Radiant Logistics looks for back-half 2024 inflection

Management from 3PL Radiant Logistics said Thursday it was hopeful for a demand turnaround in the second half of 2024, noting it has seen some lift in ocean container traffic.

“We remain optimistic that we are at or near the bottom of this cycle and would expect markets to begin to find their way to more sustainable and normalized levels towards the back half of calendar 2024,” said Bohn Crain, founder and CEO, in a news release.

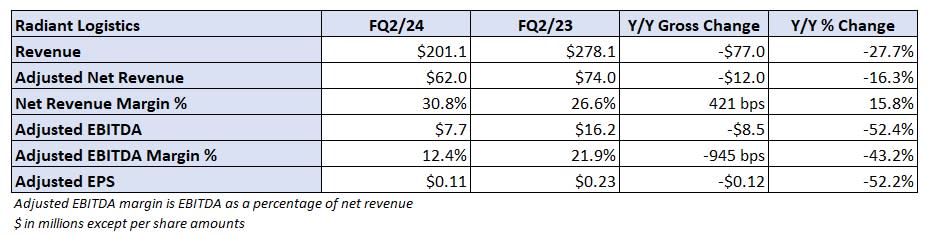

Radiant (NYSE: RLGT) reported adjusted earnings per share of 11 cents for its fiscal second quarter ended Dec. 31. The result was 2 cents ahead of the consensus estimate but 12 cents lower year over year (y/y).

The Renton, Washington-based company reported revenue of $201.1 million, which was 28% lower y/y. Revenue net of purchased transportation expenses was 16% lower. Adjusted earnings before interest, taxes, depreciation and amortization of $7.7 million was 52% lower y/y.

Radiant generated $12.1 million in cash flow from operations during the period. The company is debt-free and had $32.9 million in cash on hand at the end of the quarter. It has nothing outstanding on a $200 million credit facility.

The company said it will continue to acquire independent agent stations as well as nonaffiliated 3PLs.

Radiant announced Wednesday the acquisition of Doral, Florida-based Select Logistics and Select Cartage, which have been working under Radiant’s Adcom Worldwide brand. Operating as Select, the business provides freight forwarding services to the cruise line industry.

Financial terms of the transaction were not disclosed, but management said on a Thursday call with analysts that most agent station conversions produce an EBITDA run rate of $500,000 to $2 million. It believes Radiant could acquire one station every quarter.

It acquired operating partner Daleray in October.

The company repurchased $3.1 million in stock during the first six months of its fiscal year and said it will continue to repurchase shares moving forward.

More FreightWaves articles by Todd Maiden

The post Radiant Logistics looks for back-half 2024 inflection appeared first on FreightWaves.