R1 RCM Inc. (RCM) Reports Notable Revenue and EBITDA Growth in Q4 and Full Year 2023

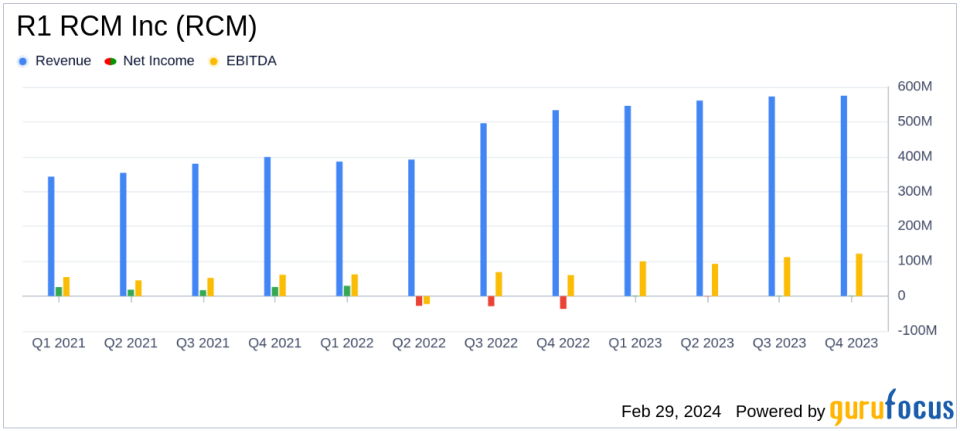

Revenue Growth: Q4 revenue increased by 7.8% year-over-year, and full-year revenue surged by 24.8%.

Net Income Improvement: Transitioned from a net loss in the previous year to a GAAP net income of $3.3 million for the full year.

Adjusted EBITDA: Q4 adjusted EBITDA rose by 33.5%, with a full-year increase of 45.0%.

2024 Outlook: R1 RCM Inc. projects revenue between $2,625 million and $2,675 million and adjusted EBITDA of $650 million to $670 million.

Strategic Acquisitions: Contributions from Acclara and Providence expected to bolster revenue growth.

R1 RCM Inc (NASDAQ:RCM), a leading provider of technology-driven solutions for healthcare providers, released its 8-K filing on February 27, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a significant increase in revenue and adjusted EBITDA, marking a strong performance turnaround from the previous year's net loss.

R1 RCM Inc specializes in enhancing the patient experience and financial performance of healthcare providers through end-to-end revenue cycle management (NASDAQ:RCM) services. The company's comprehensive solutions include all aspects of revenue cycle personnel, technology solutions, and process workflow, primarily generating revenue from operating fees.

The fourth quarter of 2023 saw R1 RCM Inc's revenue climb to $575.1 million, a 7.8% increase compared to the same period last year. This growth contributed to a full-year revenue of $2,254.2 million, up by 24.8% from 2022. The company also reported a GAAP net income of $1.4 million for the fourth quarter, a notable improvement from the net loss of $36.6 million in the same period last year. For the full year, the GAAP net income stood at $3.3 million, compared to a net loss of $63.3 million in 2022.

Adjusted EBITDA for the fourth quarter reached $167.7 million, up by 33.5% year-over-year, while the full-year adjusted EBITDA soared by 45.0% to $614.3 million. CEO Lee Rivas attributed the company's success to the execution of key objectives, including establishing a stronger growth foundation, stabilizing client metrics, and realizing synergies from the Cloudmed integration. Rivas also highlighted the enhancement of R1's technology platform through generative AI and global infrastructure improvements.

Looking ahead to 2024, R1 RCM Inc expects to generate revenue between $2,625 million and $2,675 million, with GAAP operating income projected at $105 million to $135 million and adjusted EBITDA estimated between $650 million and $670 million. CFO Jennifer Williams expressed confidence in the company's platform and its focus on growth and operating discipline to deliver value for customers and shareholders.

Financial Highlights and Challenges

The company's financial achievements are particularly significant in the context of the healthcare industry, where efficient revenue cycle management is crucial for maintaining financial health. The robust increase in adjusted EBITDA reflects R1 RCM Inc's ability to improve operating margins and cash flows, which are vital metrics for the sustainability of healthcare providers.

Despite these achievements, R1 RCM Inc faces challenges such as customer attrition and facility divestitures, which may impact future revenue growth. The company's forward-looking statements also indicate potential risks, including economic downturns, market conditions, and the successful integration of acquisitions like Cloudmed and Acclara.

In conclusion, R1 RCM Inc's financial performance in 2023 demonstrates a strong rebound and a positive outlook for 2024. The company's strategic focus on technology and global scale enhancements positions it well to continue delivering value to its customers and shareholders. For a detailed analysis of R1 RCM Inc's financials and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from R1 RCM Inc for further details.

This article first appeared on GuruFocus.