Quest Diagnostics (DGX) Tops Q3 Earnings, Gross Margin Dips

Quest Diagnostics Incorporated’s DGX third-quarter 2023 adjusted earnings per share (EPS) of $2.22 beat the Zacks Consensus Estimate by 1.4%. However, adjusted earnings declined 5.9% from the year-ago adjusted figure.

Certain one-time expenses, like the ones related to amortization expenses, particular restructuring and integration charges, other expenses and amortization expenses, were excluded from the quarter’s adjusted figures.

GAAP earnings came in at $1.96 per share, down 9.7% from the year-ago reported figure.

Revenues

Reported revenues in the third quarter declined 7.7% year over year to $2.29 billion. However, revenues exceeded the Zacks Consensus Estimate by 1.7%.

Quarterly Details

Base Business (excludes COVID-19 testing) revenues were $2.27 billion in the reported quarter, up 4.6% year over year. This figure compares with our model’s projection of $2.22 billion for the third quarter.

COVID-19 Testing revenues nosedived 92% in the third quarter to $26 million. The figure exceeded our model’s projected revenues of $20.8 million from this segment in the third quarter of 2023.

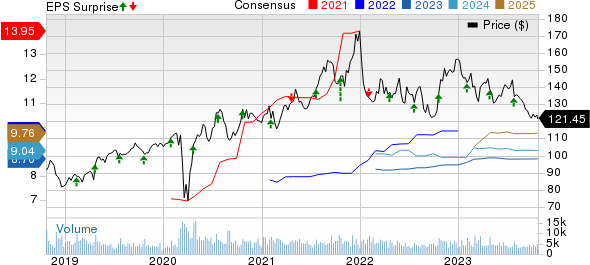

Quest Diagnostics Incorporated Price, Consensus and EPS Surprise

Quest Diagnostics Incorporated price-consensus-eps-surprise-chart | Quest Diagnostics Incorporated Quote

Diagnostic Information Services revenues in the quarter were down 7.9% on a year-over-year basis to $2.23 billion. This figure compares with our model’s projection of $2.17 billion for the third quarter.

Volumes (measured by the number of requisitions) were down 0.5% year over year in the second quarter. Revenue per requisition declined 7.2% year over year.

Margins

The cost of services during the reported quarter was $1.54 billion, down 4.8% year over year. The gross profit declined 13.1% to $754 million. The gross margin was 32.9%, reflecting a 206-basis point (bps) contraction from the year-ago figure.

SG&A expenses fell 18.1% to $380 million in the quarter under review. The adjusted operating margin of 16.2% represented a 5-bps expansion year over year.

Cash, Capital Structure and Solvency

Quest Diagnostics exited the third quarter of 2023 with cash and cash equivalents of $143 million compared with $126 million at the end of the second quarter. The cumulative net cash provided by operating activities at the end of the third quarter was $745 million compared with $1.38 billion in the year-ago period.

The company has a five-year annualized dividend growth rate of 7.42%.

Guidance

Quest Diagnostics updated its full-year 2023 guidance.

Full-year net revenue estimates were raised to a new range of $9.19-$9.24 billion (from the earlier band of $9.12-$9.22 billion). The Zacks Consensus Estimate for the same is pegged at $9.16 billion.

Adjusted EPS is now expected in the range of $8.65-$8.75 (narrowed from the $8.50-$8.90 band earlier). The Zacks Consensus Estimate for the metric is pegged at $8.70.

Our Take

Quest Diagnostics reported better-than-expected earnings and revenues in the third quarter of 2023. However, year-over-year declines in the top line and earnings are worrisome. COVID-19 testing revenues fell significantly in the reported quarter. A contraction of gross margin raises apprehension.

On a positive note, the strength demonstrated in the base business is encouraging, reflecting the company’s ongoing efforts to partner with health plans, hospitals and physicians amid a continued return to care. DGX’s updated revenue outlook for the full year boosts optimism while operating in a tight labor market.

Zacks Rank and Key Picks

Quest Diagnostics currently carries a Zacks Rank #3 (Hold).

Some of the top-ranked stocks from the broader medical space that is supposed to report earnings soon are Addus HomeCare ADUS, Insulet PODD and Inari Medical NARI.

Addus currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for its third-quarter 2023 adjusted EPS is pegged at $1.05. The same for its revenues stands at $266.2 million.

Addus has a long-term historical growth rate of 12.6%. ADUS’ earnings yield of 5.24% compares favorably with the industry’s yield of 4.37%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Insulet’s third-quarter 2023 adjusted EPS is currently pegged at 40 cents. The consensus estimate for revenues is pegged at $413.8 million. Insulet currently carries a Zacks Rank #2 (Buy).

Insulet has an estimated long-term growth rate of 41.5%. PODD’s earnings yield of 1.14% compares favorably with the industry’s -2.62%.

Inari Medical currently has a Zacks Rank #2. The Zacks Consensus Estimate for its third-quarter 2023 adjusted EPS is currently pegged at a breakeven level. The same for revenues is pegged at $122.4 million.

NARI has an estimated growth rate of 107.3% for 2023. NARI’s earnings yield of 0.07% compares favorably with the industry’s yield of -8.47%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Addus HomeCare Corporation (ADUS) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report