.7% in the past six months compared with the industry's 4.4% decline. In its updated guidance for the full year, Quest Diagnostics anticipates delivering approximately $200 million from COVID-19 testing revenues. Our model predicts a staggering decrease in COVID-19 testing revenues to $53.7 million in fiscal 2024.

Pressure on volume, owing to a difficult macroeconomic situation and pricing, constitutes the primary risk for Quest Diagnostics. Although total volumes measured by the number of requisitions grew a mere 0.2% in the second quarter, revenues per requisition declined 4.9% year over year due to lower COVID-19 molecular testing volumes.

Key Picks

Some better-ranked stocks in the broader medical space are Cardinal Health CAH, Haemonetics HAE and DaVita Inc. DVA, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health stock has risen 31.1% in the past year. Earnings estimates for the company have increased from $6.65 to $6.66 for 2023 in the past 30 days and from $7.56 to $7.57 for 2024 in the past seven days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.03%. In the last reported quarter, it posted an earnings surprise of 4.73%.

Estimates for Haemonetics’ 2023 earnings per share have remained constant at $3.82 in the past 30 days. Shares of the company have increased 13.1% in the past year against the industry’s decline of 10.3%.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%.

DaVita has gained 25.5% against the industry’s 8.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report