RA Capital Management, L.P. Acquires Significant Stake in Nektar Therapeutics

RA Capital Management, L.P., a Boston-based investment firm, recently made a significant acquisition in the biopharmaceutical sector. The firm purchased a substantial number of shares in Nektar Therapeutics (NASDAQ:NKTR), a leading biopharmaceutical company. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and an evaluation of Nektar Therapeutics' financial performance and future prospects.

Details of the Transaction

On August 7, 2023, RA Capital Management, L.P. acquired 18,700,000 shares of Nektar Therapeutics at a trading price of $1.02 per share. This transaction significantly impacted the firm's portfolio, with the newly acquired shares constituting 0.36% of the total portfolio. Following the transaction, RA Capital Management, L.P. now holds a total of 18,700,000 shares in Nektar Therapeutics, representing 9.80% of the company's total shares.

Profile of the Guru: RA Capital Management, L.P.

RA Capital Management, L.P. is a renowned investment firm located at 200 Berkeley Street, 18th Floor, Boston, MA 02116. The firm manages a diverse portfolio of 54 stocks, with a total equity of $5.3 billion. Its top holdings include Ascendis Pharma A/S (NASDAQ:ASND), 89bio Inc (NASDAQ:ETNB), Legend Biotech Corp (NASDAQ:LEGN), Vaxcyte Inc (NASDAQ:PCVX), and DICE Therapeutics Inc (NASDAQ:DICE).

Overview of Nektar Therapeutics

Nektar Therapeutics, a US-based biopharmaceutical company, was established in 1994. The company focuses on the research and development of investigational medicines in oncology, immunology, and virology. It also has a portfolio of approved partnered medicines. Nektar Therapeutics generates revenue from license, collaboration, and other revenue, non-cash royalty revenue related to the sales of future royalties, and product sales. The company has a market capitalization of $136.885 million and a current stock price of $0.72.

Analysis of Nektar Therapeutics' Financial Performance

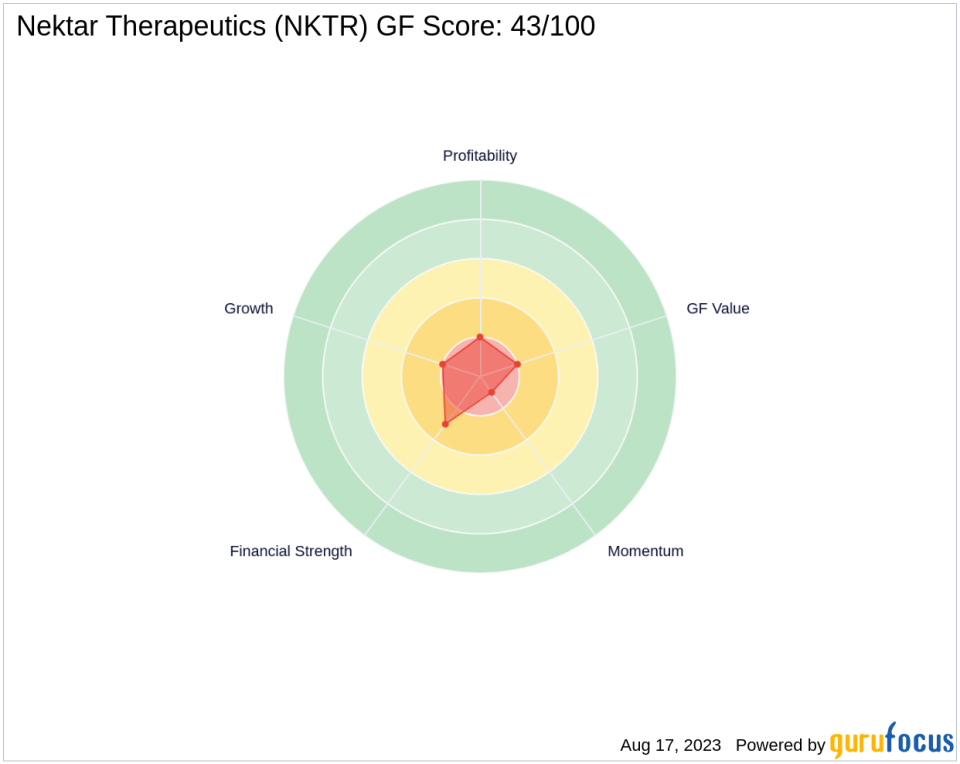

Nektar Therapeutics' financial performance can be evaluated using various metrics. The company's GF Score is 43/100, indicating poor future performance potential. Its Financial Strength is ranked 3/10, while its Profitability Rank and Growth Rank are both 2/10. The company's Piotroski F-Score is 4, and its Altman Z score is -10.03, indicating financial distress. Nektar Therapeutics' cash to debt ratio is 3.28, ranking 982 in the industry.

Comparison of Nektar Therapeutics' Performance with Industry Standards

When compared to industry standards, Nektar Therapeutics' performance is below average. The company's ROE and ROA are -91.58 and -45.00, respectively, ranking 1061 and 937 in the industry. Its gross margin growth is -4.30, and its operating margin growth is 0.00. The company's 3-year revenue growth is -9.10, while its EBITDA and earning growth over the same period are 7.40 and 7.90, respectively.

Evaluation of Nektar Therapeutics' Future Prospects

Despite the current financial performance, Nektar Therapeutics' future prospects remain uncertain. The company's predictability rank is not available, and its RSI 14-day rank is 1315. Its momentum index for 6 - 1 month and 12 - 1 month are -81.54 and -88.25, respectively, indicating a negative momentum.

Conclusion

In conclusion, RA Capital Management, L.P.'s acquisition of Nektar Therapeutics' shares is a significant move that has considerably impacted its portfolio. However, given Nektar Therapeutics' current financial performance and future prospects, the implications of this transaction for both the guru and the traded company remain to be seen.

This article first appeared on GuruFocus.