I Ran A Stock Scan For Earnings Growth And Olympia Financial Group (TSE:OLY) Passed With Ease

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Olympia Financial Group (TSE:OLY). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Olympia Financial Group

How Fast Is Olympia Financial Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Olympia Financial Group has managed to grow EPS by 32% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

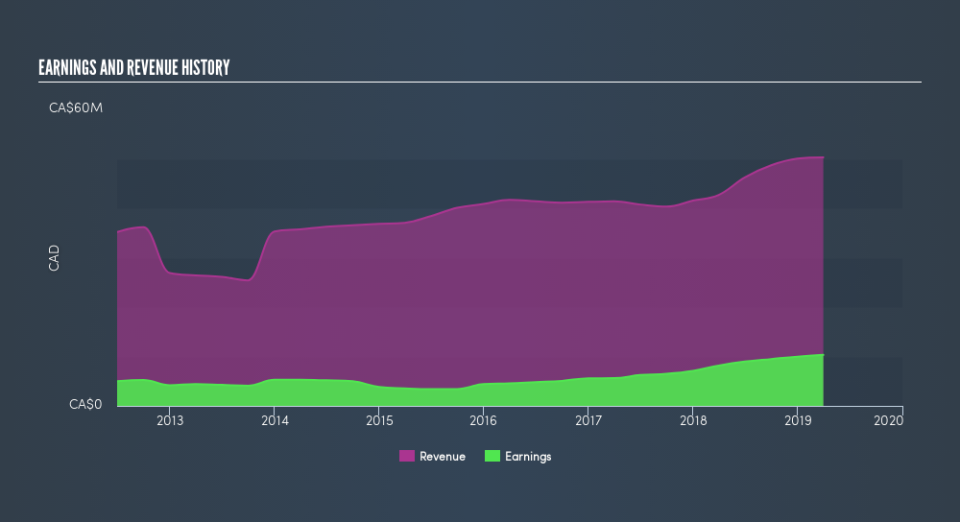

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Olympia Financial Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Olympia Financial Group maintained stable EBIT margins over the last year, all while growing revenue 18% to CA$50m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Olympia Financial Group isn't a huge company, given its market capitalization of CA$129m. That makes it extra important to check on its balance sheet strength.

Are Olympia Financial Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Olympia Financial Group insiders walking the walk, by spending CA$551k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Independent Director, Brian Newman, who made the biggest single acquisition, paying CA$100k for shares at about CA$38.85 each.

Does Olympia Financial Group Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Olympia Financial Group's strong EPS growth. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe Olympia Financial Group is probably worth spending some time on. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Olympia Financial Group.

As a growth investor I do like to see insider buying. But Olympia Financial Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.