QuidelOrtho's (QDEL) Rapid Antigen Test Gets CLIA Waiver

QuidelOrtho Corporation QDEL recently announced that it has been granted a CLIA Waiver by the FDA, which applies to its new Sofia 2 SARS Antigen+ FIA (fluorescent immunoassay). The Sofia 2 SARS Antigen+ FIA, the first rapid antigen test that detects COVID-19 to be awarded FDA market clearance through the FDA’s De Novo process, is now the first rapid antigen test also to receive CLIA waiver.

The test, intended for prescription use only, can be used in CLIA-waived point-of-care settings.

The latest waiver is likely to significantly boost QuidelOrtho’s Point of Care business unit.

A Few Words About the Test

The enhanced Sofia 2 SARS Antigen+ FIA Test kit includes other upgraded features, such as pre-filled reagent vials, improved ergonomic sample extraction and a dropper design for easy dispensing of patient samples into the test cassette sample well. The Sofia 2 instrument also offers two distinct workflows — WALK AWAY Mode and READ NOW Mode.

The results obtained via the test kit are for the identification of the SARS-CoV-2 nucleocapsid protein antigen, which is generally detectable in upper respiratory specimens during the acute phase of infection.

The Sofia 2 system connects to Virena, QuidelOrtho’s data management system, which provides aggregated, de-identified testing and surveillance data in near real time.

Significance of the Waiver

Following the CLIA waiver, the Sofia 2 SARS Antigen+ FIA is deemed to be simple and has a low risk of error. Hence, it no longer requires administration by trained clinical laboratory personnel, thereby opening broader use in any point-of-care setting equipped with Sofia 2 instruments.

The Sofia 2 analyzer utilizes QuidelOrtho’s proprietary fluorescent chemistry design, intuitive graphical user interface and optics system to provide an accurate, objective and automated result in 10 minutes. This is a 33% reduction from the breakthrough 15-minute processing time achieved in the first iterations of the Sofia SARS Antigen FIA assay.

Per management, the receipt of the FDA’s CLIA waiver qualifies as a trifecta/milestone of innovation, advancement and accessibility in the in vitro diagnostics space. This is reflective of QuidelOrtho’s efforts to aid customers in reducing costs and speeding workflows, thus delivering improved patient care.

Industry Prospects

Per a report by Precedence Research, the global diagnostic testing market was valued at $165.58 billion in 2021 and is anticipated to exceed $348.75 billion by 2030 at a CAGR of approximately 8.6%. Factors like the increasing use of point-of-care diagnostic products and the rising elderly population leading to an increase in the chance of developing a wide range of illnesses (including diabetes) are likely to drive the market.

Given the market potential, the latest regulatory achievement will likely provide a significant impetus to QuidelOrtho’s business.

Notable Development

Last month, QuidelOrtho reported its second-quarter 2023 results, wherein it registered an uptick in the company’s overall top line. The company recorded a continued uptick in Sofia’s non-COVID pull-through and growth in QuidelOrtho’s integrated installed base and automation. During the quarter, QuidelOrtho completed the Savanna Emergency Use Authorization and 510(k) FDA submissions, including 510(k) for the instrument in both RVP4 and HSV VZV lesion panels.

Price Performance

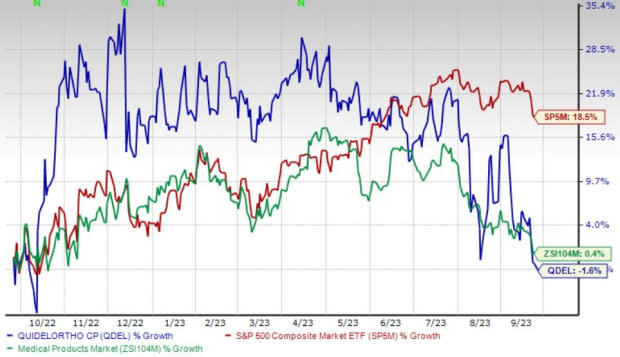

Shares of the company have lost 1.7% in the past year against the industry’s 0.4% rise and the S&P 500's 18.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, QuidelOrtho carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, McKesson Corporation MCK and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 16.9% against the industry’s 1.6% decline over the past year.

McKesson, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 8.1%.

McKesson has gained 27.9% compared with the industry’s 20% rise over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 29.1% compared with the industry’s 2.8% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report