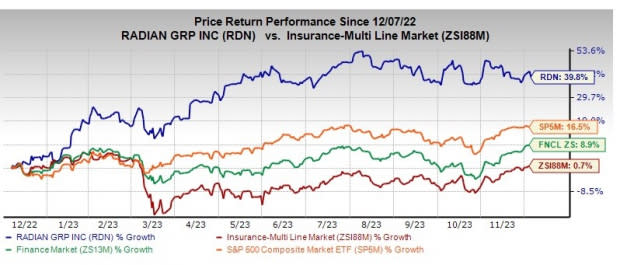

Radian Group (RDN) Up 39.8% in a Year: More Room for Growth?

Radian Group, Inc.'s RDN shares have risen 39.8% in the past year compared with the industry's 0.7% growth. The Finance sector has grown 8.9% and the Zacks S&P 500 index has gained 16.5% in the said time frame. With a market capitalization of $4 billion, the average volume of shares traded in the last three months totaled 1.1 million.

Image Source: Zacks Investment Research

The rally was largely driven by improved persistency and mortgage insurance portfolio, robust capital position as well as prudent capital deployment.

The multi-line insurer has a solid track record of beating on earnings in each of the last four quarters, delivering an average surprise of 25.26%.

Radian Group’s return on equity for the trailing 12 months is 15.6%, better than the industry average of 13.2%. This reflects its efficiency in utilizing shareholders’ funds.

Can It Retain the Momentum?

The Zacks Consensus Estimate for RDN’s 2023 earnings has moved 4.2% north in the past 30 days, reflecting analysts’ optimism about the stock.

Radian’s earnings are poised to grow on the strength of its mortgage insurance portfolio. The primary mortgage insurance in force should benefit from an increase in single premium policy insurance in force and a higher monthly premium policy. Notably, in terms of the housing market and based on industry projections for the total mortgage originations of $1.6 trillion, RDN expects the private mortgage insurance market in 2023 to be around $300 billion.

Persistency rate is poised to show improvement, given lower refinance activity, due to an increase in mortgage interest rates. Its business restructuring moves are focused on the core business and services with higher growth potential, ensuring a predictable and recurring fee-based revenue stream.

This Zacks Rank #3 (Hold) insurer has been witnessing declining claims over the past few years. Given the strong credit characteristics of the new loans insured, we expect the company to witness a lesser number of claims, favoring profitability.

However, Radian Group’s homegenius title and real estate businesses are affected by a decrease in industry-wide mortgage and real estate transaction volume, inflationary pressures and a higher interest rate environment. Nonetheless, with the continuing focus on disciplined cost management, the insurer remains hopeful about managing the homegenius business through this challenging environment.

Banking on operational excellence, this mortgage insurer maintains a solid balance sheet with sufficient liquidity and strong cash flows.

Solid liquidity favors effective capital deployment. RDN has increased dividends for four straight years and boasts the highest dividend yield in the private MI industry. Its current dividend yield of 3.5% is better than the industry average of 2.6%. The company has $230 million remaining under its buyback authorization.

Stocks to Consider

Some better-ranked stocks from the multi-line insurance industry are Assurant, Inc. AIZ, Everest Group, Ltd. EG and Goosehead Insurance GSHD, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Assurant’s earnings surpassed estimates in each of the last four quarters, delivering an average surprise of 42.38%.

The Zacks Consensus Estimate for AIZ’s 2023 and 2024 earnings implies 30.8% and 3.6% growth, respectively, on a year-over-year basis. In the past year, the insurer has gained 32.8%.

Everest Group’s earnings surpassed estimates in three of the last four quarters and missed in one, delivering an average surprise of 24.50%.

The Zacks Consensus Estimate for EG’s 2023 and 2024 earnings implies 105.32% and 10.98% growth, respectively, on a year-over-year basis. In the past year, the insurer has gained 19.3%.

Goosehead Insurance’s earnings surpassed estimates in three of the last four quarters and missed in one, delivering an average surprise of 100.43%.

The Zacks Consensus Estimate for GSHD’s 2023 and 2024 earnings implies 150.9% and 28.2% growth, respectively, on a year-over-year basis. In the past year, the insurer has gained 83.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Goosehead Insurance (GSHD) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report