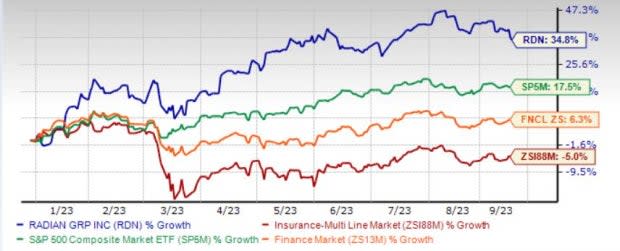

Radian (RDN) Up 35% YTD: Should You Buy It for Better Return?

Radian Group’s RDN shares have gained 34.8% year to date against the industry’s decline of 5%. The Finance sector has risen 6.3% and the Zacks S&P 500 index has gained 17.5% in the said time frame. With a market capitalization of $4 billion, the average volume of shares traded in the last three months was 1 million.

Improving mortgage insurance portfolio, declining claims, the well-performing homegenius segment, solid capital position and effective capital deployment continue to drive this Zacks Rank #2 (Buy) insurer.

The insurer’s earnings have increased 19.5% in the past five years, better than the industry average of 5.5%. RDN has a solid surprise history, beating earnings estimates in each of the last seven reported quarters.

Radian’s return on equity for the trailing 12 months is 17.3%, which compares favorably with the industry’s 10.5%, reflecting the company’s efficiency in utilizing shareholders’ funds.

Image Source: Zacks Investment Research

Will the Bull Run Continue?

The Zacks Consensus Estimate for RDN’s 2023 earnings has moved north by 5.8%, while that for 2024 has moved up 4% in the past 60 days, reflecting analysts’ optimism. The expected long-term earnings growth is pegged at 5%.

Based on a total mortgage origination market of $1.7 trillion, Radian expects the private mortgage insurance market in 2023 to be around $325 billion. An improved mortgage insurance portfolio, the main catalyst of long-term earnings growth, creates a strong foundation for RDN’s earnings. The primary mortgage insurance in force should benefit from an increase in single premium policy insurance in force and a higher monthly premium policy.

Lower refinance activity, due to an increase in mortgage interest rates, is favoring persistency rate. Given the increase in market mortgage interest rates, Radian expects a continued positive impact on persistency rates.

RDN has been witnessing declining claims over the past few years. With the strong credit characteristics of the new loans insured, we expect the company to witness lesser number of claims.

Decrease in industry wide mortgage and real estate transaction volume, inflationary pressures and higher interest rate environment are negatively impacting homegenius title and real estate businesses. However, with the continuing focus on disciplined cost management, Radian remains hopeful to manage the homegenius business through this challenging environment.

Banking on operational excellence, the insurer maintains a solid balance sheet with sufficient liquidity and strong cash flows.

Radian Group’s solid liquidity aids in effective capital deployment. RDN has increased dividend for four straight years and boasts the highest dividend yield in the private MI industry. Its current dividend yield of 3.5% is better than the industry average of 2.7%. RDN has $280 million remaining under its buyback authorization.

Attractive Valuation

Shares are trading at a price-to-book multiple of 0.96, lower than the industry average of 2.41.

The company has a Value Score of B. This style score helps find the most attractive value stocks. Back-tested results have shown that stocks with a Value Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or #2, offer better returns.

Before its valuation expands, it is advisable to take a position in the stock.

Other Stocks to Consider

Some other top-ranked stocks from the multi-line insurance industry are Old Republic International Corporation ORI, Everest Group, Ltd. EG and Enact Holdings Inc. ACT. Old Republic International sports a Zacks Rank #1, and Everest Group and Enact Holdings carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Old Republic International’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 14.1%.

The Zacks Consensus Estimate for ORI’s 2023 and 2024 earnings has moved 8.3% and 5.2% north, respectively, in the past 60 days. Year to date, the insurer has gained 11.7%.

Everest Group’s earnings surpassed estimates in three of the last four quarters and missed in one, the average earnings surprise being 17.36%.

The Zacks Consensus Estimate for EG’s 2023 and 2024 earnings implies 72.7% and 24% year-over-year growth, respectively. Year to date, the insurer has climbed 13.2%.

Enact’s earnings surpassed estimates in three of the last four quarters, the average earnings surprise being 25.04%.

The Zacks Consensus Estimate for ACT’s 2023 and 2024 earnings has moved 9% and 2.3% north, respectively, in the past 60 days. Year to date, the insurer has gained 14.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report