Radian Group Inc. (RDN) Reports Full Year and Q4 2023 Earnings

Net Income: Q4 net income of $143 million, full year net income of $603 million.

Earnings Per Share: Q4 EPS at $0.91, full year EPS at $3.77.

Revenue: Full year total revenue increased by 4% to $1.2 billion.

Book Value: Book value per share grew 15% year-over-year to $28.71.

Mortgage Insurance: Primary mortgage insurance in force reached a record $270 billion.

Capital Return: $279 million returned to shareholders through dividends and share repurchases in 2023.

ROE: Full year return on equity stood at 14.5%.

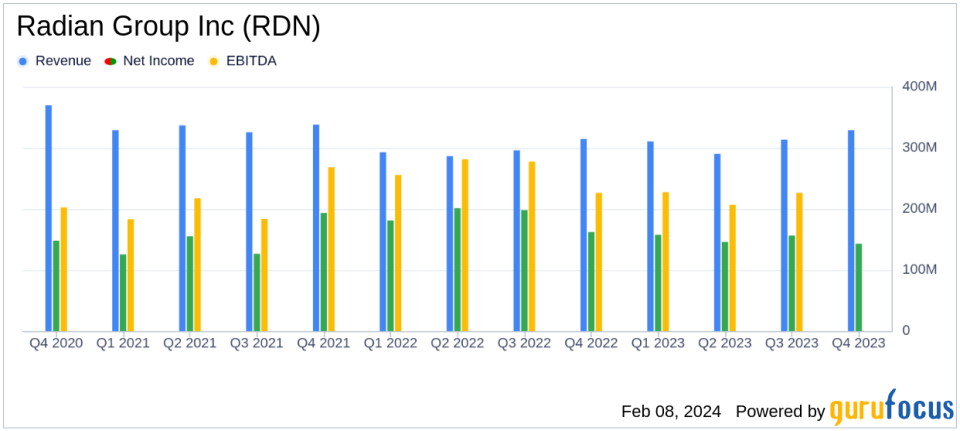

Radian Group Inc (NYSE:RDN) released its 8-K filing on February 7, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a provider of mortgage insurance and services to the real estate and mortgage finance industries, reported a net income of $143 million for the fourth quarter, or $0.91 per diluted share, compared to the net income of $162 million, or $1.01 per diluted share for the same period in the previous year. For the full year, net income was $603 million, or $3.77 per diluted share, down from $743 million, or $4.35 per diluted share in 2022.

The company's book value per share increased by 15% year-over-year to $28.71, reflecting a solid growth in equity for shareholders. Total revenue for the year grew by 4% to $1.2 billion, indicating a steady top-line expansion. Radian's primary mortgage insurance in force reached an all-time high of $270 billion, signaling strong future earnings potential for the company. Moreover, Radian returned $279 million of capital to shareholders during the year through dividends and share repurchases, demonstrating its commitment to delivering shareholder value.

Financial Performance and Challenges

Radian's performance in 2023 was marked by a challenging macroeconomic environment, yet the company managed to grow its book value and total revenues. The decline in net income and earnings per share year-over-year reflects the broader economic pressures, including a higher interest rate environment and potential market volatility. These challenges may lead to problems such as reduced demand for mortgage insurance and increased claims, which could impact future profitability.

Key Financial Metrics

Important metrics from the income statement include a slight decrease in net premiums earned for the fourth quarter to $230 million, consistent with the same quarter in the previous year. The balance sheet shows a robust increase in book value per share, while the cash flow statement highlights the company's ability to return capital to shareholders. These metrics are crucial as they demonstrate Radian's financial health, profitability, and operational efficiency, which are key considerations for investors in the insurance industry.

Management Commentary

"We reported another successful year for Radian in 2023, increasing book value per share by 15% year-over-year, generating net income of $603 million and delivering a return on equity of approximately 15%. Despite a challenging macroeconomic environment, total revenues grew to $1.2 billion and our primary mortgage insurance in force, which is the main driver of future earnings for our company, reached an all-time high of $270 billion," said Radians Chief Executive Officer Rick Thornberry.

Analysis and Outlook

Radian's strategic management of capital and its ability to navigate a difficult economic landscape have positioned it well for the future. The growth in mortgage insurance in force is a positive indicator for future revenue streams. However, the company must continue to adapt to changing market conditions, including interest rate fluctuations and housing market dynamics, to sustain its growth trajectory.

For a more detailed analysis and additional information, including financial tables and adjusted financial measures, readers are encouraged to review the full 8-K filing.

For investors seeking to understand the nuances of Radian's financial health and prospects, the full earnings report provides valuable insights into the company's operational and financial strategies, as well as its ability to generate shareholder value in a complex economic environment.

Explore the complete 8-K earnings release (here) from Radian Group Inc for further details.

This article first appeared on GuruFocus.