Ramaco Resources Inc (METC) Reports Solid Q4 and Full-Year 2023 Results Amid Market Challenges

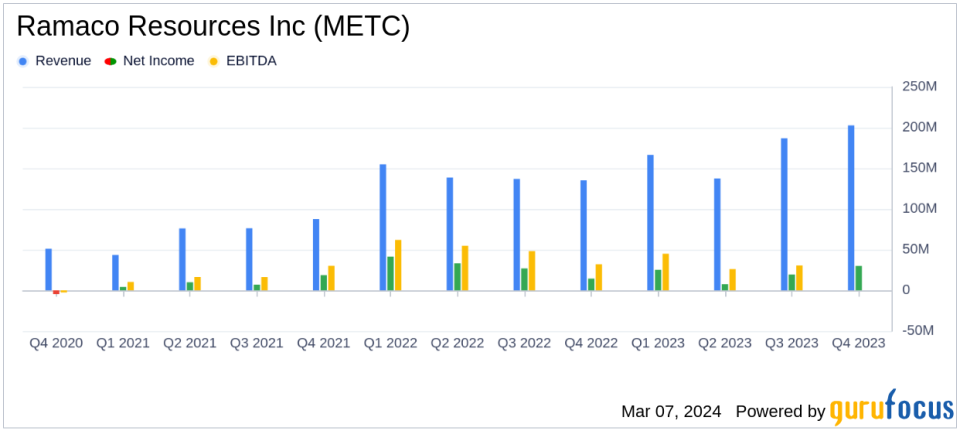

Total Tons Sold: Increased by 41% year-over-year to 3.455 million tons.

Revenue: Rose by 23% year-over-year to $693.5 million.

Net Income: Reported at $82.3 million, a decrease of 29% from the previous year.

Adjusted EBITDA: Reached $182.1 million, down 11% year-over-year.

Debt Reduction: Term debt reduced by $55 million in 2023, ending the year with $48 million outstanding.

Liquidity: Increased to a record $91 million, up from $49 million at year-end 2022.

Capital Expenditures: Decreased by 33% to $82.9 million for the year.

On March 7, 2024, Ramaco Resources Inc (NASDAQ:METC) released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. The company, a prominent operator and developer of high-quality, low-cost metallurgical coal, has navigated through a year marked by fluctuating market prices and has managed to post solid financial results.

Performance and Challenges

Ramaco Resources Inc (NASDAQ:METC) faced a challenging market environment with metallurgical coal prices ending the year more than 10% below the levels of the first quarter of 2023. Despite these headwinds, the company increased its sales volume, shipping at a 4 million ton per annum rate during the second half of the year, compared to a 3 million ton rate in the first half. This strategic increase in sales volume, coupled with cost management, has allowed Ramaco to maintain a strong financial position.

Financial Achievements

The company's financial achievements are significant, particularly in the context of the steel industry, which relies heavily on metallurgical coal. Ramaco's focus on reducing costs and increasing sales volume has led to a robust revenue increase of 23% year-over-year to $693.5 million. The company's ability to reduce term debt by $55 million, ending the year with just $48 million of term debt outstanding, underscores its commitment to maintaining a strong balance sheet. Moreover, the record liquidity of $91 million provides the company with the financial flexibility to pursue growth opportunities.

Key Financial Metrics

For the fourth quarter, Ramaco reported net income of $30.0 million, a 54% increase from the third quarter and a 109% increase year-over-year. Adjusted EBITDA for the quarter was $58.5 million, up 29% from the third quarter and 83% year-over-year. The company's capital expenditures in the fourth quarter totaled $18.0 million, down from $31.6 million in the same period of 2022. The effective tax rate for the quarter was 23%, with an income tax expense of $8.8 million.

"Our fourth quarter results highlight the growth trajectory we have pursued," said Randall Atkins, Ramaco Resources Chairman and Chief Executive Officer. "We are essentially targeting over the coming years a doubling of the level of our 2023 production levels."

Analysis of Company's Performance

Ramaco's strategic initiatives, such as the acquisition of a coal preparation plant for $3 million, which is expected to reduce trucking and mine cash costs, demonstrate the company's proactive approach to growth and cost management. The company's balance sheet management, with a significant reduction in term debt and an increase in liquidity, positions it well for retiring all debt in 2024 if it chooses to do so. Additionally, the agreement with KeyBank NA to increase the size of the Revolver to up to $275 million further strengthens Ramaco's financial flexibility.

The company's operational efficiency is evident in the increased production and sales volumes, with the Elk Creek complex producing 412,000 tons, and the Berwind, Knox Creek, and Maben complexes increasing production to 333,000 tons in the quarter. The cost reduction achieved despite inflationary pressures showcases Ramaco's effective cost management strategies.

Ramaco Resources Inc (NASDAQ:METC) is poised for a pivotal year in 2024, with plans to execute its core growth strategy, reduce debt, grow its dividend, and advance the commercial development of its Brook Mine REE project. The company's focus on operational excellence and financial prudence is expected to drive continued success in the metallurgical coal market.

For more detailed information on Ramaco Resources Inc (NASDAQ:METC)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ramaco Resources Inc for further details.

This article first appeared on GuruFocus.