Rackspace Technology Inc (RXT) Reports Decline in Q4 and Full Year 2023 Revenue

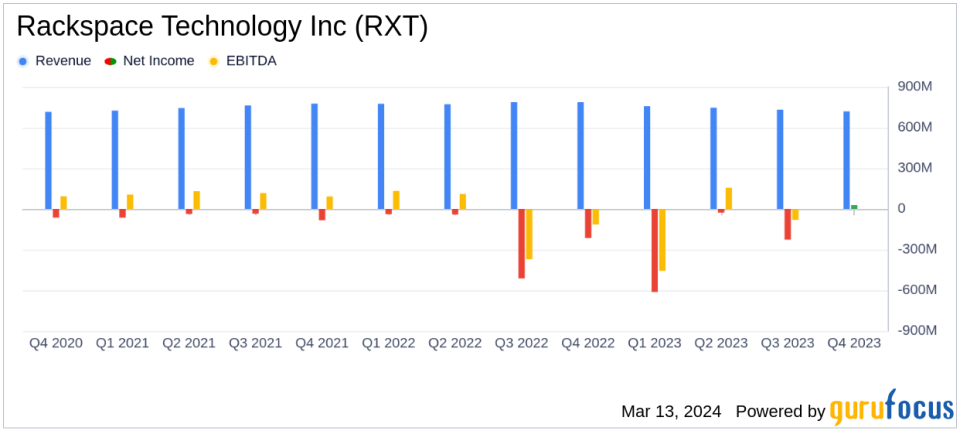

Q4 Revenue: $720 million, down 9% Year-over-Year.

2023 Full Year Revenue: $2,957 million, down 5% Year-over-Year.

Q4 Net Income: $28 million, compared to net loss of $(214) million in Q4 2022.

2023 Full Year Net Loss: $(838) million, compared to $(805) million in 2022.

Debt Refinancing: Over $900 million in estimated net financial debt reduction through debt repurchases and refinancings.

Financial Outlook: Q1 2024 guidance anticipates revenue between $680 - $690 million and Non-GAAP Loss Per Share of ($0.12) - ($0.14).

On March 12, 2024, Rackspace Technology Inc (NASDAQ:RXT), a leading provider of end-to-end multi cloud technology services, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates across various cloud environments and offers a range of services including application services, data, and managed cloud, reported a decrease in revenue both for the quarter and the full year, reflecting ongoing challenges in the industry.

Financial Performance and Challenges

Rackspace Technology's fourth quarter revenue saw a 9% decline year-over-year to $720 million, with a notable 14% decrease in Private Cloud revenue. The full year revenue also dipped by 5% to $2,957 million. Despite these declines, the company managed to report a net income of $28 million in Q4 2023, a significant improvement from the net loss of $(214) million in the same quarter of the previous year. However, the full year net loss widened to $(838) million in 2023 from $(805) million in 2022.

The company's performance is critical as it reflects the competitive and rapidly evolving cloud services industry. The challenges faced by Rackspace, including the revenue decline, may lead to concerns about the company's ability to adapt to market demands and maintain its financial health.

Debt Refinancing and Financial Outlook

Rackspace Technology has made significant strides in strengthening its capital structure, with an estimated net financial debt reduction of over $900 million through debt repurchases and refinancings. This strategic move is expected to lower net annual interest expense by approximately $40 million, assuming full participation in the public exchange offer.

Looking ahead, the company provided guidance for the first quarter of 2024, projecting revenue between $680 - $690 million and a Non-GAAP Loss Per Share of ($0.12) - ($0.14). This outlook is important as it indicates the company's expectations for its financial trajectory and its ability to navigate through the current challenges.

Key Financial Metrics

Important metrics from the financial statements include:

The fourth quarter cash flow from operating activities was $72 million, contributing to the full year's $375 million.

Capital expenditures were $38 million in Q4 2023, down from $43 million in Q4 2022.

As of December 31, 2023, Rackspace had cash and cash equivalents of $197 million with no balance outstanding on its Revolving Credit Facility.

These metrics are crucial as they provide insights into the company's operational efficiency, liquidity, and investment in growth.

Management's Commentary

"I'm pleased to announce that our results for the fiscal fourth quarter of 2023 exceeded the midpoint of our revenue, operating profit, and EPS guidance. FY23 was a period of transition, through which we focused on implementing structural changes to facilitate a turnaround, repositioning Rackspace to capitalize on emerging technology inflections points and strengthening our capital structure and I am happy with the progress we have made this year," said Amar Maletira, Chief Executive Officer.

Rackspace Technology's earnings report underscores the company's efforts to navigate a challenging environment while laying the groundwork for future growth. Investors and stakeholders will be closely monitoring the company's progress as it continues to refine its strategy and operations in the dynamic cloud services market.

Explore the complete 8-K earnings release (here) from Rackspace Technology Inc for further details.

This article first appeared on GuruFocus.