Ralph Lauren Corp (RL) Posts Robust Q3 Fiscal 2024 Results with Notable Earnings Surge

Revenue: Increased by 6% on a reported basis and 5% in constant currency.

Direct-to-Consumer Sales: Comparable store sales grew by 9%, with positive retail comps across all regions.

Operating Margins: Exceeded expectations, reflecting brand elevation and disciplined expense management.

Earnings Per Share (EPS): Reported diluted EPS grew by 31% and adjusted EPS by 24%.

Inventory Levels: Global inventories down by 15% compared to the prior year.

Shareholder Returns: Approximately $425 million returned to shareholders through dividends and stock repurchases this fiscal year-to-date.

Outlook: Reiterated full-year fiscal 2024 outlook of low-single-digit revenue growth, centering on 2%, and adjusted gross and operating margin expansion in constant currency.

Ralph Lauren Corp (NYSE:RL) released its 8-K filing on February 8, 2024, announcing strong third-quarter fiscal 2024 results that surpassed expectations. The iconic fashion house, known for its premium lifestyle products ranging from apparel to home goods, demonstrated resilience and strategic prowess in navigating a challenging market landscape.

Financial Performance Highlights

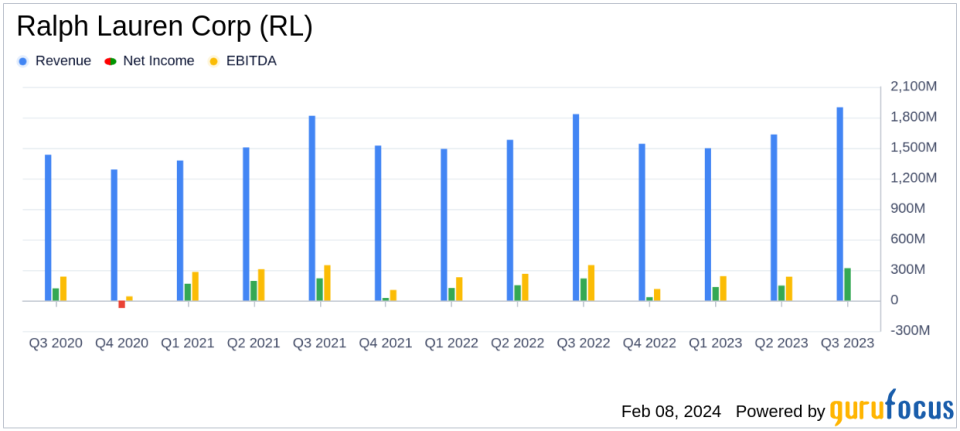

Ralph Lauren Corp's revenue saw a healthy increase, reaching $1.9 billion, with all regions contributing to this growth, particularly Asia, which saw a significant uptick. The company's direct-to-consumer segment, including both brick-and-mortar and digital channels, experienced a robust 9% growth in comparable store sales, indicating strong consumer demand for Ralph Lauren's offerings.

The company's operating margins outperformed expectations, a testament to its ongoing brand elevation efforts and strict expense discipline, which helped to counterbalance product cost headwinds and increased marketing investments. Notably, Ralph Lauren's reported diluted EPS saw a remarkable 31% growth, while adjusted EPS grew by 24%, reflecting solid operating profit growth and discrete tax benefits realized during the quarter.

Strategic Achievements and Outlook

Ralph Lauren Corp's strategic initiatives under its "Next Great Chapter: Accelerate" plan have been instrumental in driving growth. The company has successfully attracted 1.7 million new consumers to its direct-to-consumer businesses and has seen accelerated net promoter scores over the holiday quarter. Product launches and marketing campaigns have resonated well with consumers, contributing to the company's positive performance.

Looking ahead, Ralph Lauren Corp remains confident in its full-year fiscal 2024 outlook, expecting low-single-digit revenue growth, centering around 2%, and adjusted gross and operating margin expansion, all in constant currency. The company's strong balance sheet, with $1.9 billion in cash and short-term investments, positions it well for continued investment in strategic growth initiatives.

Income Statement and Balance Sheet Review

The company's gross profit for the third quarter was $1.3 billion, with a gross margin of 66.5%. Adjusted gross margin improved by 120 basis points over the prior year, driven by lower freight costs, favorable channel and geographic mix shifts, and AUR growth across all regions. Operating expenses were up 7% to last year, reflecting strategic investments in marketing and key city ecosystem expansion.

Ralph Lauren Corp's balance sheet remains robust, ending the quarter with a significant decrease in inventory levels, down 15% compared to the prior year, indicating healthy inventory management. The company's net income for the quarter stood at $277 million, translating to $4.19 per diluted share on a reported basis and $4.17 per diluted share on an adjusted basis.

In summary, Ralph Lauren Corp's third-quarter fiscal 2024 results showcase a company that is effectively navigating market challenges through strategic growth initiatives, disciplined financial management, and a commitment to brand elevation. The company's performance is a positive signal for investors and stakeholders, reinforcing Ralph Lauren's position as a leader in the luxury lifestyle product market.

For a detailed analysis of Ralph Lauren Corp's financials and strategic outlook, investors and interested parties can access the full earnings report here.

Explore the complete 8-K earnings release (here) from Ralph Lauren Corp for further details.

This article first appeared on GuruFocus.