Qurate Retail Inc (QRTEA) Navigates Mixed 2023 Results with Strategic Adjustments and Debt Reduction

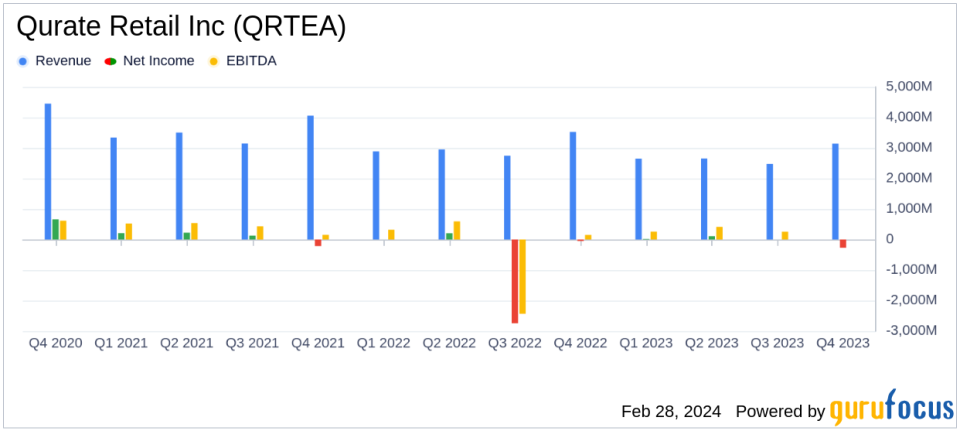

Revenue: Qurate Retail Inc (NASDAQ:QRTEA) experienced a 4% decrease in Q4 and a 5% decrease for the full year.

Adjusted OIBDA: Increased by 46% in Q4 but decreased by 3% for the full year in constant currency.

Net Income: Reported a diluted EPS of $(0.70) in Q4 and $(0.37) for the full year.

Debt Reduction: Reduced principal amount of debt by $956 million in 2023.

Portfolio Optimization: Divested Zulily and redeemed outstanding QVC 4.85% senior secured notes due 2024.

eCommerce Growth: eCommerce revenue represented a significant portion of total revenue, with mobile transactions continuing to rise.

On February 28, 2024, Qurate Retail Inc (NASDAQ:QRTEA) released its 8-K filing, revealing a year of strategic adjustments and financial maneuvering. Qurate Retail Inc, a leader in video and online commerce, operates through various segments, including QxH, QVC International, and Cornerstone, with a geographical presence in the U.S., Japan, Germany, and other countries.

President and CEO David Rawlinson highlighted the transformational nature of 2023, emphasizing improvements in merchandising, pricing strategy, and inventory management. These efforts led to a significant increase in free cash flow, substantial debt reduction, and the divestiture of Zulily. Despite a decrease in revenue, the company saw a notable increase in Adjusted OIBDA in Q4, though it experienced a slight decrease for the full year.

Performance and Challenges

Qurate Retail Inc (NASDAQ:QRTEA) faced a challenging retail environment, with revenue declines across most segments. QxH and Cornerstone segments saw decreases in revenue, attributed to lower units shipped, higher returns, and competitive pressures. However, QVC International reported a revenue increase in Q4, with constant currency revenue remaining flat, reflecting a balanced average selling price and units shipped.

The company's operational health benefited from higher product margins, lower fulfillment costs, and favorable inventory obsolescence expense. However, administrative expenses posed challenges, particularly related to Project Athens, an initiative aimed at improving operational efficiency.

Financial Achievements and Importance

Qurate Retail Inc (NASDAQ:QRTEA)'s financial achievements in 2023, particularly the increase in Adjusted OIBDA in Q4 and the reduction of debt, are critical for maintaining financial flexibility and investing in growth opportunities. The company's focus on optimizing its portfolio and improving cash flow generation positions it well for future performance in the competitive retail sector.

Key Financial Metrics

Qurate Retail Inc (NASDAQ:QRTEA) reported a mixed financial performance for the fourth quarter and full year of 2023. The company's Adjusted OIBDA margin improved, reflecting gains from higher product margins and operational efficiencies. eCommerce continued to be a strong driver, with mobile transactions representing a growing share of online revenue. The reduction in total debt and the leverage ratio improvement are indicative of the company's commitment to strengthening its balance sheet.

2023 was a transformational year for Qurate Retail. We executed better on multiple fronts including merchandising, pricing strategy and inventory management, and these efforts yielded significant, positive results in the operational health and financial performance of the business, said David Rawlinson, President and CEO of Qurate Retail.

Analysis of Company's Performance

Qurate Retail Inc (NASDAQ:QRTEA)'s strategic initiatives in 2023, including the divestiture of Zulily and debt reduction, have streamlined operations and improved financial stability. The company's ability to grow Adjusted OIBDA amidst revenue challenges demonstrates resilience and adaptability. As the company enters 2024, it expects to continue its momentum and drive improved results, leveraging its strengths in eCommerce and mobile sales.

For a detailed analysis of Qurate Retail Inc (NASDAQ:QRTEA)'s financial performance and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Qurate Retail Inc for further details.

This article first appeared on GuruFocus.