Ralph Lauren (NYSE:RL) Delivers Impressive Q3, Stock Soars

Fashion brand Ralph Lauren (NYSE:RL) reported results ahead of analysts' expectations in Q3 FY2024, with revenue up 5.6% year on year to $1.93 billion. It made a non-GAAP profit of $4.17 per share, improving from its profit of $3.35 per share in the same quarter last year.

Is now the time to buy Ralph Lauren? Find out by accessing our full research report, it's free.

Ralph Lauren (RL) Q3 FY2024 Highlights:

Revenue: $1.93 billion vs analyst estimates of $1.87 billion (3.4% beat)

EPS (non-GAAP): $4.17 vs analyst estimates of $3.55 (17.5% beat)

Free Cash Flow of $562.6 million, up from $30.1 million in the previous quarter

Gross Margin (GAAP): 66.5%, up from 65.2% in the same quarter last year

Market Capitalization: $9.51 billion

"We delivered a strong holiday, with continued progress on our Next Great Chapter: Accelerate plan and third quarter results that exceeded our expectations led by continued momentum in our direct-to-consumer channels," said Patrice Louvet, President and Chief Executive Officer.

Originally founded as a necktie company, Ralph Lauren (NYSE:RL) is an iconic American fashion brand known for its classic and sophisticated style.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

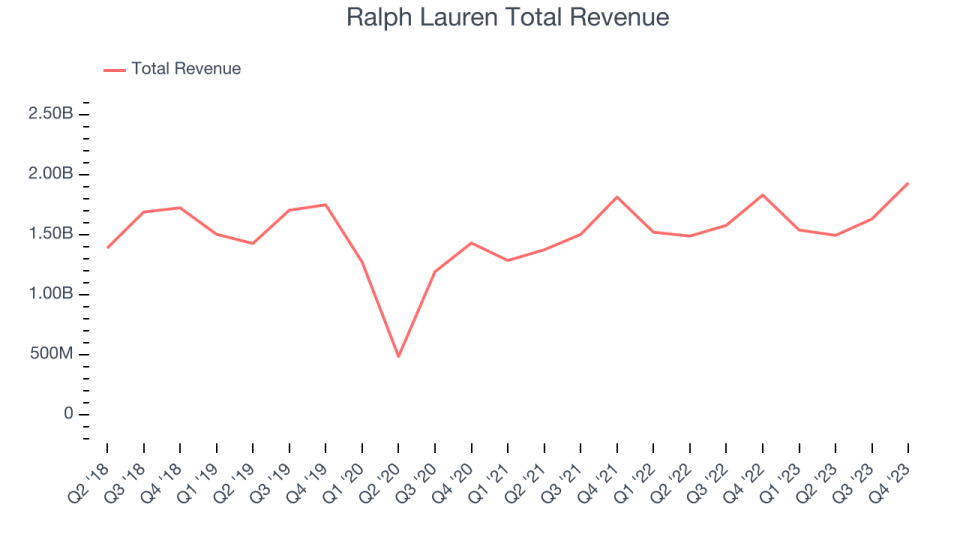

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Ralph Lauren's revenue was flat over the last 5 years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Ralph Lauren's annualized revenue growth of 5.1% over the last 2 years is above its 5-year trend, suggesting there are some bright spots.

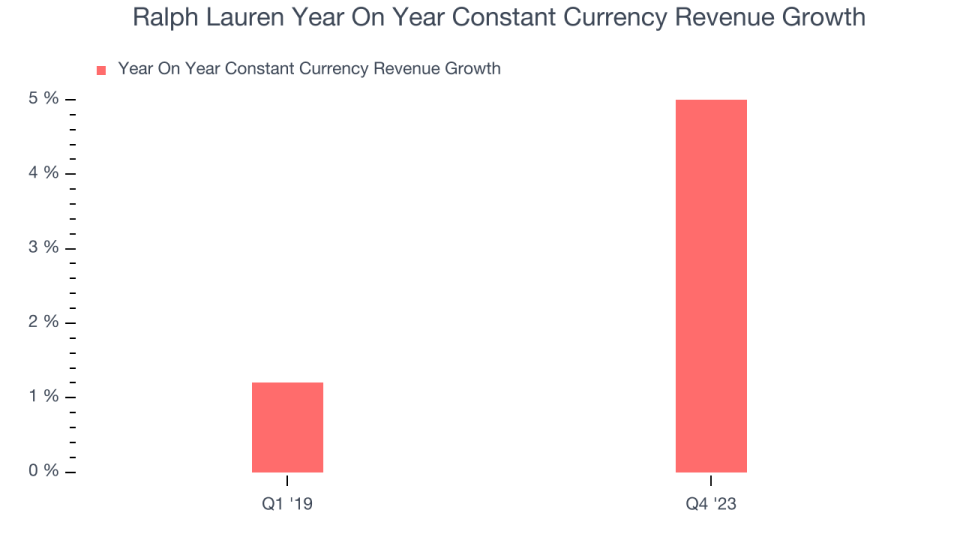

Ralph Lauren also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales averaged 8.5% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered Ralph Lauren's top-line performance.

This quarter, Ralph Lauren reported solid year-on-year revenue growth of 5.6%, and its $1.93 billion of revenue outperformed Wall Street's estimates by 3.4%. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, a deceleration from this quarter.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Cash Is King

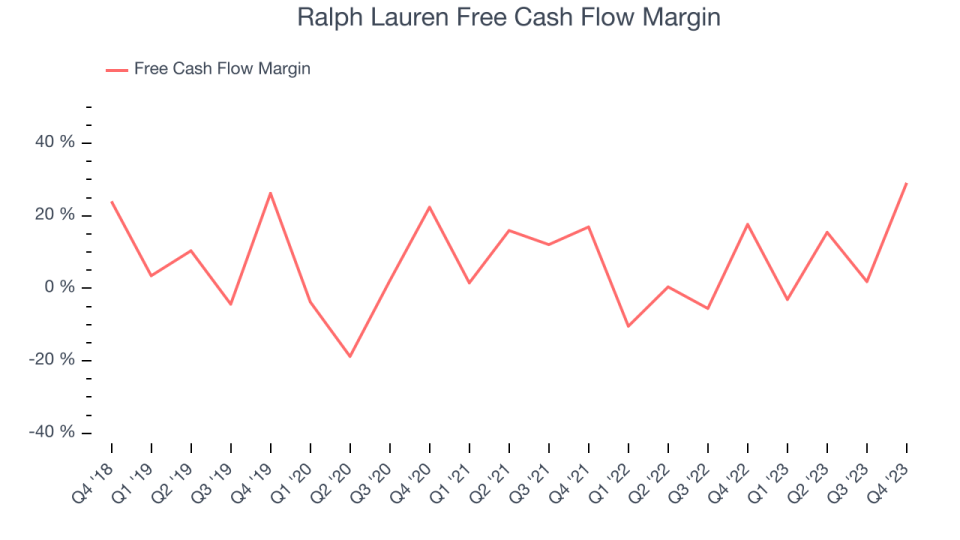

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Ralph Lauren has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.7%, subpar for a consumer discretionary business.

Ralph Lauren's free cash flow came in at $562.6 million in Q3, equivalent to a 29.1% margin, up 74.1% year on year. Over the next year, analysts predict Ralph Lauren's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 11.8% will decrease to 9%.

Key Takeaways from Ralph Lauren's Q3 Results

We were impressed by how significantly Ralph Lauren blew past analysts' revenue and EPS expectations this quarter, driven by strong outperformance in its Europe ($522 million of revenue vs estimates of $471 million) and Asia ($446 million of revenue vs estimates of $428 million) segments. The company also beat Wall Street's same-store sales estimates, posting 9% growth (vs the forecasted 4.3% growth).

Ralph Lauren repurchased approximately $103 million of its shares this quarter and guided to roughly 2% constant currency revenue growth for the full year 2024, and based on current exchange rates, expects to receive a modest benefit on overall revenue growth (a reversal from its 2-year trend). Overall, we think this was a really good quarter that should please shareholders. The stock is up 6.7% after reporting and currently trades at $157 per share.

Ralph Lauren may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.