Quest Diagnostics Inc (DGX) Reports Mixed 2023 Results and Sets Positive Outlook for 2024

Revenue: Full year revenues decreased by 6.4% to $9.25 billion in 2023.

Net Income: Reported net income for 2023 was $854 million, a 9.7% decrease from 2022.

Earnings Per Share (EPS): Adjusted diluted EPS for the full year was $8.71, down 12.5% from 2022.

COVID-19 Testing Revenues: Saw a significant decline by 84.7% to $223 million in 2023.

Base Business Revenues: Increased by 7.1% to $9.03 billion, showing resilience in core operations.

Dividend: Quarterly dividend increased to $0.75 per share, marking consistent growth since 2011.

2024 Outlook: Projected revenue growth between 1.1% and 2.1%, with adjusted diluted EPS between $8.60 and $8.90.

On February 1, 2024, Quest Diagnostics Inc (NYSE:DGX) released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. The company, a leader in diagnostic information services, faced a challenging year with a notable decline in COVID-19 testing revenues. Despite this, Quest Diagnostics managed to increase its base business revenues, demonstrating the underlying strength of its core services.

Financial Performance Overview

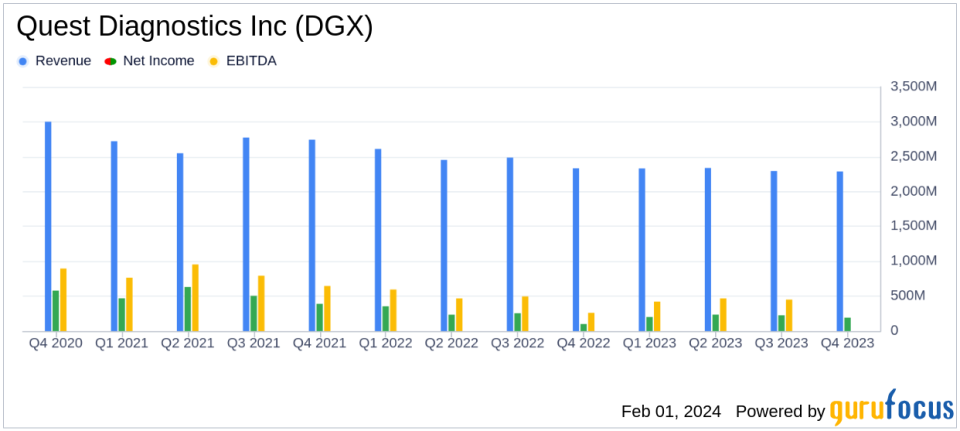

For the fourth quarter, Quest Diagnostics reported revenues of $2.29 billion, a 1.9% decrease from the previous year. However, the company's reported diluted EPS saw a significant increase of 95.4% to $1.70, and its adjusted diluted EPS rose by 8.6% to $2.15. The full year revenues were down by 6.4% to $9.25 billion, with reported diluted EPS decreasing by 6.0% to $7.49 and adjusted diluted EPS falling by 12.5% to $8.71.

The decline in annual revenue is primarily attributed to a sharp decrease in COVID-19 testing revenues, which plummeted by 84.7% to $223 million. Despite this, the company's base business revenues, which exclude COVID-19 testing, grew by 7.1% to $9.03 billion, reflecting the company's ability to grow its core diagnostic information services.

Strategic Investments and Dividend Growth

Quest Diagnostics has continued to invest in strategic areas such as advanced cardiometabolic, prenatal and hereditary genetics, neurology, and oncology. These investments are part of the company's growth strategy and have contributed to revenue growth in clinical areas.

The company's Board of Directors authorized a 5.6% increase in its quarterly dividend to $0.75 per share, continuing a trend of annual dividend increases since 2011. This decision reflects confidence in the company's financial stability and commitment to returning value to shareholders.

2024 Outlook and Guidance

Looking ahead to 2024, Quest Diagnostics expects a return to overall revenue growth, with projected increases between 1.1% and 2.1%. The company anticipates reported diluted EPS to be between $7.69 and $7.99, and adjusted diluted EPS between $8.60 and $8.90. These projections take into account both the tailwinds and headwinds expected to impact earnings in the coming year.

Quest Diagnostics' CEO, Jim Davis, expressed optimism about the company's position, stating:

We delivered strong revenue growth in our base business of 7% for the full year 2023 and delivered on our earnings commitment as we transitioned away from COVID testing... Our guidance for 2024 reflects a return to overall revenue growth while balancing the earnings tailwinds and headwinds we see for the year. Looking beyond 2024, we are well positioned to deliver our long-term financial outlook to drive mid-single digit revenue growth and high-single digit earnings growth.

The company's financial health is further evidenced by the cash provided by operations, which amounted to $1.27 billion for the year, and capital expenditures, which were slightly up by 0.9% to $408 million.

Conclusion

Despite the challenges faced in 2023, Quest Diagnostics has demonstrated resilience in its base business and is poised for growth in 2024. The company's strategic investments and increased dividend reflect a strong commitment to its long-term financial health and shareholder value. Investors and stakeholders can look forward to a year of anticipated growth and continued innovation in diagnostic services.

For a detailed analysis of Quest Diagnostics Inc (NYSE:DGX)'s financial results and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Quest Diagnostics Inc for further details.

This article first appeared on GuruFocus.