I Ran A Stock Scan For Earnings Growth And Citizens & Northern (NASDAQ:CZNC) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Citizens & Northern (NASDAQ:CZNC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Citizens & Northern

Citizens & Northern's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Citizens & Northern's EPS soared from US$1.30 to US$1.94, over the last year. That's a impressive gain of 50%.

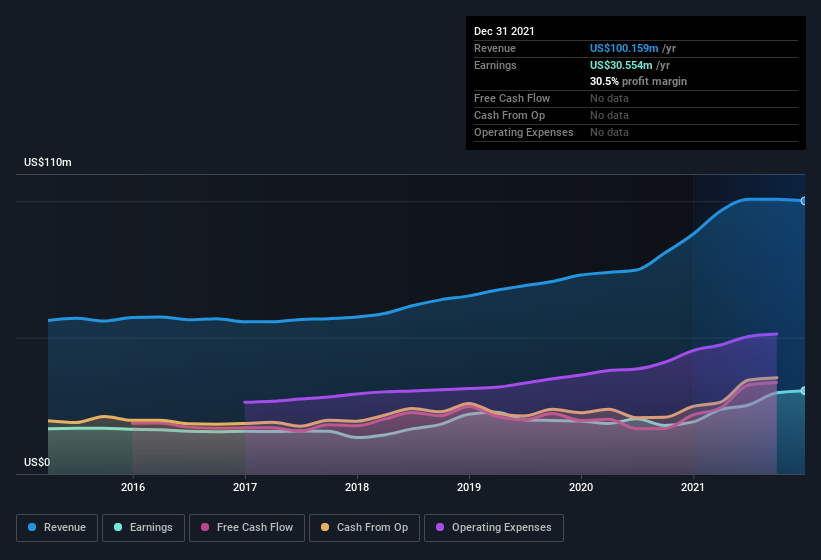

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Citizens & Northern's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Citizens & Northern maintained stable EBIT margins over the last year, all while growing revenue 14% to US$100m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Citizens & Northern's balance sheet strength, before getting too excited.

Are Citizens & Northern Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Citizens & Northern shareholders can gain quiet confidence from the fact that insiders shelled out US$291k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Independent Chairman, Terry Lehman, who made the biggest single acquisition, paying US$73k for shares at about US$25.00 each.

The good news, alongside the insider buying, for Citizens & Northern bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$17m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 4.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Brad Scovill is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Citizens & Northern with market caps between US$200m and US$800m is about US$1.7m.

The Citizens & Northern CEO received US$1.0m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Citizens & Northern Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Citizens & Northern's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. If you think Citizens & Northern might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

As a growth investor I do like to see insider buying. But Citizens & Northern isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.