Ralph Lauren (RL) Thrives on AUR Growth & Customer Engagement

Ralph Lauren Corp. RL is demonstrating commendable performance, driven by its brand strength, strong demand and expansion across various sales channels. The company's Average Unit Retail (“AUR”) has consistently increased in double digits, marking the 25th consecutive rise, supported by factors like product mix improvement, lower freight costs and a favorable channel mix.

Additionally, the company's focus on creating engaging selling environments and authentic brand messaging is helping it build brand desirability and drive sales.

Ralph Lauren is making strides in expanding its digital and omni-channel capabilities through investments in mobile, omni-channel solutions and fulfillment. Digital sales have been robust in the international markets. Regionally, digital sales were up 8% in Europe and 11% in Asia in the first quarter of fiscal 2024.

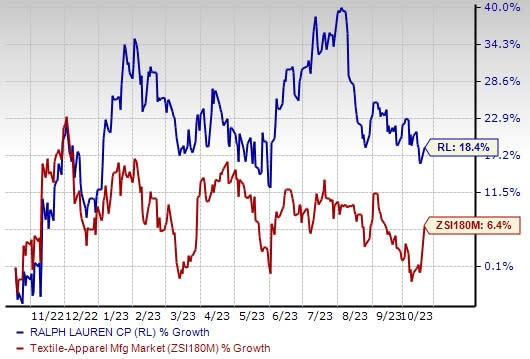

Image Source: Zacks Investment Research

For fiscal 2024, Ralph Lauren is planning to focus on rich digital content and enhanced customer personalization. The company is committed to making further digital investments, creating content for all platforms, improving the user experience, and leveraging AI and data to serve customers more effectively. It also expects higher marketing and ecosystem investments in the fiscal second quarter of fiscal 2024.

By focusing on its DTC channel and investing in its digital capabilities, the company is well-positioned to adapt to changing market dynamics and meet the evolving needs of its customers. In DTC businesses, RL added 1.2 million consumers in the fiscal first quarter, consistent with recent trends.

The company is scaling and expanding its connected retail capabilities, and offering services, such as virtual selling appointments and "buy online, pick up in store." The company launched its first-ever full catalog mobile app to provide a personalized and content-rich platform during the holiday season.

Higher Cost Challenges

Ralph Lauren has few challenges to address, including continued product cost inflation and higher compensation costs. In the first quarter of fiscal 2024, adjusted operating expenses increased 1% from the year-ago period to $830 million, partly due to higher compensation and rent and occupancy costs, offset by lower marketing expenses.

Wrapping Up

In the fiscal second quarter, Ralph Lauren anticipates its revenues to remain relatively stable, with a slight increase on a constant-currency basis. This projection considers a positive foreign currency impact of 100 basis points. The company expects its operating margin to be 9.5-10% on a reported basis and 9-9.5% when adjusted for constant-currency fluctuations. Additionally, the gross margin is forecast to expand by 40-60 basis points, which is expected to more than offset the impacts of higher operating expenses during this period.

Shares of this Zacks Rank #3 (Hold) company have gained 18.4% in the past year as compared to the industry’s 6.4% growth.

Stocks To Consider

We have highlighted three better-ranked stocks, namely G-III Apparel Group, Ltd. GIII, Guess, Inc. GES and lululemon athletica inc. LULU.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for G-III Apparel’s current fiscal-year sales and EPS suggests growth of 2.4% and 14.7%, respectively, from the year-ago reported figures. GIII has a trailing four-quarter earnings surprise of around 526.6%, on average.

Guess designs, markets, distributes and licenses casual apparel and accessories. The company currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for Guess’ current fiscal-year sales and EPS suggests growth of 3.4% and 9.9%, respectively, from the year-ago reported figures. GES has a trailing four-quarter earnings surprise of 43.4%, on average.

lululemon is a yoga-inspired athletic apparel company that creates lifestyle components. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for lululemon’s current fiscal-year sales and EPS suggests growth of 18.1% and 20.5%, respectively, from the year-ago reported figures. LULU has a trailing four-quarter earnings surprise of 6.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report