Quest Diagnostics' (DGX) New Pact to Advance Cancer Screening

Quest Diagnostics Incorporated DGX entered into a strategic collaboration with Universal DX (UDX) aimed to advance colorectal cancer screening in the United States, for which over 110 million people may be eligible.

In the United States, colorectal cancer is the third most commonly diagnosed cancer and the third highest cause of cancer death in men and women. According to the American Cancer Society, 153,020 people will be diagnosed with colorectal cancer in the United States in 2023, with 52,550 dying from the disease.

The latest move will expand Quest Diagnostics’ portfolio of cancer services, fortifying the Diagnostic Solutions business.

More on Collaboration

Under the terms of the commercial agreement, Quest Diagnostics intends to perform and offer clinical laboratory services to providers and patients in the United States based on UDX's Signal-C, an advanced colorectal cancer screening blood test, assuming premarket approval in the United States.

To gather clinical evidence for the test, UDX will enroll patients in a 15,000-patient study, including over 100 investigator sites, to support a submission to the FDA for premarket approval. Once the FDA approves the test, Quest will have exclusive rights to provide clinical laboratory services in the United States.

Additionally, UDX declared the first close of its nearly $70 million series B financing round from investors, which included Quest Diagnostics.

Strategic Implications

The partnership intends to bring together Quest's national scale and experience in the United States, along with UDX's cutting-edge liquid biopsy screening technology. This includes nearly 2,100 patient service centers for blood draws, extensive connectivity between health plans and electronic health records and more.

Image Source: Zacks Investment Research

With its national reach and superior oncology knowledge, Quest Diagnostics is well-positioned to use UDX Signal-C technology and make it widely available across the United States. This partnership will increase the likelihood that Americans will eventually have an easy, reliable and accessible way to check for colorectal cancer.

Industry Prospects

Per a report by Fortune Business Insights, the global colorectal cancer screening market size is projected to reach from $17.05 billion in 2023 to $23.03 billion by 2030, witnessing a CAGR of 4.4%. The major factors for growth of the colorectal cancer screening market include the advent of efficacious genetic tests, an increase in the prevalence of colorectal cancer and increasing cancer prevention initiatives.

Recent Developments

In July 2023, Quest Diagnostics launched a novel prostate cancer biomarker test through its subspecialty pathology business unit, AmeriPath. The laboratory test is developed in collaboration with Envision Sciences — an Australia-based clinical diagnostics company with a focus on oncology diagnostics and prognostics in tissue and blood.

In June 2023, Quest Diagnostics acquired Haystack Oncology. The acquisition is intended to improve patient outcomes through early, accurate detection of residual or recurring cancer. Based on circulating tumor DNA (ctDNA), Haystack Oncology created a highly sensitive minimal-residual disease (“MRD”) testing tool to help with the early detection of residual or reoccurring cancer and to guide treatment choices better. Quest Diagnostics will use this MRD technology to create new blood-based clinical lab services for solid tumor cancers that will be made available starting in 2024.

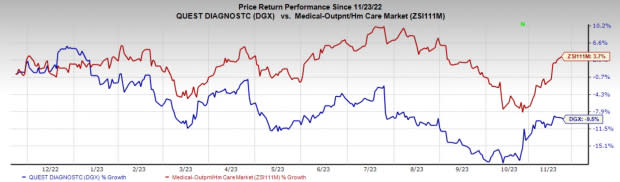

Price Performance

In the past year, DGX shares have declined 9.5% against the industry’s rise of 3.7%.

Zacks Rank and Key Picks

Quest Diagnostics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2 (Buy), Insulet presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report