The RADA Electronic Industries (NASDAQ:RADA) Share Price Has Soared 311%, Delighting Many Shareholders

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One such superstar is RADA Electronic Industries Ltd. (NASDAQ:RADA), which saw its share price soar 311% in three years. On top of that, the share price is up 29% in about a quarter.

View our latest analysis for RADA Electronic Industries

RADA Electronic Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years RADA Electronic Industries has grown its revenue at 34% annually. That's much better than most loss-making companies. And it's not just the revenue that is taking off. The share price is up 60% per year in that time. Despite the strong run, top performers like RADA Electronic Industries have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

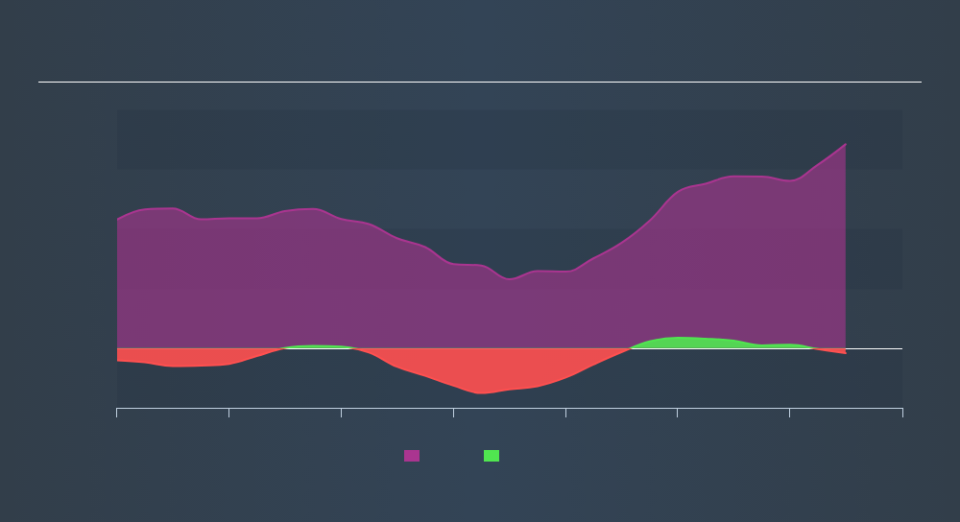

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling RADA Electronic Industries stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that RADA Electronic Industries shareholders have received a total shareholder return of 79% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: RADA Electronic Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.