QuinStreet Inc (QNST) Faces Revenue Decline in Q2 Fiscal 2024 Amidst Auto Insurance Inflection

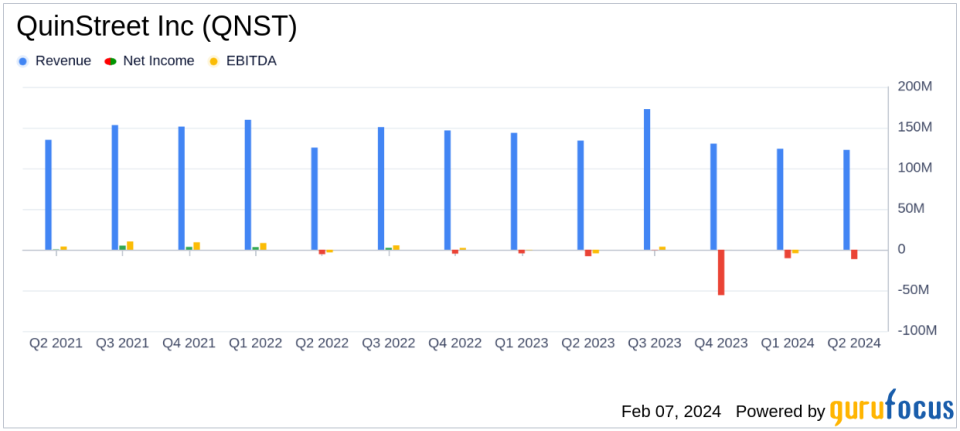

Revenue: Reported $122.7 million, an 8% decrease year-over-year.

Net Loss: GAAP net loss of $(11.6) million, or $(0.21) per diluted share.

Adjusted EBITDA: Achieved $0.4 million for the fiscal second quarter.

Liquidity: Closed the quarter with $45.5 million in cash and cash equivalents, no bank debt.

Outlook: Expects Q3 revenue between $160 and $170 million, and adjusted EBITDA between $7 and $9 million.

Full Fiscal Year 2024: Anticipates revenue growth of 5% to 15% over fiscal year 2023.

On February 7, 2024, QuinStreet Inc (NASDAQ:QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, released its 8-K filing, reporting financial results for the fiscal second quarter ended December 31, 2023. The company, known for its pioneering role in delivering online marketplace solutions, reported a revenue of $122.7 million, marking an 8% decline from the previous year. Despite this, QuinStreet Inc (NASDAQ:QNST) managed to achieve a positive adjusted EBITDA of $0.4 million and closed the quarter with a strong liquidity position, having $45.5 million in cash and cash equivalents and no bank debt.

QuinStreet Inc (NASDAQ:QNST) operates in the Media - Diversified industry, generating revenue by delivering measurable online marketing results to its clients through a range of performance marketing products. The company's CEO, Doug Valenti, commented on the results, stating, "The December quarter continued recent positive trends," and highlighted the significant positive inflection in Auto Insurance client spending. Valenti expressed pride in the company's ability to deliver positive adjusted EBITDA despite the market bottom and the seasonally challenging quarter.

Financial Performance and Future Outlook

QuinStreet Inc (NASDAQ:QNST) reported a GAAP net loss of $(11.6) million, or $(0.21) per diluted share, and an adjusted net loss of $(2.3) million, or $(0.04) per diluted share. The company's performance reflects the challenges faced in the Auto Insurance sector, which is now showing signs of recovery with expected revenue growth of over 100% in the current quarter compared to the December quarter. This anticipated growth is supported by broad-based increases in client spending and consumer shopping traffic.

The company's outlook for the fiscal third quarter is optimistic, with expected revenue between $160 and $170 million, representing a sequential growth of 35% at the midpoint of the range, and adjusted EBITDA between $7 and $9 million. For the full fiscal year 2024, QuinStreet Inc (NASDAQ:QNST) continues to expect revenue growth of between 5% and 15% over fiscal year 2023.

Key Financial Metrics and Importance

QuinStreet Inc (NASDAQ:QNST)'s financial achievements and the challenges it faces are critical for investors and stakeholders to understand the company's operational efficiency and market position. Key metrics such as revenue, net loss, and adjusted EBITDA provide insights into the company's financial health and its ability to generate profit and manage expenses. The positive outlook for revenue growth and EBITDA margin expansion is particularly important as it signals potential improvements in profitability and operational performance.

The company's strong liquidity position, with significant cash reserves and no bank debt, is an important indicator of financial stability and the ability to invest in growth opportunities or weather economic downturns. These financial metrics are essential for value investors who seek to assess the company's long-term value and potential for return on investment.

QuinStreet Inc (NASDAQ:QNST)'s performance in the Media - Diversified industry is significant as it competes with other companies for client budgets and access to third-party media. The company's ability to adapt to market trends and client spending patterns is crucial for maintaining and growing its market share.

In conclusion, QuinStreet Inc (NASDAQ:QNST)'s latest earnings report reflects a challenging yet stabilizing period, with expectations for significant growth in the coming quarters. The company's strategic focus and positive financial outlook may appeal to value investors looking for opportunities in the Media - Diversified sector.

For a detailed analysis of QuinStreet Inc (NASDAQ:QNST)'s financials and future prospects, investors are encouraged to review the full earnings report and consider the implications for their investment strategies.

Explore the complete 8-K earnings release (here) from QuinStreet Inc for further details.

This article first appeared on GuruFocus.