QuidelOrtho (QDEL) Reports Solid Preliminary Q3 Revenues

QuidelOrtho Corporation QDEL recently announced preliminary revenues for third-quarter 2023. The robust preliminary results drove up the company’s shares by 1.5% in the after-hours trading session.

The company is scheduled to release third-quarter results on Nov 1, after the closing bell.

Per the preliminary report, third-quarter 2023 total revenues are estimated to be $738 million-$744 million on a reported basis. The Zacks Consensus Estimate of $650.1 million lies below the preliminary figure.

The company’s respiratory product revenues are expected to be in the range of $181 million-$184 million, while the non-respiratory product revenues are anticipated to be in the range of $557 million-$560 million.

Per management, the uptick in third-quarter revenues was primarily driven by strong demand for QuidelOrtho’s retail and point-of-care offerings on the back of the presence of influenza and new variants of COVID-19 across the Northern Hemisphere during the to-be-reported period. Management is also upbeat about QuidelOrtho’s continued strength in its non-respiratory businesses and all of its regions (including China) meeting or exceeding its expectations. This raises our optimism about the stock.

Guidance

QuidelOrtho has reiterated its full-year guidance provided during its second-quarter 2023 earnings release.

Total revenues are continued to be expected to lie in the range of $2.88 billion-$3.08 billion. The Zacks Consensus Estimate is pegged at $2.97 billion.

Non-respiratory revenues are continued to be expected between $2.27 billion and $2.31 billion (up 5-6.5% at CER from 2022 levels).

Respiratory revenues for the full year are continued to be expected to lie in the range of $610 million-$775 million. The respiratory revenues continue to include COVID-19-related revenues of $300 million-$400 million.

Adjusted EPS is continued to be expected to lie between $4.85 and $5.30. The Zacks Consensus Estimate is pegged at $5.00.

A Brief Q3 Analysis

On the second-quarter earnings call in August, QuidelOrtho’s management confirmed that the Labs instrument supply issues were expected to continue to improve as it moves through the second half of the year. This, along with the continued recovery in China, are expected to have driven the non-respiratory revenue uptick in the Labs segment.

At the time of the release of the preliminary third-quarter 2023 results, management stated that the earlier-than-expected arrival of respiratory illnesses has been driving greater demand for QuidelOrtho’s diagnostics. This has raised management’s optimism, which now anticipates the third-quarter performance to be higher than its original expectations. Management reiterated its outlook for 2023 on the back of the pull-forward of the typical respiratory seasonality into the third quarter from the fourth quarter. Management’s confidence in QuidelOrtho’s strategic plan and ability to achieve its full-year financial guidance also look promising for the company.

In September, QuidelOrtho announced that it had been granted a CLIA Waiver by the FDA, which applies to its new Sofia 2 SARS Antigen+ FIA (fluorescent immunoassay). The Sofia 2 SARS Antigen+ FIA is now the first rapid antigen test to receive a CLIA waiver. This looks promising for the stock.

The company’s preliminary projection of robust improvement in revenues on the back of strength in its businesses lifts our confidence about the stock.

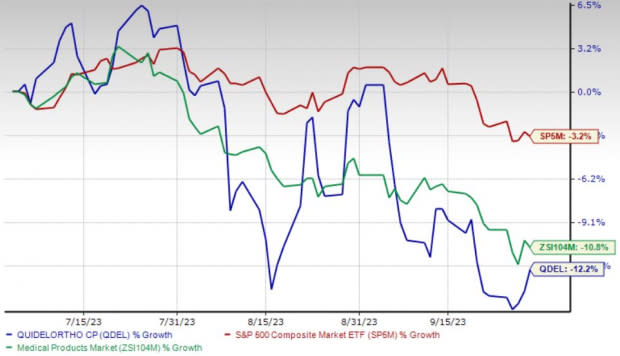

Price Performance

Shares of the company have lost 12.3% between Jul 3 and Oct 1, 2023 compared with the industry’s 10.8% decline and the S&P 500’s 3.2% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, QuidelOrtho carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Boston Scientific Corporation BSX, McKesson Corporation MCK and Integer Holdings Corporation ITGR.

Boston Scientific, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.8%. BSX’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed in the other two, the average beat being 2.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific has lost 1.4% compared with the industry’s 10.8% decline between Jul 3 and Oct 1, 2023.

McKesson, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 8.1%.

McKesson has gained 3.3% against the industry’s 4.4% decline between Jul 3 and Oct 1, 2023.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has lost 11.4% compared with the industry’s 11.6% decline between Jul 3 and Oct 1, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report